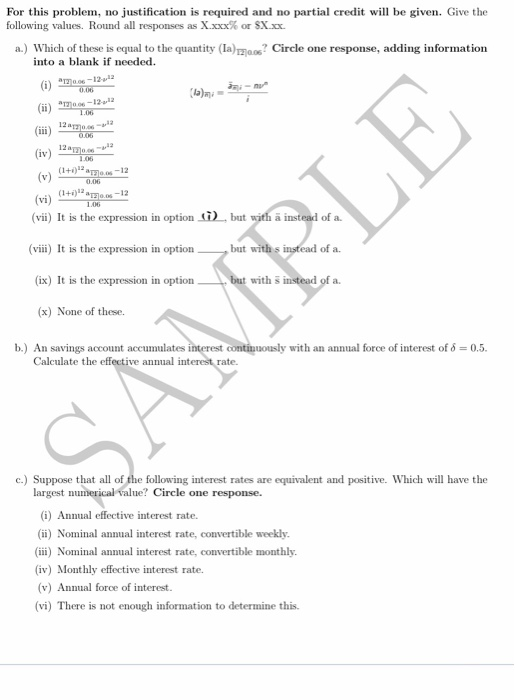

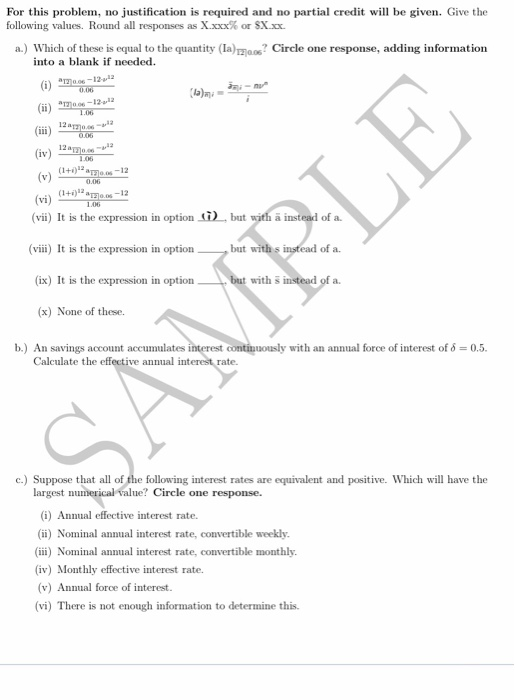

For this problem, no justification is required and no partial credit will be given. Give the following values. Round all responses as Xxxx% or SX.3x. a.) Which of these is equal to the quantity (Ia005? Circle one response, adding information into a blank if needed. (l)a; -mov (i) 20-1212 (ii) *17/08-12-12 12-170. (iv) 2017 - - 0706 (1+27.06-12 0.06 (1+r)* 2 70.05-12 (vii) It is the expression in option (i), but with a instead of a. (viii) It is the expression in option but with s instead of a. (ix) It is the expression in option but with s instead of a. (x) None of these. b.) An savings account accumulates interest continuously with an annual force of interest of d = 0.5. Calculate the effective annual interest rate. c.) Suppose that all of the following interest rates are equivalent and positive. Which will have the largest numerical value? Circle one response. (i) Annual effective interest rate. (ii) Nominal annual interest rate, convertible weekly. (iii) Nominal annual interest rate, convertible monthly (iv) Monthly effective interest rate. (v) Annual force of interest. (vi) There is not enough information to determine this. For this problem, no justification is required and no partial credit will be given. Give the following values. Round all responses as Xxxx% or SX.3x. a.) Which of these is equal to the quantity (Ia005? Circle one response, adding information into a blank if needed. (l)a; -mov (i) 20-1212 (ii) *17/08-12-12 12-170. (iv) 2017 - - 0706 (1+27.06-12 0.06 (1+r)* 2 70.05-12 (vii) It is the expression in option (i), but with a instead of a. (viii) It is the expression in option but with s instead of a. (ix) It is the expression in option but with s instead of a. (x) None of these. b.) An savings account accumulates interest continuously with an annual force of interest of d = 0.5. Calculate the effective annual interest rate. c.) Suppose that all of the following interest rates are equivalent and positive. Which will have the largest numerical value? Circle one response. (i) Annual effective interest rate. (ii) Nominal annual interest rate, convertible weekly. (iii) Nominal annual interest rate, convertible monthly (iv) Monthly effective interest rate. (v) Annual force of interest. (vi) There is not enough information to determine this