Question

For this problem, where I am asked to calculate the pension expense for the year ended December 31, 2017, do I multiply 2017's discount rate

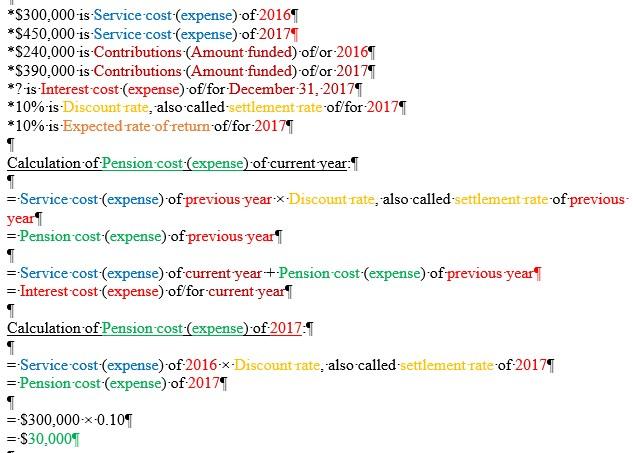

For this problem, where I am asked to calculate the pension expense for the year ended December 31, 2017, do I multiply 2017's discount rate of 10% by $300,000, the service cost of 2016? Or, do I multiply 2016's discount rate of 10% by $300,000, the service cost of 2016, to calculate the pension cost for 2017?

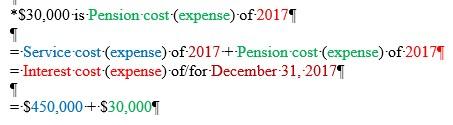

In order to calculate the Actual return of/for 2017, do I multiply 10%, the expected rate of return of/for 2016 by $240,000, the Contributions (Amount funded) of/for 2016 to get the Actual return of/for 2017?

In order to calculate the Actual return of/for 2017, do I multiply 10%, the expected rate of return of/for 2017 by $240,000, the Contributions (Amount funded) of/for 2016 to get the Actual return of/for 2017?

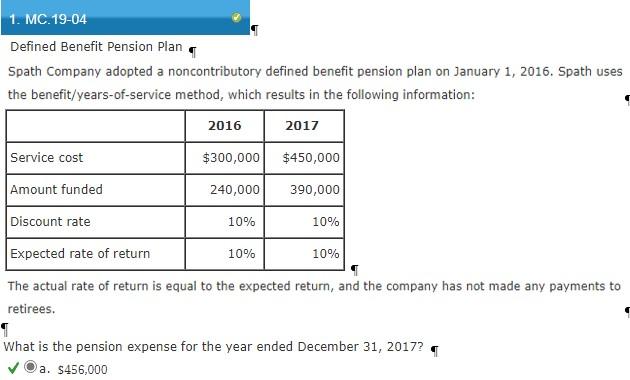

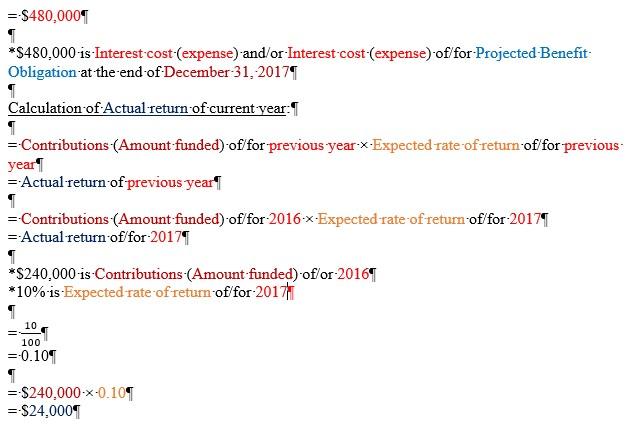

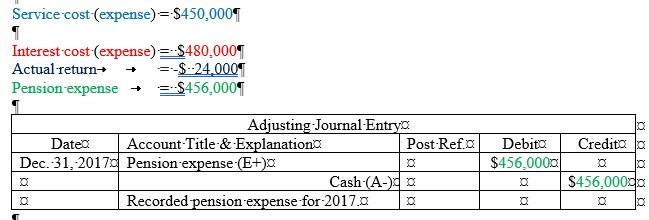

1. MC. 19-04 Defined Benefit Pension Plan Spath Company adopted a noncontributory defined benefit pension plan on January 1, 2016. Spath uses the benefit/years-of-service method, which results in the following information: 2016 2017 Service cost $300,000 $450,000 Amount funded 240,000 390,000 Discount rate 10% 10% Expected rate of return 10% 10% The actual rate of return is equal to the expected return, and the company has not made any payments to retirees, 1 What is the pension expense for the year ended December 31, 2017? a. $456,000 *$300,000 -is-Service cost expense) of 2016 *$450,000 -is-Service cost-expense) of 2017 *$240,000 -is-Contributions (Amount-funded) of/or 2016 *$390,000 -is-Contributions (Amount-funded) of/or 2017 *?-is-Interest-cost-expense) of for December 31, 2017 *10%-is-Discount rate, also called settlement rate of/for-2017/ *10%-is-Expected rate of return of/for-20171 1 Calculation-of-Pension-cost (expense) of current year. I =-Service cost-(expense) of previous year-x-Discount rate, also called settlement rate of previous- year = Pension cost (expense) of previous year' 1 =-Service cost (expense) of current year+-Pension cost (expense) of previous year =-Interest cost expense) of for current year 1 Calculation of Pension-cost (expense) of 2017: =-Service cost-(expense) of-2016-x-Discount rate, also called settlement rate-of-2017 =-Pension cost-expense) of 2017 1 =-$300.000-x-0.101 =$30,000 *$30,000 -is-Pension cost (expense) of 2017 =-Service cost (expense) of 2017+Pension cost (expense) of 20171 =-Interest cost (expense) of for December 31, 2017 = $450,000+ $30.000 = $480,0001 *$480.000-is-Interest cost (expense) and/or Interest-cost expense) of'for Projected -Benefit: Obligation at the end of December 31, 2017 Calculation of Actual return of current year: 1 = Contributions (Amount funded) of for previous year-x-Expected rate of return of for previous year =-Actual return of previous year 1 =-Contributions (Amount-funded) of for-2016-x-Expected rate of return-of'for-20171 =-Actual return of for 2017 *$240,000 is Contributions (Amount-funded) of/or 2016 *10%-is-Expected rate of return of/for-2017 10 100 =-0.109 1 =-$240,000-x-0.101 = $24,000 Service-cost expense)=-$450,000 Interest-cost expense) = $480,000 Actual return ---$-24.0001 Pension expense + 3-$456,0000 Credito Adjusting Journal-Entry Dated Account-Title-& Explanation Post-Ref. Dec. 31, 2017 Pension expense (E+) Cash (A- Recorded pension expense-for-2017 Debito $456,0000 $456,000go 10 1. MC. 19-04 Defined Benefit Pension Plan Spath Company adopted a noncontributory defined benefit pension plan on January 1, 2016. Spath uses the benefit/years-of-service method, which results in the following information: 2016 2017 Service cost $300,000 $450,000 Amount funded 240,000 390,000 Discount rate 10% 10% Expected rate of return 10% 10% The actual rate of return is equal to the expected return, and the company has not made any payments to retirees, 1 What is the pension expense for the year ended December 31, 2017? a. $456,000 *$300,000 -is-Service cost expense) of 2016 *$450,000 -is-Service cost-expense) of 2017 *$240,000 -is-Contributions (Amount-funded) of/or 2016 *$390,000 -is-Contributions (Amount-funded) of/or 2017 *?-is-Interest-cost-expense) of for December 31, 2017 *10%-is-Discount rate, also called settlement rate of/for-2017/ *10%-is-Expected rate of return of/for-20171 1 Calculation-of-Pension-cost (expense) of current year. I =-Service cost-(expense) of previous year-x-Discount rate, also called settlement rate of previous- year = Pension cost (expense) of previous year' 1 =-Service cost (expense) of current year+-Pension cost (expense) of previous year =-Interest cost expense) of for current year 1 Calculation of Pension-cost (expense) of 2017: =-Service cost-(expense) of-2016-x-Discount rate, also called settlement rate-of-2017 =-Pension cost-expense) of 2017 1 =-$300.000-x-0.101 =$30,000 *$30,000 -is-Pension cost (expense) of 2017 =-Service cost (expense) of 2017+Pension cost (expense) of 20171 =-Interest cost (expense) of for December 31, 2017 = $450,000+ $30.000 = $480,0001 *$480.000-is-Interest cost (expense) and/or Interest-cost expense) of'for Projected -Benefit: Obligation at the end of December 31, 2017 Calculation of Actual return of current year: 1 = Contributions (Amount funded) of for previous year-x-Expected rate of return of for previous year =-Actual return of previous year 1 =-Contributions (Amount-funded) of for-2016-x-Expected rate of return-of'for-20171 =-Actual return of for 2017 *$240,000 is Contributions (Amount-funded) of/or 2016 *10%-is-Expected rate of return of/for-2017 10 100 =-0.109 1 =-$240,000-x-0.101 = $24,000 Service-cost expense)=-$450,000 Interest-cost expense) = $480,000 Actual return ---$-24.0001 Pension expense + 3-$456,0000 Credito Adjusting Journal-Entry Dated Account-Title-& Explanation Post-Ref. Dec. 31, 2017 Pension expense (E+) Cash (A- Recorded pension expense-for-2017 Debito $456,0000 $456,000go 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started