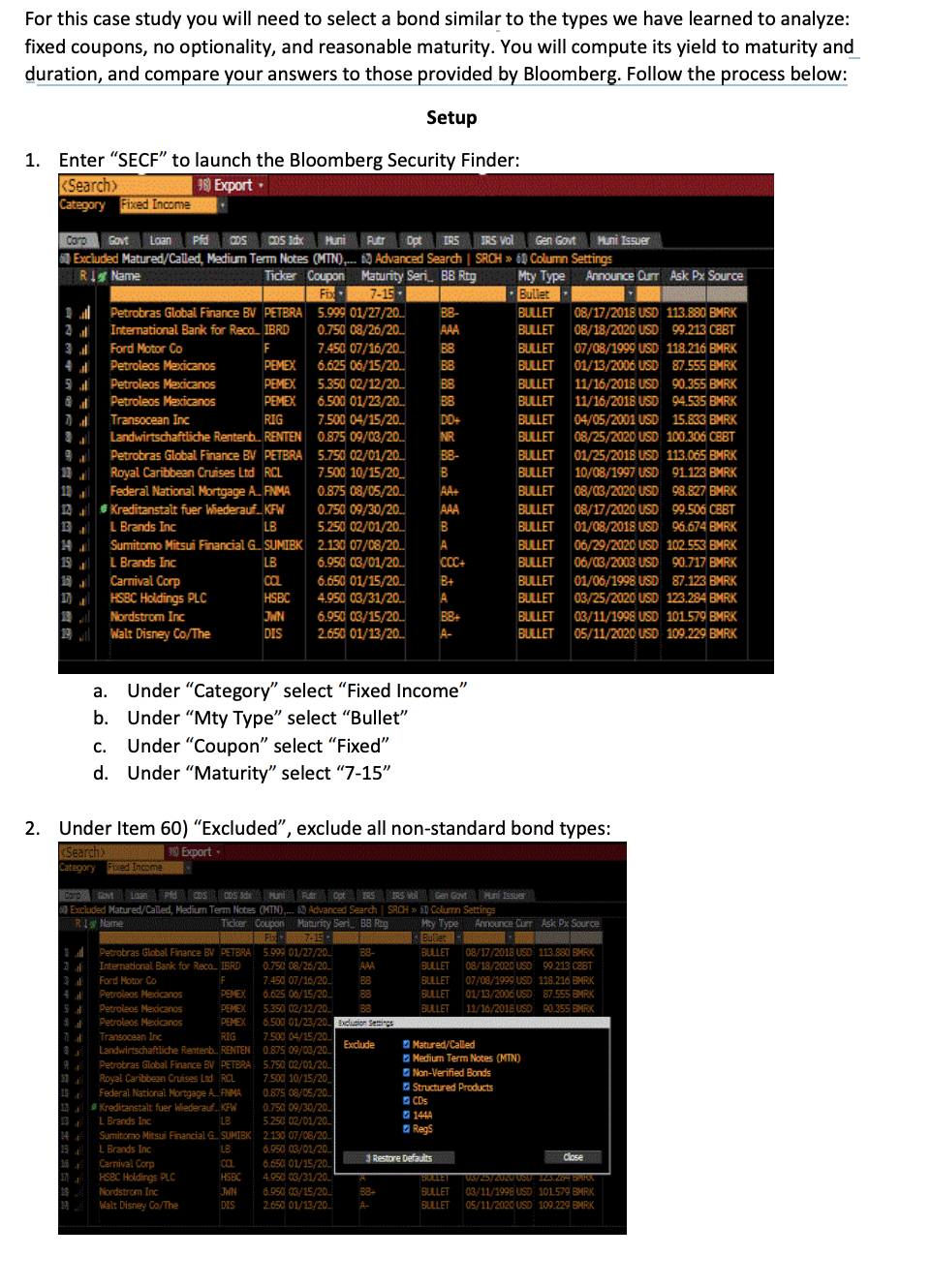

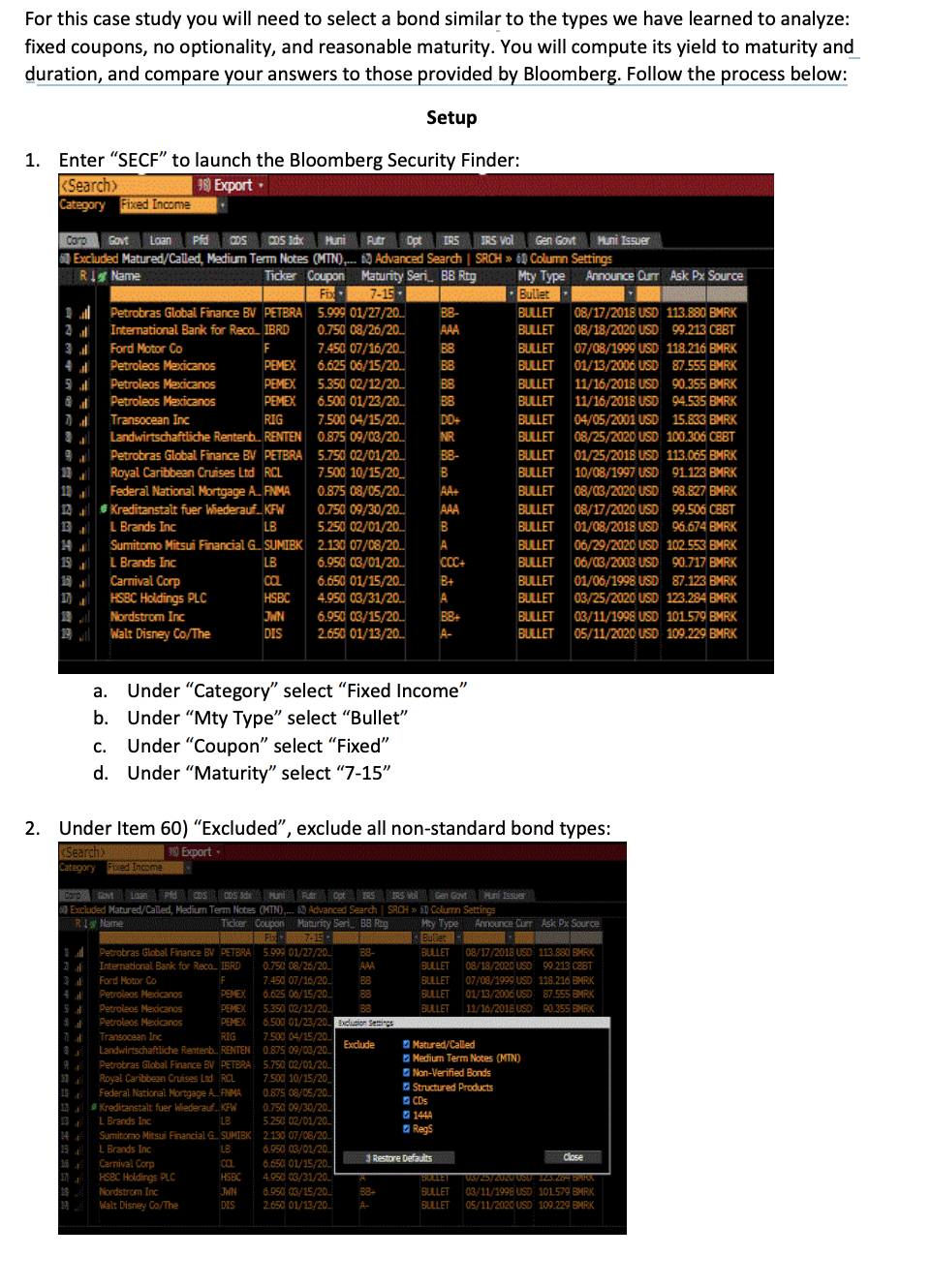

For this case study you will need to select a bond similar to the types we have learned to analyze: fixed coupons, no optionality, and reasonable maturity. You will compute its yield to maturity and duration, and compare your answers to those provided by Bloomberg. Follow the process below: Setup 1. Enter "SECF" to launch the Bloomberg Security Finder:

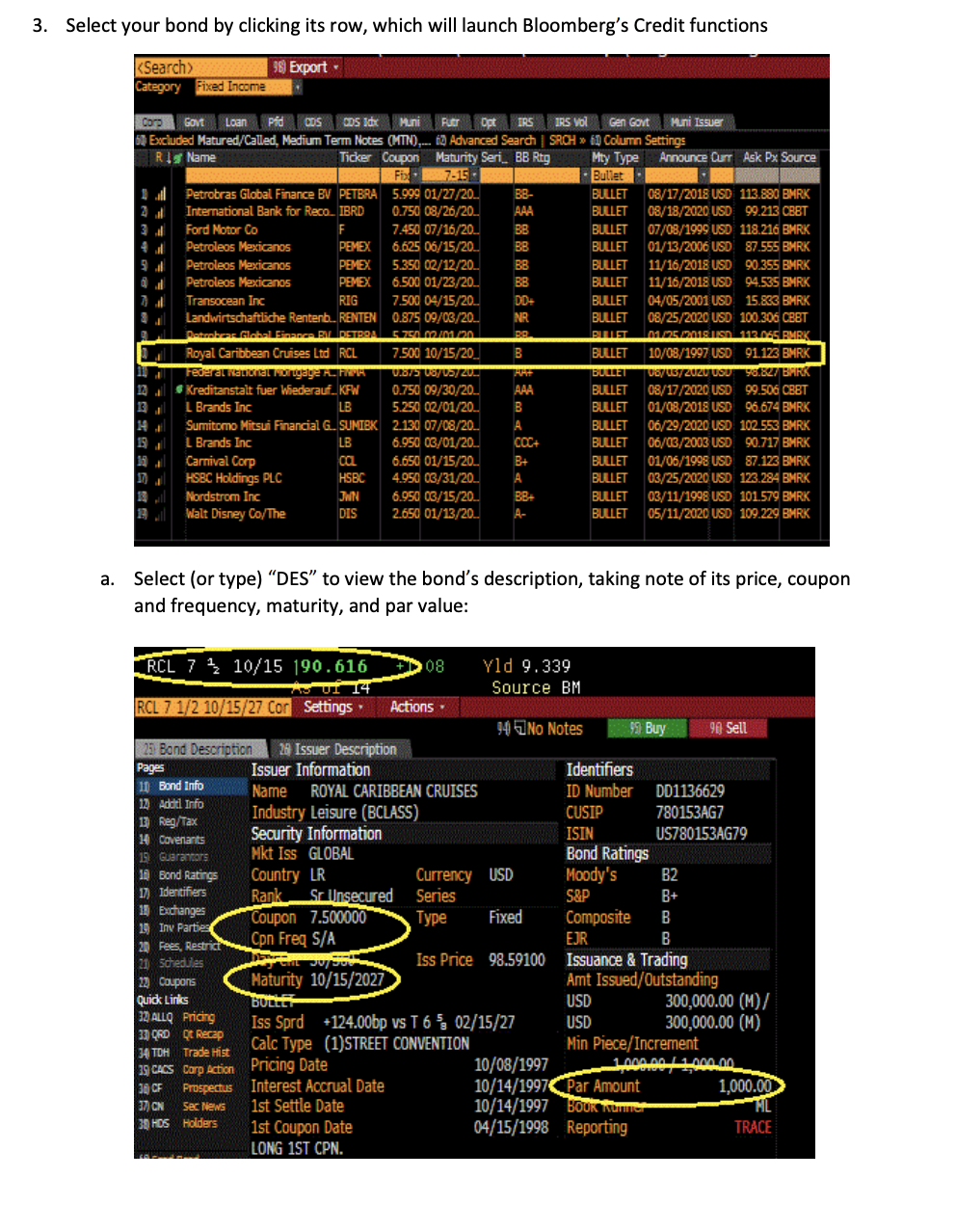

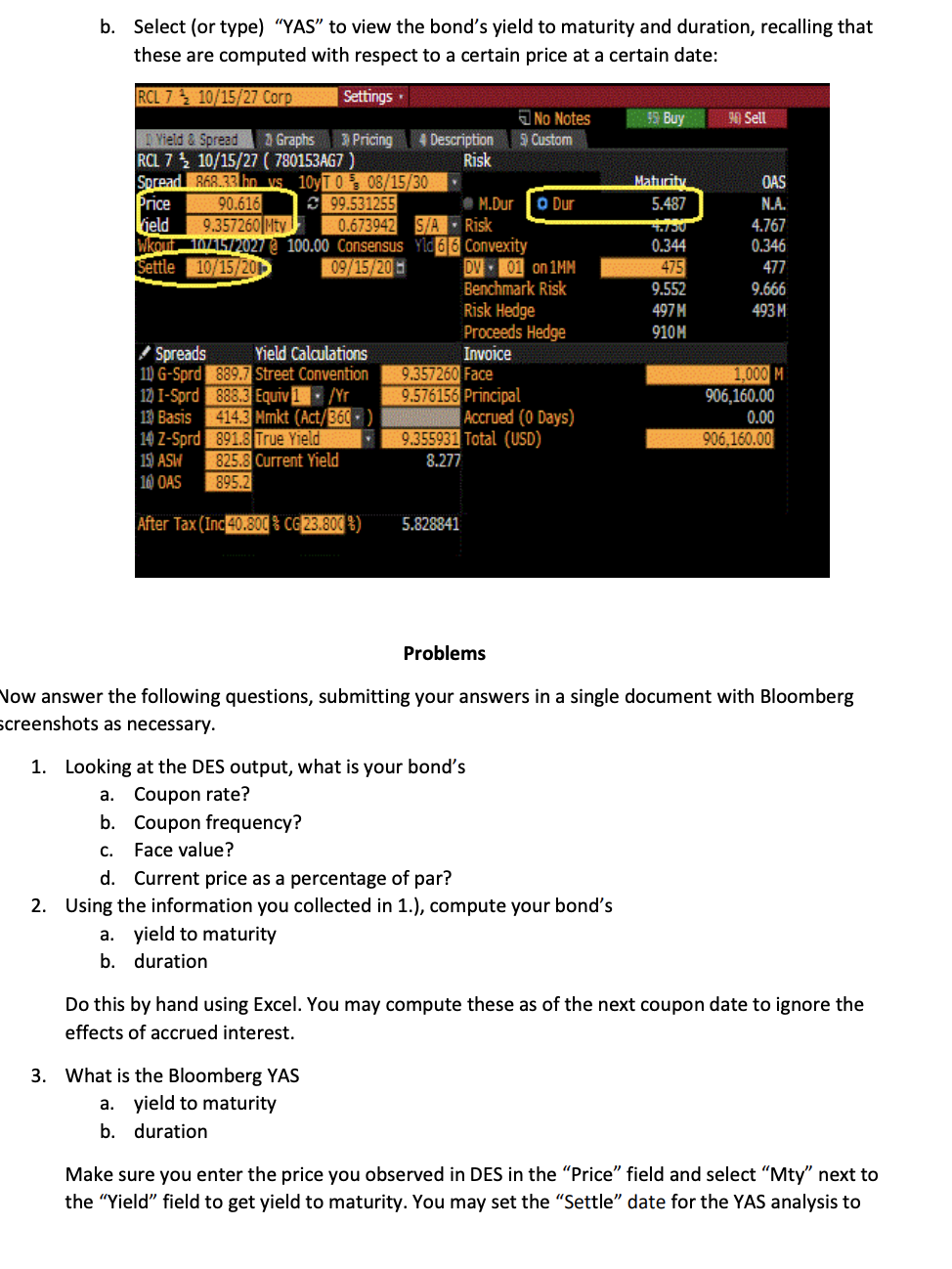

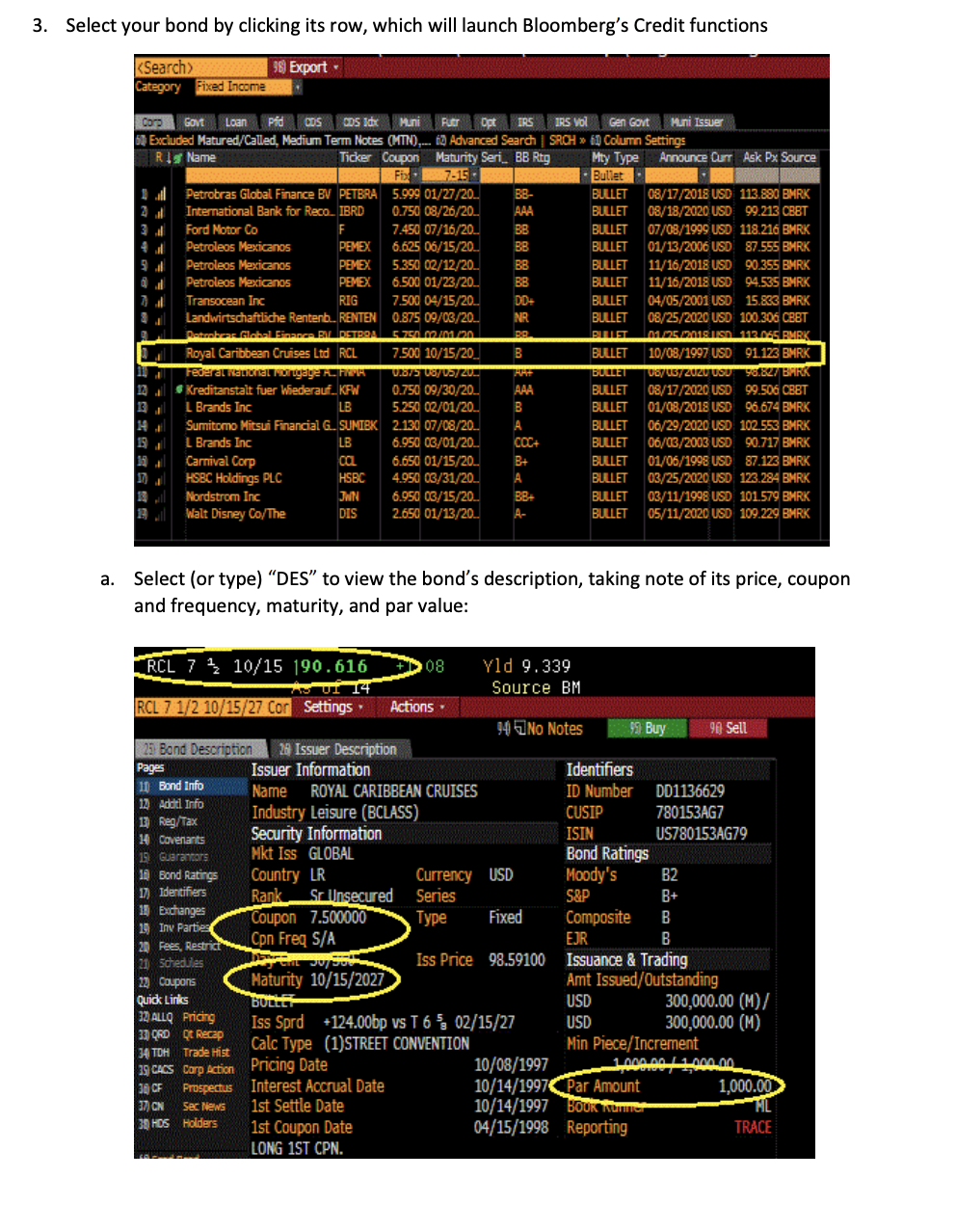

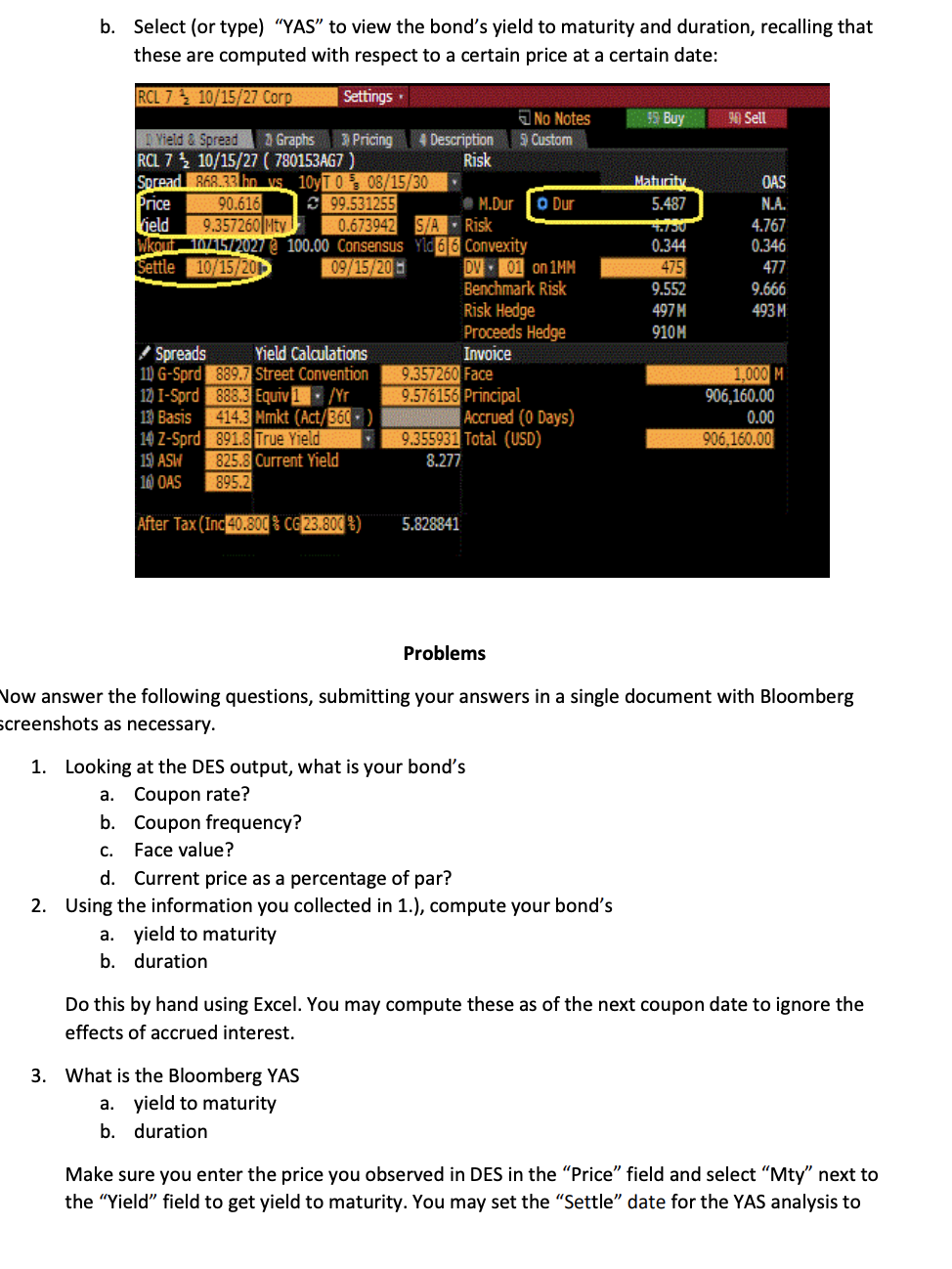

> 6 Column Settings Ris Name Ticker Coupon Maturity Seri BB Rtg Mty Type Announce Curr Ask Px Source Fi 7-15 - Bullet Petrobras Global Finance BV PETBRA 5.999 01/27/20 BB- BULLET 08/17/2018 USD 113.880 BMRK International Bank for Reco. IBRD 0.750 08/26/20 AAA BULLET 08/18/2020 USD 99.213 CBBT Ford Motor Co F 7.450 07/16/20 BB BULLET 07/08/1999 USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20 BB BULLET 01/13/2006 USD 87.555 BMRK 9 Petroleos Mexicanos PEMEX 5.350 02/12/20 BB BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 BB BULLET 11/16/2018 USD 94.535 BMRK Transocean Inc RIG 7.500 04/15/20.. BULLET 04/05/2001 USD 15.83 BMRK Landwirtschaftliche Rentenb.. RENTEN 0.875 09/03/20. NR BULLET 08/5/20USD 100 306 BBT Petrobras Global Finance BV PETBRA 5.750 02/01/20 BB- BULLET 01/25/2018 USD 113.065 BMRK Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 B BULLET 10/08/1997 USD 91.123 BMRK Federal National Mortgage A. PAMA 0.875 08/05/20. AA+ BULLET 08/03/2020 USD 98.827 BMRK 12 Kreditanstalt fuer Wiederauf.KFW 0.750 09/30/20 AAA BULLET 08/17/2020 USD 99,506 BET L Brands Inc LB 5.250 02/01/20 B BULLET 01/08/2018 USD 96.674 BMRK Sumitomo Mitsui Financial G. SUMIBK 2.130 07/08/20_ A BULLET 06/29/2020 USD 102.553 BMRK L Brands Inc LB 6.950 03/01/20 COC+ BULLET 06/08/2003 USD 90.717 BMRK Carnival Corp oa 6.650 01/15/20 B+ BULLET 01/06/1998 USD 87.123 BMRK HSBC Holdings PLC HSBC 4.950 03/31/20 A BULLET 03/25/2020 USD 123.284 BMRK Nordstrom Inc JWN 6.950 03/15/20 BULLET 03/11/1998 USD 101.579 BMRK Walt Disney Co/The DIS 2.650 01/13/20. BULLET 05/11/2020 USD 109.229 BMRK a. Under "Category" select "Fixed Income" b. Under "Mty Type" select "Bullet" c. Under "Coupon" select "Fixed" d. Under "Maturity" select "7-15" 2. Under Item 60) Excluded", exclude all non-standard bond types: Search 98) Export Category Fixed Income Como Laan POS ORSRS YOU Gencontumise Excluded Matured/Called, Medium Term Notes (MT),... 10 Advanced Search SRCH 1 Column Settings RIS Name Tider Coupon Maturity Seri B8 Reg My Type Announce Durt Ask Px Source Petrobras Global Finance BV PETBRA 5.999 01/27/2003 B9 BULLET 08/17/2018 USD 113.880 SMRK International Bank for Reco_ IBRD 0.750 08/26/20 AAA BULLET 03/19 2020 USD 99 13 PET Ford Motor Co 7.450 07/16/20. 88 BULLET 07/08/1999. USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20. 88 BULLET 01/13/2006 USD 87.555 BMRK Petroleos Mexicanos PEMEX 5.350 02/12/20 BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 Exclusion Series Transocean Inc RIG 7.500 04/15/2001 Exclude Matured/Called Landwirtschaftliche Rentenb. RENTEN 0.875 09/03/20 Medium Term Notes (MTN) Petrobras Global Finance BV PETERA 5.750 02/01/20_ Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 Non-Verified Bonds Structured Products Federal National Mortgage AFMA 0.875 08/05/20 CDs Kreditanstalt fuer Wiederauf.KFW 0.750 09/30/20 L Brands Inc LB 144 5250 02/01/20. Regs Sumitomo Mitsui Financial G_SUMIBK 2.130 07/08/20 I Brands Inc LB 6.950 03/01/201 Carnival Corp OOL Close 6.650 01/15/20. 3 Restore Defaults HSBC Holdings PLC HSBC 4.950 03/31/20. BUELE! 1372572020. USU 123.28 BPR Nordstrom Inc JWN 6.950 03/15/20 38 BULLET 03/11/1998 USD 101579 BMRK Walt Disney Co/The DIS 2.650 01/13/20. BULLET 05/11/2020. USD 109.229 BMRK 3. Select your bond by clicking its row, which will launch Bloomberg's Credit functions 98) Export Search Category Fixed Income Como Govt Loan COS SDS idx Muni Putr Opt IRS IRS VOI Gen Govt Muni Issue Excluded Matured/Caled, Medium Term Notes (MTNO)... ) Advanced Search SRCH >> 1 Column Settings Ris Name Ticker Coupon Maturity Seri_ BB Rtg Mty Type Announce Curr Ask Px Source Fish 7.15- - Bullet Petrobras Global Finance BV PETBRA 5.999 01/27/20.. BB- BULLET 08/17/2018 USD 113.880 BMRK International Bank for Reco_ IBRD 0.750 08/26/20 AAA BULLET 08/18/2020 USD 9,213 CRET Ford Motor Co F 7.450 07/16/20. BB BULLET 07/08/1999 USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20 BB BULLET 01/13/2006 USD 87.555 BMRK 9 Petroleos Mexicanos PEMEX 5.350 02/12/20 BB BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 BB BULLET 11/16/2018 USD 94.535 BMRK Transocean Inc RIG 7.500 04/15/20 DD BULLET 04/05/2001 USD 15.83 BMRK Landwirtschaftliche Rentenb. RENTEN 0.875 09/03/20.. NR BULLET 08/25/2020 USD 100.306 CHT Retetar Global FC BARSTBOA CL00 De BUILT 01/2018 | 112.05 PMRK Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 B BULLET 10/08/1997 USD 91.123 BMRK Fever It Turysty V.87320 BULLET USTUTZUZU USU 98.827 BIRK Kreditanstalt fuer Wiederauf.. KFW 0.750 09/30/20.. AAA BULLET 08/17/2020 USD 506 CRET 13 L Brands Inc LB 5.250 02/01/20 B BULLET 01/08/2018 USD 96.674 BMRK Sumitomo Mitsui Financial G. SUMIBK 2.130 07/08/20 A BULLET 06/29/2020 USD 102.553 BMRK L Brands Inc LB 6.950 03/01/20 COC+ BULLET 06/03/2003 USD 90.717 BMRK Carnival Corp ca 6.650 01/15/20 B+ BULLET 01/06/1998 USD 87.128 BMRK HSBC Holdings PLC HSBC 4.950 03/31/20 A BULLET 03/25/2020 USD 123.284 BMRK Nordstrom Inc WN 6.950 03/15/20 BB+ BULLET 03/11/1998 USD 101.579 BMRK Walt Disney Co/The DIS 2.650 01/13/20 A- BULLET 05/11/2020 USD 109.229 BMRK a. Select (or type) "DES" to view the bond's description, taking note of its price, coupon and frequency, maturity, and par value: RCL 7 * 10/15 190.616 08 Yld 9.339 Source BM RCL 7 1/2 10/15/27 Cor Settings Actions 94 No Notes 99 Buy 90 Sell 23 Bond Description 28 Issuer Description Pages Issuer Information Identifiers 11 Bond Info Name ROYAL CARIBBEAN CRUISES ID Number DD1136629 12 Addtl Info Industry Leisure (BCLASS) CUSIP 1) Reg/Tax 780153AG7 14 Covenants Security Information ISIN US780153A679 19 Guaracons Mkt Iss GLOBAL Bond Ratings 10 Bond Ratings Country LR Currency USD Moody's B2 11) Identifiers Rank Sr Insecured Series S&P B+ 11 Exchanges Coupon 7.500000 Fixed Composite B 19 Inv Parties Con Freq S/A EJR B 20 Fees, Restrid 21 schedules Iss Price 98.59100 Issuance & Trading 22 Coupons Maturity 10/15/2027 Amt Issued/Outstanding Quick Links USD 300,000.00 (M)/ 19 ALLQ Pricing Iss Sprd +124.00bp vs T 602/15/27 USD 300,000.00 (M) 33 QRD t Recap Calc Type (1)STREET CONVENTION Min Piece/Increment 34 TDH Trade Hist 29 CHCS Carp ection Pricing Date 10/08/1997 1,000.00 / 4,000.00 Prospectus Interest Accrual Date 10/14/1997 Par Amount 1,000.00 17) CN Sec News 1st Settle Date 10/14/1997 BOUK un NL 39HDS Holders 1st Coupon Date 04/15/1998 Reporting TRACE LONG 1ST CPN. Type 36 CF b. Select (or type) "YAS to view the bond's yield to maturity and duration, recalling that these are computed with respect to a certain price at a certain date: 55 Buy 90 Sell OAS N.A. Maturity 5.487 ov 0.344 475 RCL 7 10/15/27 Corp Settings No Notes Yield & Spread a Graphs 3 Pricing 4 Descriptions Custom RAL 7 2 10/15/27 ( 780153AG7 ) Risk Spread 268.33 hovs 10yT0 08/15/30 Price 90.616 99.531255 M.Dur O Dur Vield 9.357260 Mty 0.673942 S/A. Risk WkOut AL12027100.00 Consensus Yld 66 Convexity Settle 10/15/201 09/15/205 DV. 01 on 1MM Benchmark Risk Risk Hedge Proceeds Hedge Spreads Yield Calculations Invoice 11) G-Sprd 889.7 Street Convention 9.357260 Face 12 I-Sprd 888.3 Equiv 1 /Yr 9.576156 Principal 13 Basis 414.3 Mmkt (Act/360 Accrued (0 Days) 14 Z-Sprd 891.8 True Yield 9.355931 Total (USD) 15) ASW 825.8 Current Yield 8.277 10 OAS 895.2 4.767 0.346 477 9.666 493M 9.552 497M 910M 1,000 M 906,160.00 0.00 906,160.00 After Tax (Inc 40.80C CG23.800 ) 5.828841 Problems Now answer the following questions, submitting your answers in a single document with Bloomberg screenshots as necessary. 1. Looking at the DES output, what is your bond's a. Coupon rate? b. Coupon frequency? C. Face value? d. Current price as a percentage of par? 2. Using the information you collected in 1.), compute your bond's a. yield to maturity b. duration Do this by hand using Excel. You may compute these as of the next coupon date to ignore the effects of accrued interest. 3. What is the Bloomberg YAS a. yield to maturity b. duration Make sure you enter the price you observed in DES in the "Price" field and select "Mty" next to the "Yield" field to get yield to maturity. You may set the Settle date for the YAS analysis to the next coupon date to make the results similar to your hand-computed answer to avoid the effects of accrued interest. 4. Your hand-computed yield to maturity and duration are likely to not be the same as Bloomberg YAS's yield to maturity and duration. Why do you think this is? You must reference one idea from class and aim for a brief answer of at most 100 words. For this case study you will need to select a bond similar to the types we have learned to analyze: fixed coupons, no optionality, and reasonable maturity. You will compute its yield to maturity and duration, and compare your answers to those provided by Bloomberg. Follow the process below: Setup 1. Enter "SECF" to launch the Bloomberg Security Finder: > 6 Column Settings Ris Name Ticker Coupon Maturity Seri BB Rtg Mty Type Announce Curr Ask Px Source Fi 7-15 - Bullet Petrobras Global Finance BV PETBRA 5.999 01/27/20 BB- BULLET 08/17/2018 USD 113.880 BMRK International Bank for Reco. IBRD 0.750 08/26/20 AAA BULLET 08/18/2020 USD 99.213 CBBT Ford Motor Co F 7.450 07/16/20 BB BULLET 07/08/1999 USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20 BB BULLET 01/13/2006 USD 87.555 BMRK 9 Petroleos Mexicanos PEMEX 5.350 02/12/20 BB BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 BB BULLET 11/16/2018 USD 94.535 BMRK Transocean Inc RIG 7.500 04/15/20.. BULLET 04/05/2001 USD 15.83 BMRK Landwirtschaftliche Rentenb.. RENTEN 0.875 09/03/20. NR BULLET 08/5/20USD 100 306 BBT Petrobras Global Finance BV PETBRA 5.750 02/01/20 BB- BULLET 01/25/2018 USD 113.065 BMRK Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 B BULLET 10/08/1997 USD 91.123 BMRK Federal National Mortgage A. PAMA 0.875 08/05/20. AA+ BULLET 08/03/2020 USD 98.827 BMRK 12 Kreditanstalt fuer Wiederauf.KFW 0.750 09/30/20 AAA BULLET 08/17/2020 USD 99,506 BET L Brands Inc LB 5.250 02/01/20 B BULLET 01/08/2018 USD 96.674 BMRK Sumitomo Mitsui Financial G. SUMIBK 2.130 07/08/20_ A BULLET 06/29/2020 USD 102.553 BMRK L Brands Inc LB 6.950 03/01/20 COC+ BULLET 06/08/2003 USD 90.717 BMRK Carnival Corp oa 6.650 01/15/20 B+ BULLET 01/06/1998 USD 87.123 BMRK HSBC Holdings PLC HSBC 4.950 03/31/20 A BULLET 03/25/2020 USD 123.284 BMRK Nordstrom Inc JWN 6.950 03/15/20 BULLET 03/11/1998 USD 101.579 BMRK Walt Disney Co/The DIS 2.650 01/13/20. BULLET 05/11/2020 USD 109.229 BMRK a. Under "Category" select "Fixed Income" b. Under "Mty Type" select "Bullet" c. Under "Coupon" select "Fixed" d. Under "Maturity" select "7-15" 2. Under Item 60) Excluded", exclude all non-standard bond types: Search 98) Export Category Fixed Income Como Laan POS ORSRS YOU Gencontumise Excluded Matured/Called, Medium Term Notes (MT),... 10 Advanced Search SRCH 1 Column Settings RIS Name Tider Coupon Maturity Seri B8 Reg My Type Announce Durt Ask Px Source Petrobras Global Finance BV PETBRA 5.999 01/27/2003 B9 BULLET 08/17/2018 USD 113.880 SMRK International Bank for Reco_ IBRD 0.750 08/26/20 AAA BULLET 03/19 2020 USD 99 13 PET Ford Motor Co 7.450 07/16/20. 88 BULLET 07/08/1999. USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20. 88 BULLET 01/13/2006 USD 87.555 BMRK Petroleos Mexicanos PEMEX 5.350 02/12/20 BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 Exclusion Series Transocean Inc RIG 7.500 04/15/2001 Exclude Matured/Called Landwirtschaftliche Rentenb. RENTEN 0.875 09/03/20 Medium Term Notes (MTN) Petrobras Global Finance BV PETERA 5.750 02/01/20_ Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 Non-Verified Bonds Structured Products Federal National Mortgage AFMA 0.875 08/05/20 CDs Kreditanstalt fuer Wiederauf.KFW 0.750 09/30/20 L Brands Inc LB 144 5250 02/01/20. Regs Sumitomo Mitsui Financial G_SUMIBK 2.130 07/08/20 I Brands Inc LB 6.950 03/01/201 Carnival Corp OOL Close 6.650 01/15/20. 3 Restore Defaults HSBC Holdings PLC HSBC 4.950 03/31/20. BUELE! 1372572020. USU 123.28 BPR Nordstrom Inc JWN 6.950 03/15/20 38 BULLET 03/11/1998 USD 101579 BMRK Walt Disney Co/The DIS 2.650 01/13/20. BULLET 05/11/2020. USD 109.229 BMRK 3. Select your bond by clicking its row, which will launch Bloomberg's Credit functions 98) Export Search Category Fixed Income Como Govt Loan COS SDS idx Muni Putr Opt IRS IRS VOI Gen Govt Muni Issue Excluded Matured/Caled, Medium Term Notes (MTNO)... ) Advanced Search SRCH >> 1 Column Settings Ris Name Ticker Coupon Maturity Seri_ BB Rtg Mty Type Announce Curr Ask Px Source Fish 7.15- - Bullet Petrobras Global Finance BV PETBRA 5.999 01/27/20.. BB- BULLET 08/17/2018 USD 113.880 BMRK International Bank for Reco_ IBRD 0.750 08/26/20 AAA BULLET 08/18/2020 USD 9,213 CRET Ford Motor Co F 7.450 07/16/20. BB BULLET 07/08/1999 USD 118.216 BMRK Petroleos Mexicanos PEMEX 6.625 06/15/20 BB BULLET 01/13/2006 USD 87.555 BMRK 9 Petroleos Mexicanos PEMEX 5.350 02/12/20 BB BULLET 11/16/2018 USD 90.355 BMRK Petroleos Mexicanos PEMEX 6.500 01/23/20 BB BULLET 11/16/2018 USD 94.535 BMRK Transocean Inc RIG 7.500 04/15/20 DD BULLET 04/05/2001 USD 15.83 BMRK Landwirtschaftliche Rentenb. RENTEN 0.875 09/03/20.. NR BULLET 08/25/2020 USD 100.306 CHT Retetar Global FC BARSTBOA CL00 De BUILT 01/2018 | 112.05 PMRK Royal Caribbean Cruises Ltd RCL 7.500 10/15/20 B BULLET 10/08/1997 USD 91.123 BMRK Fever It Turysty V.87320 BULLET USTUTZUZU USU 98.827 BIRK Kreditanstalt fuer Wiederauf.. KFW 0.750 09/30/20.. AAA BULLET 08/17/2020 USD 506 CRET 13 L Brands Inc LB 5.250 02/01/20 B BULLET 01/08/2018 USD 96.674 BMRK Sumitomo Mitsui Financial G. SUMIBK 2.130 07/08/20 A BULLET 06/29/2020 USD 102.553 BMRK L Brands Inc LB 6.950 03/01/20 COC+ BULLET 06/03/2003 USD 90.717 BMRK Carnival Corp ca 6.650 01/15/20 B+ BULLET 01/06/1998 USD 87.128 BMRK HSBC Holdings PLC HSBC 4.950 03/31/20 A BULLET 03/25/2020 USD 123.284 BMRK Nordstrom Inc WN 6.950 03/15/20 BB+ BULLET 03/11/1998 USD 101.579 BMRK Walt Disney Co/The DIS 2.650 01/13/20 A- BULLET 05/11/2020 USD 109.229 BMRK a. Select (or type) "DES" to view the bond's description, taking note of its price, coupon and frequency, maturity, and par value: RCL 7 * 10/15 190.616 08 Yld 9.339 Source BM RCL 7 1/2 10/15/27 Cor Settings Actions 94 No Notes 99 Buy 90 Sell 23 Bond Description 28 Issuer Description Pages Issuer Information Identifiers 11 Bond Info Name ROYAL CARIBBEAN CRUISES ID Number DD1136629 12 Addtl Info Industry Leisure (BCLASS) CUSIP 1) Reg/Tax 780153AG7 14 Covenants Security Information ISIN US780153A679 19 Guaracons Mkt Iss GLOBAL Bond Ratings 10 Bond Ratings Country LR Currency USD Moody's B2 11) Identifiers Rank Sr Insecured Series S&P B+ 11 Exchanges Coupon 7.500000 Fixed Composite B 19 Inv Parties Con Freq S/A EJR B 20 Fees, Restrid 21 schedules Iss Price 98.59100 Issuance & Trading 22 Coupons Maturity 10/15/2027 Amt Issued/Outstanding Quick Links USD 300,000.00 (M)/ 19 ALLQ Pricing Iss Sprd +124.00bp vs T 602/15/27 USD 300,000.00 (M) 33 QRD t Recap Calc Type (1)STREET CONVENTION Min Piece/Increment 34 TDH Trade Hist 29 CHCS Carp ection Pricing Date 10/08/1997 1,000.00 / 4,000.00 Prospectus Interest Accrual Date 10/14/1997 Par Amount 1,000.00 17) CN Sec News 1st Settle Date 10/14/1997 BOUK un NL 39HDS Holders 1st Coupon Date 04/15/1998 Reporting TRACE LONG 1ST CPN. Type 36 CF b. Select (or type) "YAS to view the bond's yield to maturity and duration, recalling that these are computed with respect to a certain price at a certain date: 55 Buy 90 Sell OAS N.A. Maturity 5.487 ov 0.344 475 RCL 7 10/15/27 Corp Settings No Notes Yield & Spread a Graphs 3 Pricing 4 Descriptions Custom RAL 7 2 10/15/27 ( 780153AG7 ) Risk Spread 268.33 hovs 10yT0 08/15/30 Price 90.616 99.531255 M.Dur O Dur Vield 9.357260 Mty 0.673942 S/A. Risk WkOut AL12027100.00 Consensus Yld 66 Convexity Settle 10/15/201 09/15/205 DV. 01 on 1MM Benchmark Risk Risk Hedge Proceeds Hedge Spreads Yield Calculations Invoice 11) G-Sprd 889.7 Street Convention 9.357260 Face 12 I-Sprd 888.3 Equiv 1 /Yr 9.576156 Principal 13 Basis 414.3 Mmkt (Act/360 Accrued (0 Days) 14 Z-Sprd 891.8 True Yield 9.355931 Total (USD) 15) ASW 825.8 Current Yield 8.277 10 OAS 895.2 4.767 0.346 477 9.666 493M 9.552 497M 910M 1,000 M 906,160.00 0.00 906,160.00 After Tax (Inc 40.80C CG23.800 ) 5.828841 Problems Now answer the following questions, submitting your answers in a single document with Bloomberg screenshots as necessary. 1. Looking at the DES output, what is your bond's a. Coupon rate? b. Coupon frequency? C. Face value? d. Current price as a percentage of par? 2. Using the information you collected in 1.), compute your bond's a. yield to maturity b. duration Do this by hand using Excel. You may compute these as of the next coupon date to ignore the effects of accrued interest. 3. What is the Bloomberg YAS a. yield to maturity b. duration Make sure you enter the price you observed in DES in the "Price" field and select "Mty" next to the "Yield" field to get yield to maturity. You may set the Settle date for the YAS analysis to the next coupon date to make the results similar to your hand-computed answer to avoid the effects of accrued interest. 4. Your hand-computed yield to maturity and duration are likely to not be the same as Bloomberg YAS's yield to maturity and duration. Why do you think this is? You must reference one idea from class and aim for a brief answer of at most 100 words