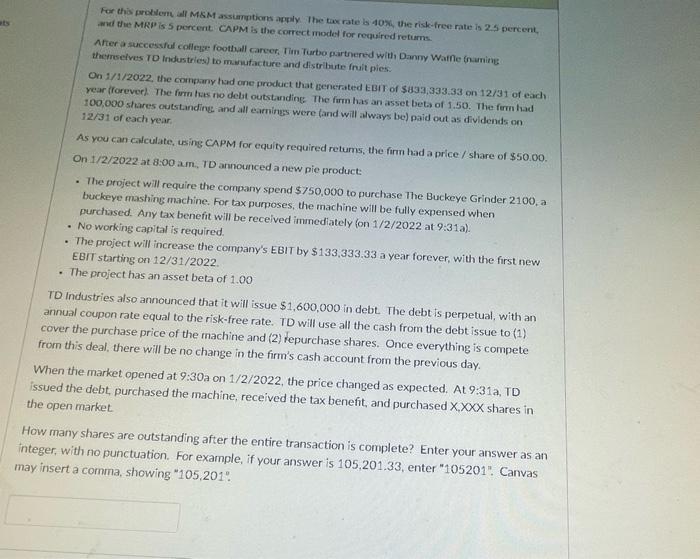

For this problem, all M&M assumptions apply. The tax rate is 40%, the risk-free rate is 2.5 percent, and the MRP is 5 percent. CAPM is the correct model for required returns. After a successful college football career, Tim Turbo partnered with Danny Waffle (naming themselves TD Industries) to manufacture and distribute fruit pies. On 1/1/2022, the company had one product that generated EBIT of $833,333.33 on 12/31 of each year (forever). The firm has no debt outstanding. The firm has an asset beta of 1.50. The firm had 100,000 shares outstanding, and all earnings were (and will always be) paid out as dividends on 12/31 of each year. As you can calculate, using CAPM for equity required retums, the firm had a price / share of $50.00. On 1/2/2022 at 8:00 am, TD announced a new pie product: . The project will require the company spend $750,000 to purchase The Buckeye Grinder 2100, a buckeye mashing machine. For tax purposes, the machine will be fully expensed when purchased. Any tax benefit will be received immediately (on 1/2/2022 at 9:31a). . No working capital is required. . The project will increase the company's EBIT by $133,333.33 a year forever, with the first new EBIT starting on 12/31/2022. . The project has an asset beta of 1.00 TD Industries also announced that it will issue $1,600,000 in debt. The debt is perpetual, with an annual coupon rate equal to the risk-free rate. TD will use all the cash from the debt issue to (1) cover the purchase price of the machine and (2) repurchase shares. Once everything is compete from this deal, there will be no change in the firm's cash account from the previous day. When the market opened at 9:30a on 1/2/2022, the price changed as expected. At 9:31a, TD issued the debt, purchased the machine, received the tax benefit, and purchased X,XXX shares in the open market. How many shares are outstanding after the entire transaction is complete? Enter your answer as an integer, with no punctuation. For example, if your answer is 105,201.33, enter "105201". Canvas may insert a comma, showing "105,201". For this problem, all M&M assumptions apply. The tax rate is 40%, the risk-free rate is 2.5 percent, and the MRP is 5 percent. CAPM is the correct model for required returns. After a successful college football career, Tim Turbo partnered with Danny Waffle (naming themselves TD Industries) to manufacture and distribute fruit pies. On 1/1/2022, the company had one product that generated EBIT of $833,333.33 on 12/31 of each year (forever). The firm has no debt outstanding. The firm has an asset beta of 1.50. The firm had 100,000 shares outstanding, and all earnings were (and will always be) paid out as dividends on 12/31 of each year. As you can calculate, using CAPM for equity required retums, the firm had a price / share of $50.00. On 1/2/2022 at 8:00 am, TD announced a new pie product: . The project will require the company spend $750,000 to purchase The Buckeye Grinder 2100, a buckeye mashing machine. For tax purposes, the machine will be fully expensed when purchased. Any tax benefit will be received immediately (on 1/2/2022 at 9:31a). . No working capital is required. . The project will increase the company's EBIT by $133,333.33 a year forever, with the first new EBIT starting on 12/31/2022. . The project has an asset beta of 1.00 TD Industries also announced that it will issue $1,600,000 in debt. The debt is perpetual, with an annual coupon rate equal to the risk-free rate. TD will use all the cash from the debt issue to (1) cover the purchase price of the machine and (2) repurchase shares. Once everything is compete from this deal, there will be no change in the firm's cash account from the previous day. When the market opened at 9:30a on 1/2/2022, the price changed as expected. At 9:31a, TD issued the debt, purchased the machine, received the tax benefit, and purchased X,XXX shares in the open market. How many shares are outstanding after the entire transaction is complete? Enter your answer as an integer, with no punctuation. For example, if your answer is 105,201.33, enter "105201". Canvas may insert a comma, showing "105,201