Question

For this mastery assignment, students will develop a cash flow statement with assumptions, valuation techniques, and risk variables. Using page 268 as a setup guide

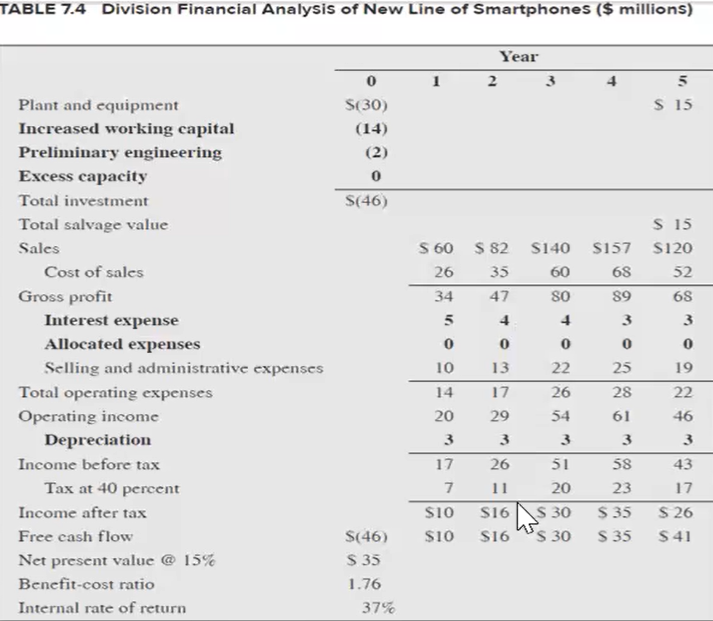

For this mastery assignment, students will develop a cash flow statement with assumptions, valuation techniques, and risk variables. Using page 268 as a setup guide along with the Excel Task Walk Through Video, determine the Net Present Value (NPV), Benefit-cost Ratio (BCR), and Internal rate of Return (IRR) for this problem. Beyond the valuation, utilize a decision tree (setup like page 312) to evaluate success and failure scenarios based on risk analysis. All line items should be formula driven when appropriate. The following is the page 268 numbers for the assignment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started