FOR THIS PROBLEM CAN YOU HELP ME FILL IN THE BLUE HIGHLIGHTED PARTS.

PLEASE HELP ANSWER THE HIGHLIGHTED AREAS

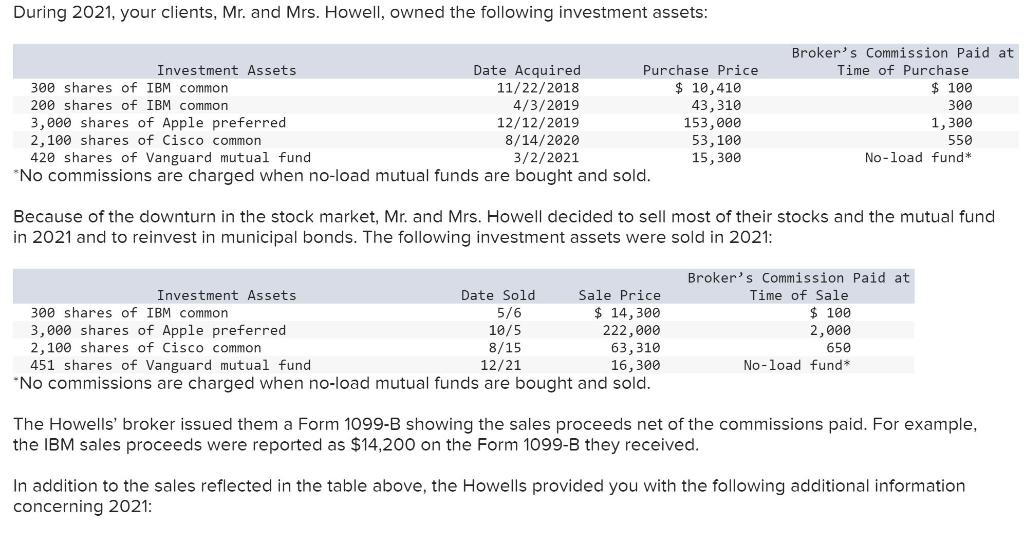

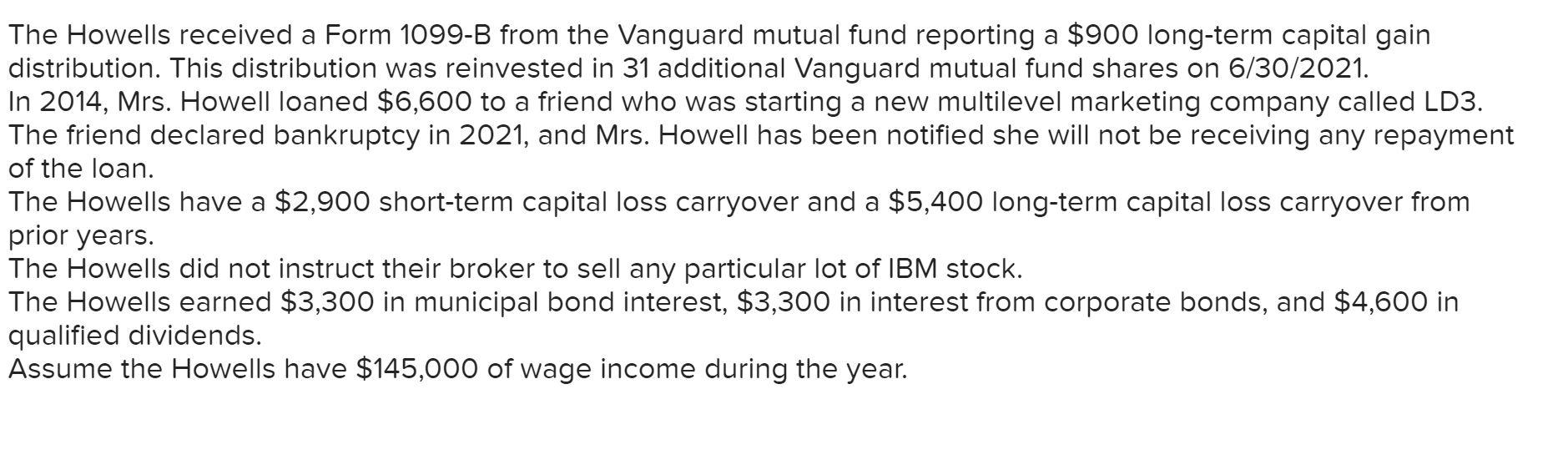

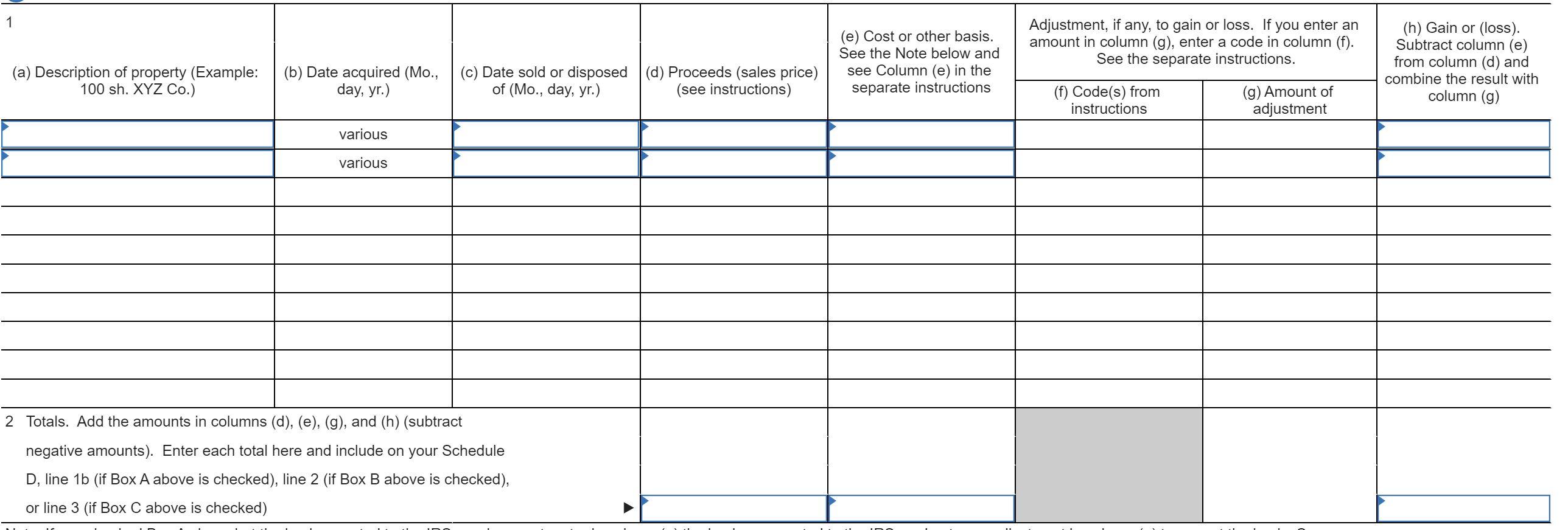

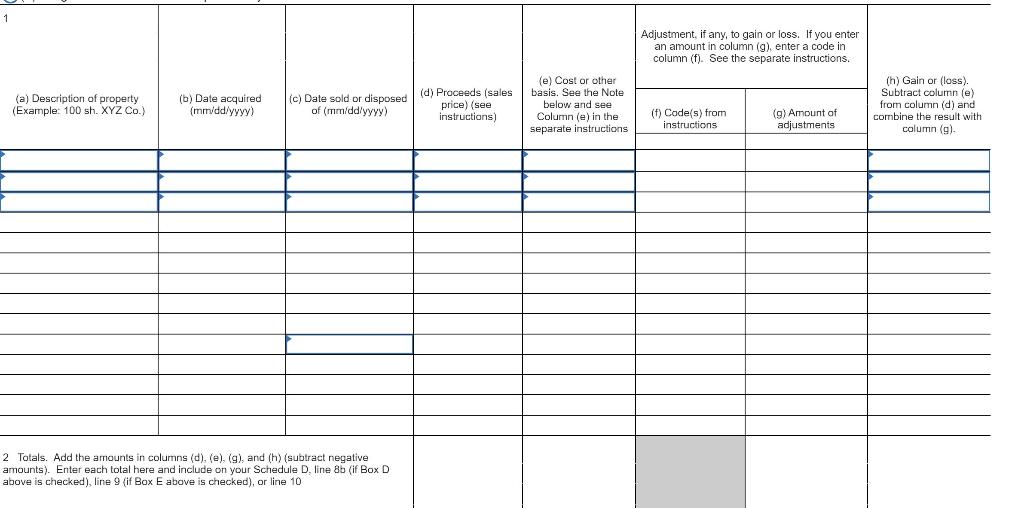

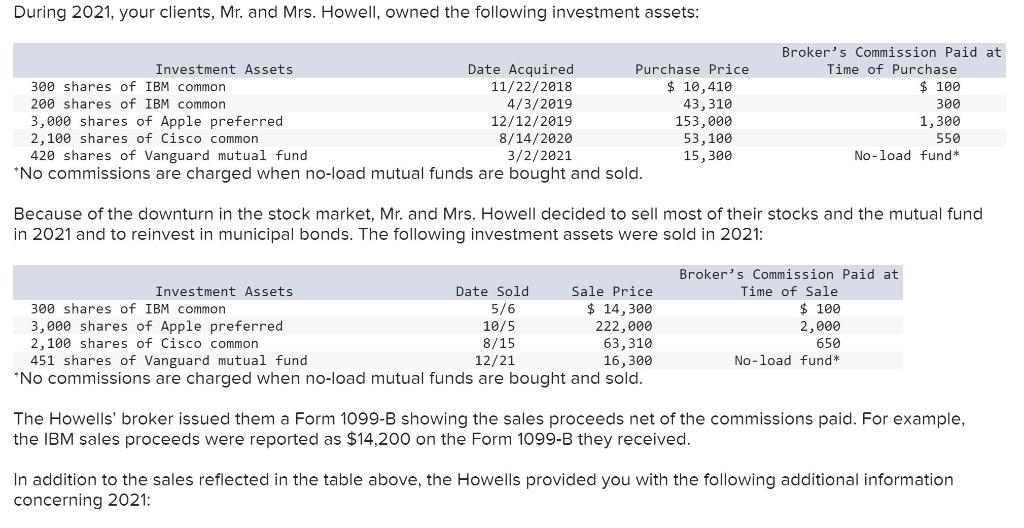

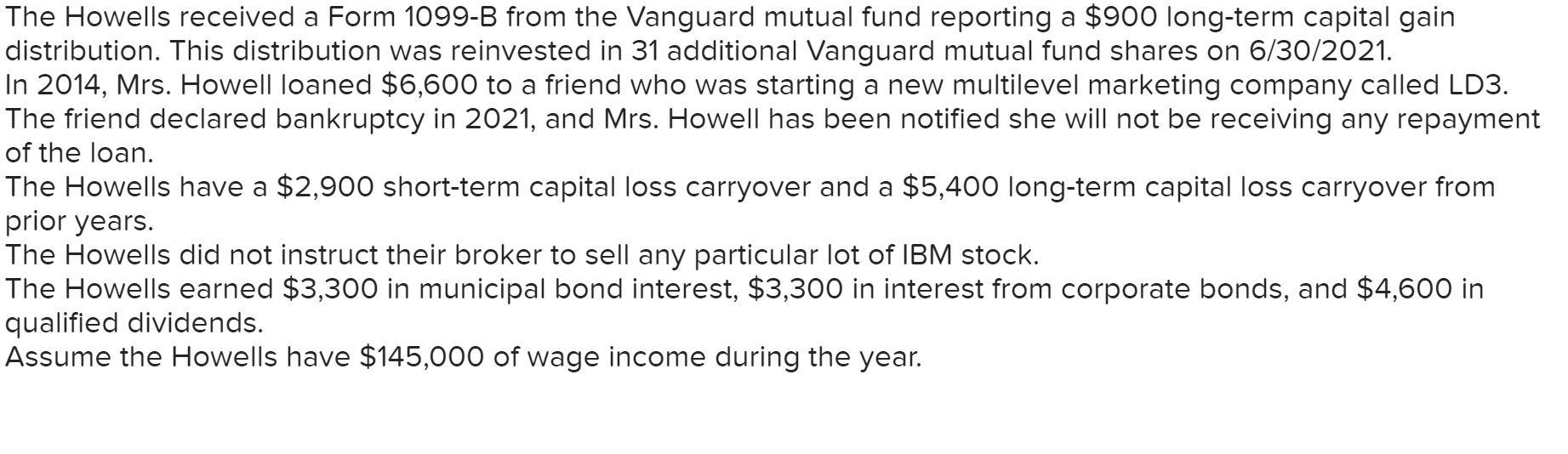

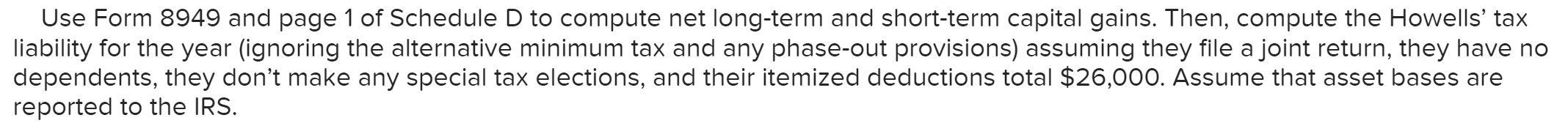

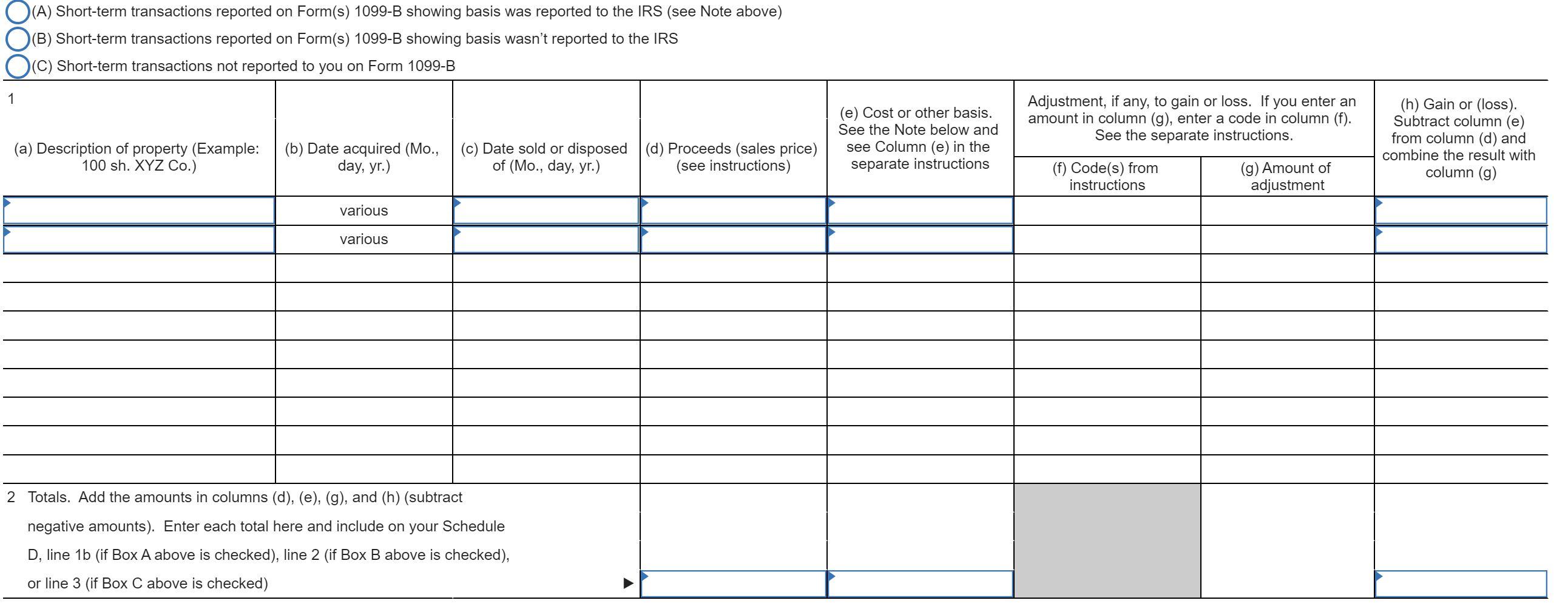

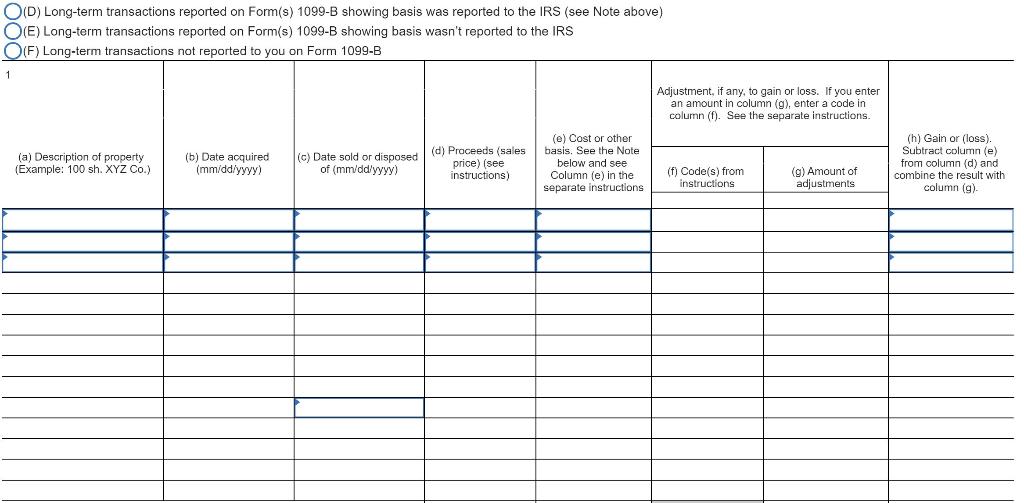

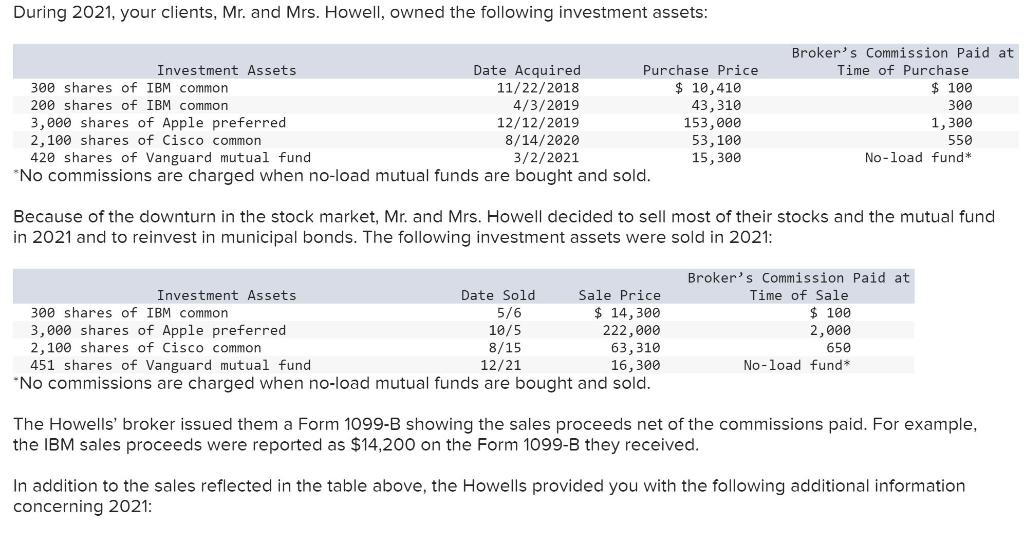

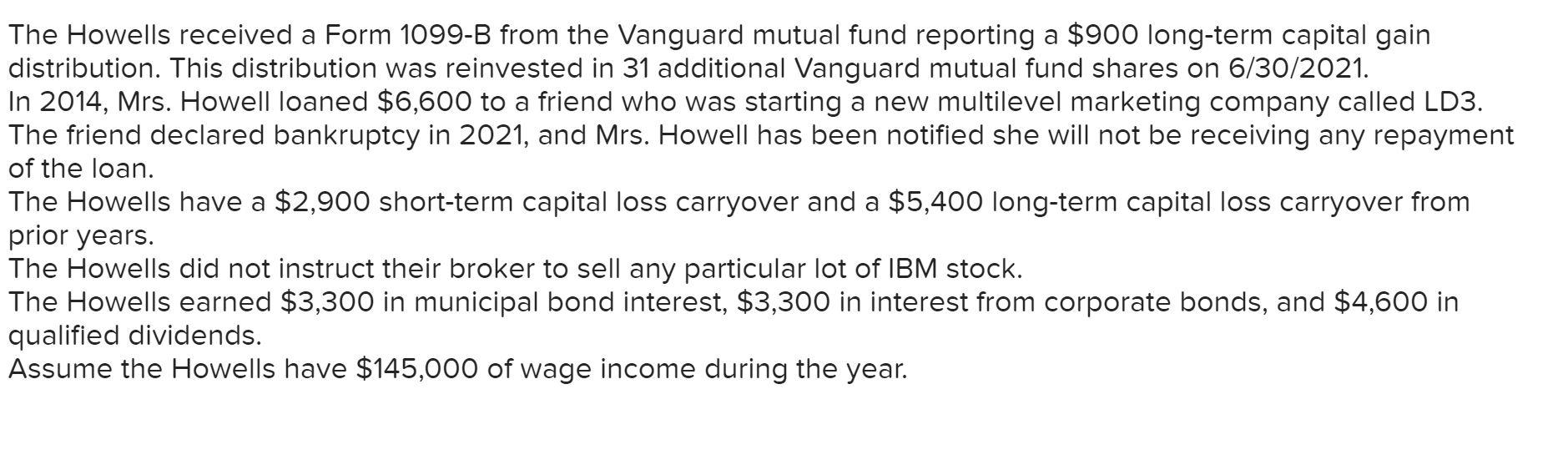

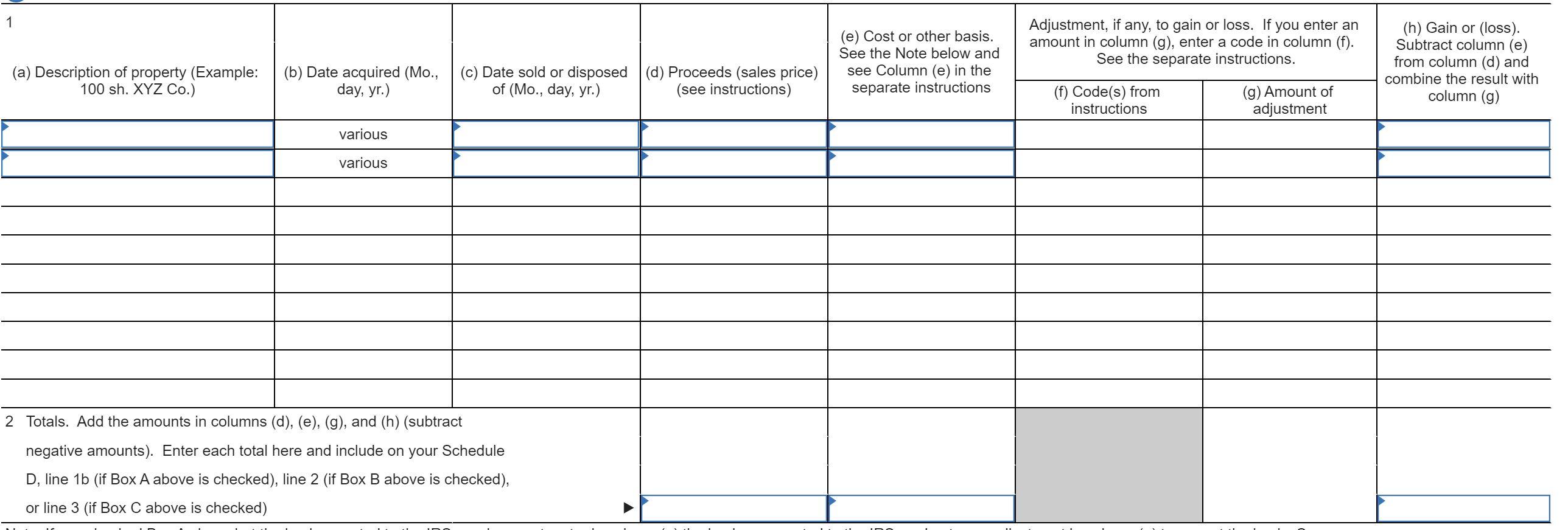

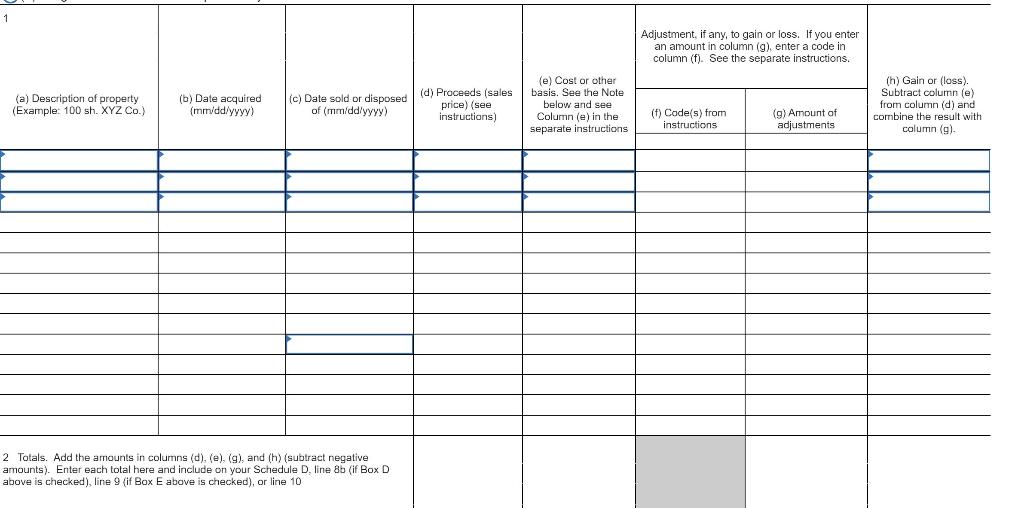

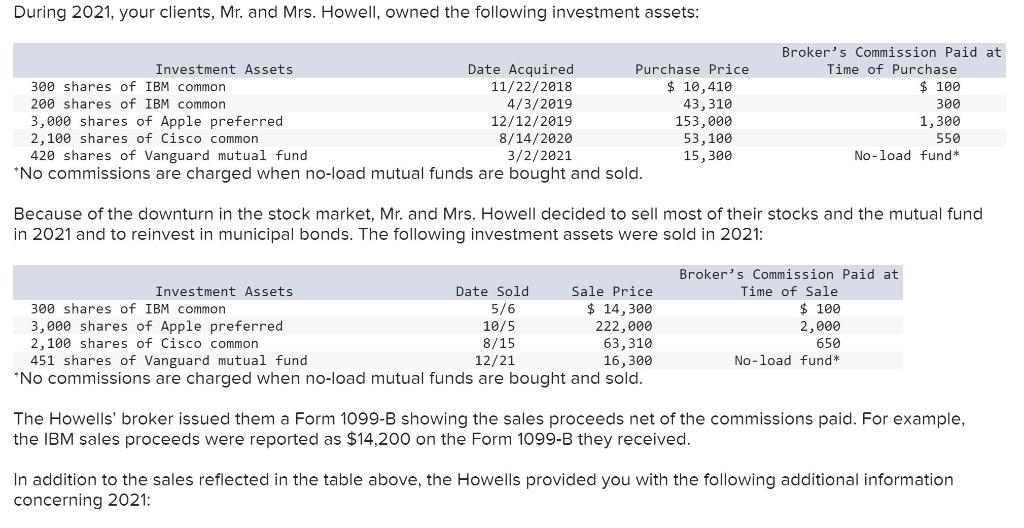

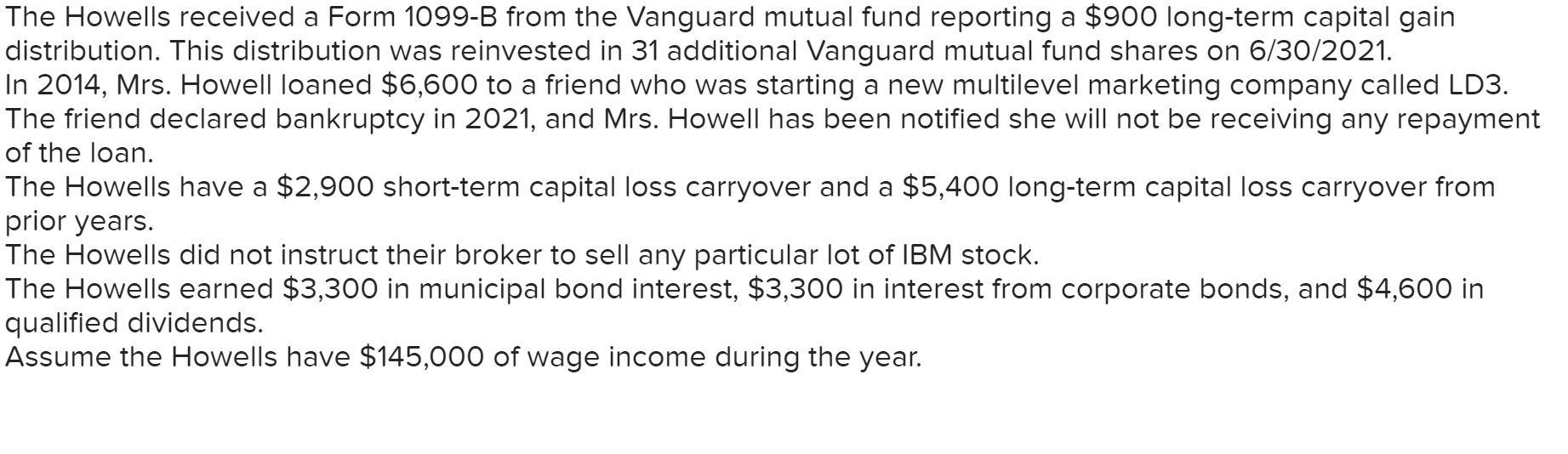

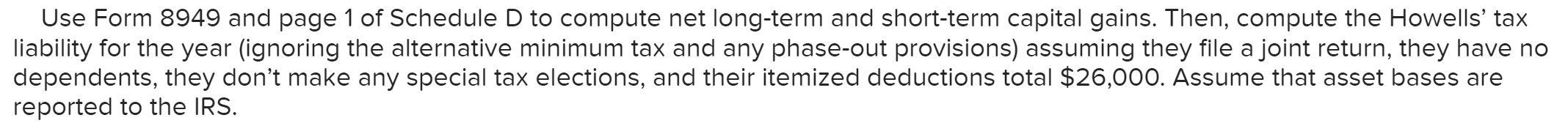

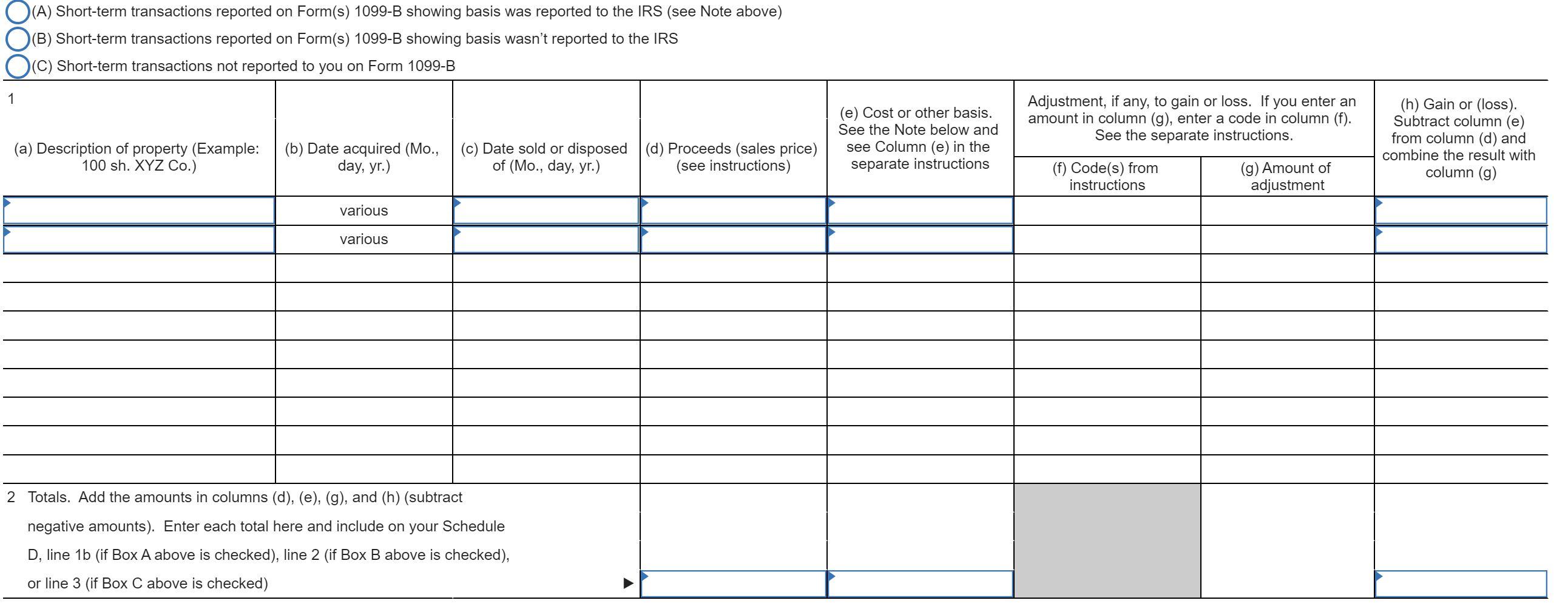

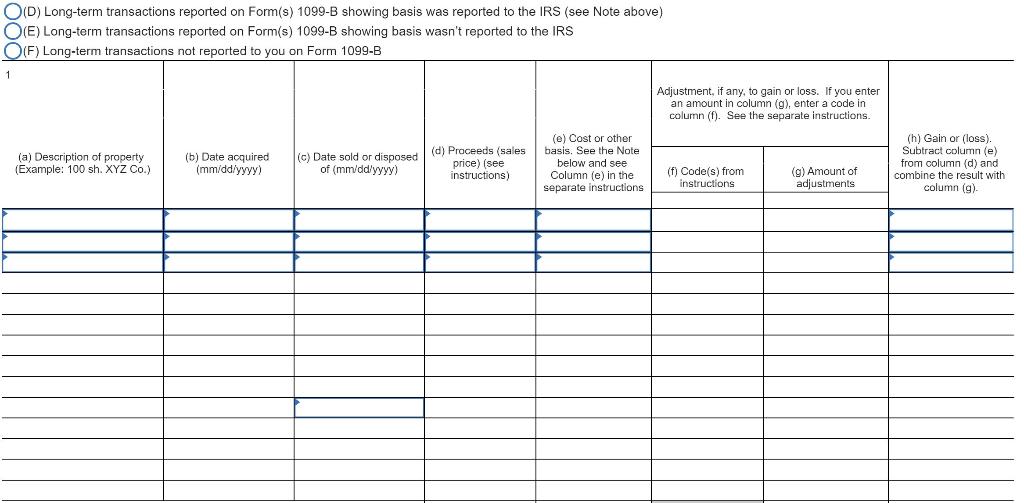

During 2021, your clients, Mr. and Mrs. Howell, owned the following investment assets: Investment Assets Date Acquired Purchase Price 300 shares of IBM common 11/22/2018 $ 10,410 200 shares of IBM common 4/3/2019 43,310 3,000 shares of Apple preferred 12/12/2019 153,000 2,100 shares of Cisco common 8/14/2020 53,100 420 shares of Vanguard mutual fund 3/2/2021 15,300 *No commissions are charged when no-load mutual funds are bought and sold. Broker's Commission Paid at Time of Purchase $ 100 300 1,300 550 No-load fund* Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2021 and to reinvest in municipal bonds. The following investment assets were sold in 2021: Investment Assets Date Sold Sale Price 300 shares of IBM common 5/6 $ 14,300 3,000 shares of Apple preferred 10/5 222,000 2,100 shares of Cisco common 8/15 63,310 451 shares of Vanguard mutual fund 12/21 16,300 *No commissions are charged when no-load mutual funds are bought and sold. Broker's Commission Paid at Time of Sale $ 100 2,000 650 No-load fund The Howells' broker issued them a Form 1099-B showing the sales proceeds net of the commissions paid. For example, the IBM sales proceeds were reported as $14,200 on the Form 1099-B they received. In addition to the sales reflected in the table above, the Howells provided you with the following additional information concerning 2021: The Howells received a Form 1099-B from the Vanguard mutual fund reporting a $900 long-term capital gain distribution. This distribution was reinvested in 31 additional Vanguard mutual fund shares on 6/30/2021. In 2014, Mrs. Howell loaned $6,600 to a friend who was starting a new multilevel marketing company called LD3. The friend declared bankruptcy in 2021, and Mrs. Howell has been notified she will not be receiving any repayment of the loan. The Howells have a $2,900 short-term capital loss carryover and a $5,400 long-term capital loss carryover from prior years. The Howells did not instruct their broker to sell any particular lot of IBM stock. The Howells earned $3,300 in municipal bond interest, $3,300 in interest from corporate bonds, and $4,600 in qualified dividends. Assume the Howells have $145,000 of wage income during the year. 1 Adjustment, if any, to gain or loss. If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (a) Description of property (Example: 100 sh. XYZ Co.) (h) Gain or loss). Subtract column (e) from column (d) and combine the result with column (g) (e) Cost or other basis. See the Note below and see Column (e) in the separate instructions (b) Date acquired (Mo., day, yr.) (c) Date sold or disposed (d) Proceeds (sales price) of (Mo., day, yr.) (see instructions) (f) Code(s) from instructions (g) Amount of adjustment various various 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked) 1 Adjustment, if any, to gain or loss. If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (a) Description of property (Example: 100 sh. XYZ Co.) (b) Date acquired (mm/dd/yyyy) (c) Date sold or disposed (d) Proceeds (sales of (mm/dd/yyyy) price) (see instructions) (e) Cost or other basis. See the Note below and see Column (e) in the separate instructions (f) Code(s) from instructions (h) Gain or loss). Subtract column (e) from column (d) and combine the result with column (9) (9) Amount of adjustments 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D. line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 During 2021, your clients, Mr. and Mrs. Howell, owned the following investment assets: Investment Assets Date Acquired Purchase Price 300 shares of IBM common 11/22/2018 $ 10,410 200 shares of IBM common 4/3/2019 43,310 3,000 shares of Apple preferred 12/12/2019 153,000 2,100 shares of Cisco common 8/14/2020 53,100 420 shares of Vanguard mutual fund 3/2/2021 15,300 *No commissions are charged when no-load mutual funds are bought and sold. Broker's Commission Paid at Time of Purchase $ 100 300 1,300 550 No-load fund* Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2021 and to reinvest in municipal bonds. The following investment assets were sold in 2021: Investment Assets Date Sold Sale Price 300 shares of IBM common 5/6 $ 14,300 3,000 shares of Apple preferred 10/5 222,000 2,100 shares of Cisco common 8/15 63,310 451 shares of Vanguard mutual fund 12/21 16,300 *No commissions are charged when no-load mutual funds are bought and sold. Broker's Commission Paid at Time of Sale $ 100 2,000 650 No-load fund The Howells' broker issued them a Form 1099-B showing the sales proceeds net of the commissions paid. For example, the IBM sales proceeds were reported as $14,200 on the Form 1099-B they received. In addition to the sales reflected in the table above, the Howells provided you with the following additional information concerning 2021: The Howells received a Form 1099-B from the Vanguard mutual fund reporting a $900 long-term capital gain distribution. This distribution was reinvested in 31 additional Vanguard mutual fund shares on 6/30/2021. In 2014, Mrs. Howell loaned $6,600 to a friend who was starting a new multilevel marketing company called LD3. The friend declared bankruptcy in 2021, and Mrs. Howell has been notified she will not be receiving any repayment of the loan. The Howells have a $2,900 short-term capital loss carryover and a $5,400 long-term capital loss carryover from prior years. The Howells did not instruct their broker to sell any particular lot of IBM stock. The Howells earned $3,300 in municipal bond interest, $3,300 in interest from corporate bonds, and $4,600 in qualified dividends. Assume the Howells have $145,000 of wage income during the year. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. Then, compute the Howells' tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming they file a joint return, they have no dependents, they don't make any special tax elections, and their itemized deductions total $26,000. Assume that asset bases are reported to the IRS. O(A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (B) Short-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-B 1 Adjustment, if any, to gain or loss. If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (a) Description of property (Example: 100 sh. XYZ Co.) (h) Gain or (loss). Subtract column (e) from column (d) and combine the result with column (g) (e) Cost or other basis. See the Note below and see Column (e) in the separate instructions (b) Date acquired (Mo., day, yr.) (c) Date sold or disposed (d) Proceeds (sales price) of (Mo., day, yr.) (see instructions) (f) Code(s) from instructions (g) Amount of adjustment various various 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked) O(D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) O(E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS O(F) Long-term transactions not reported to you on Form 1099-B 1 Adjustment, if any, to gain or loss. If you enter an amount in column (g), enter a code in column (f). See the separate instructions. (a) Description of property (Example: 100 sh.XYZ Co.) (b) Date acquired (mm/dd/yyyy) (c) Date sold or disposed (d) Proceeds (sales of (mm/dd/yyyy) price) (see instructions) (e) Cost or other basis. See the Note below and see Column (e) in the separate instructions (h) Gain or loss). Subtract column (e) from column (d) and combine the result with column (g) (f) Code(s) from instructions (g) Amount of adjustments