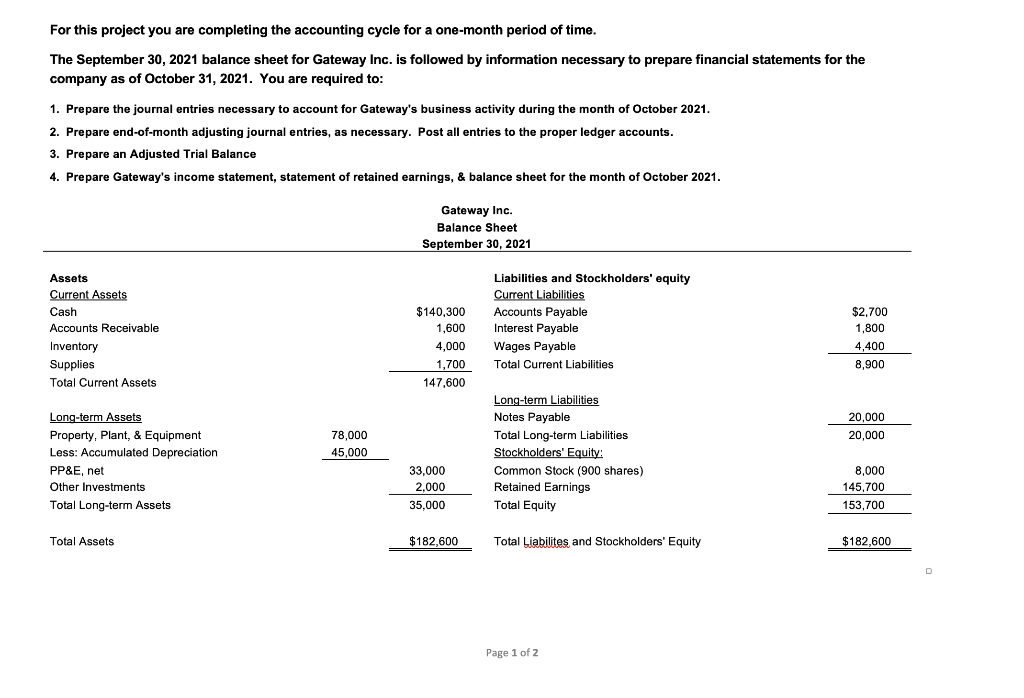

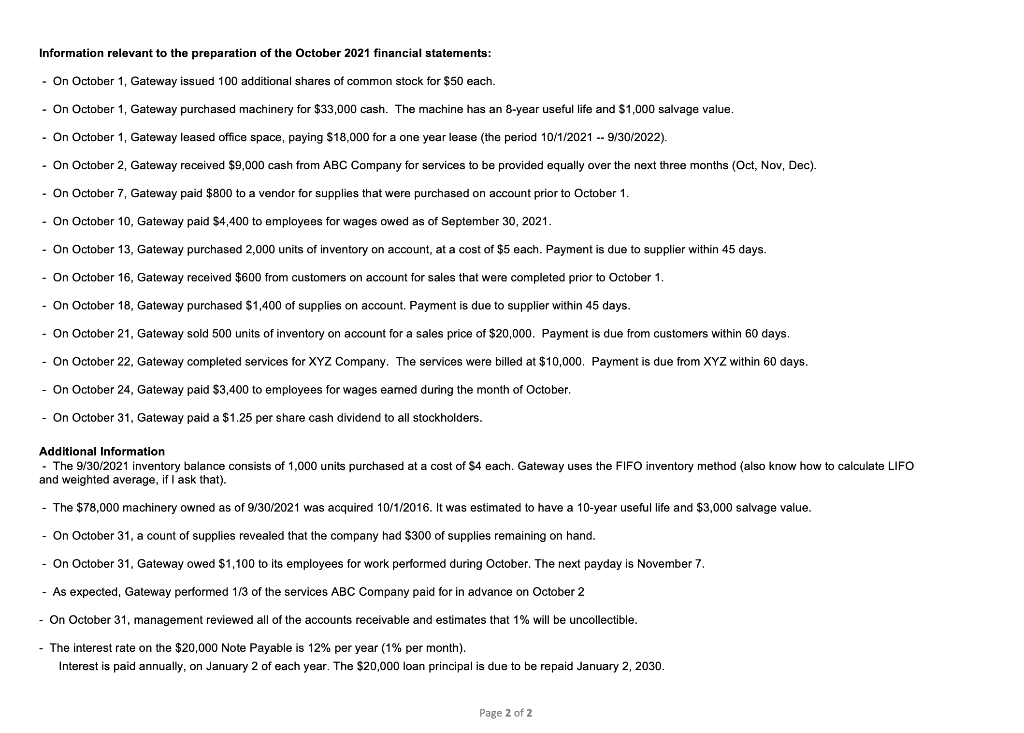

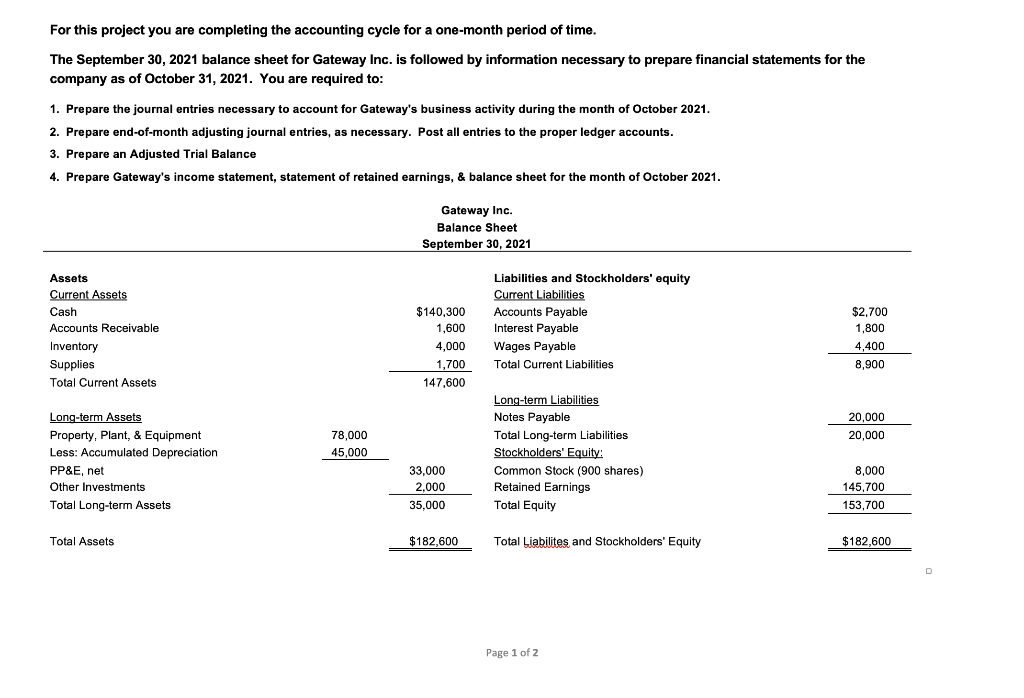

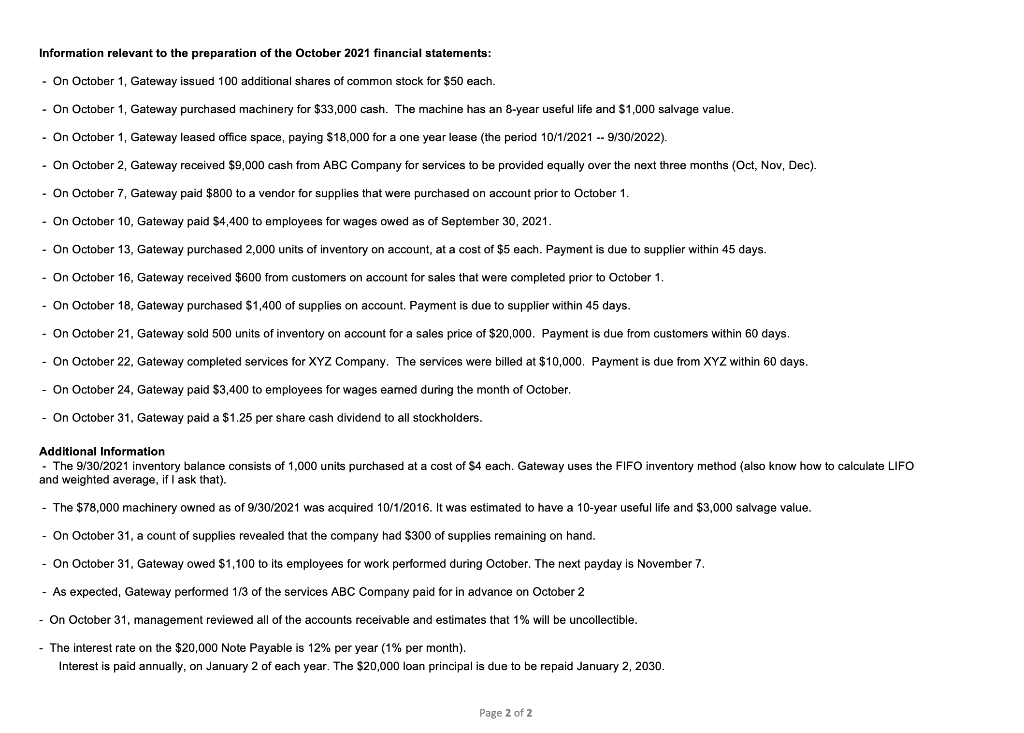

For this project you are completing the accounting cycle for a one-month period of time. The September 30, 2021 balance sheet for Gateway Inc. is followed by information necessary to prepare financial statements for the company as of October 31, 2021. You are required to: 1. Prepare the journal entries necessary to account for Gateway's business activity during the month of October 2021. 2. Prepare end-of-month adjusting journal entries, as necessary. Post all entries to the proper ledger accounts. 3. Prepare an Adjusted Trial Balance 4. Prepare Gateway's income statement, statement of retained earnings, & balance sheet for the month of October 2021. Gateway Inc. Balance Sheet September 30, 2021 Assets Current Assets Cash Accounts Receivable Inventory Supplies Total Current Assets $140,300 1,600 4,000 1,700 147,600 Liabilities and Stockholders' equity Current Liabilities Accounts Payable Interest Payable Wages Payable Total Current Liabilities $2,700 1,800 4,400 8,900 20,000 20,000 78,000 45,000 Long-term Assets Property, Plant, & Equipment Less: Accumulated Depreciation PP&E, net Other Investments Total Long-term Assets Long-term Liabilities Notes Payable Total Long-term Liabilities Stockholders' Equity: Common Stock (900 shares) Retained Earnings Total Equity 33,000 2.000 35,000 8,000 145,700 153,700 Total Assets $182,600 Total Liabilites and Stockholders' Equity $182,600 Page 1 of 2 Information relevant to the preparation of the October 2021 financial statements: - On October 1, Gateway issued 100 additional shares of common stock for $50 each. - On October 1, Gateway purchased machinery for $33,000 cash. The machine has an 8-year useful life and $1,000 salvage value. - On October 1, Gateway leased office space, paying $18,000 for a one year lease (the period 10/1/2021 -- 9/30/2022). - On October 2, Gateway received $9,000 cash from ABC Company for services to be provided equally over the next three months (Oct, Nov, Dec). - On October 7, Gateway paid $800 to a vendor for supplies that were purchased on account prior to October 1. - On October 10, Gateway paid $4,400 to employees for wages owed as of September 30, 2021. - On October 13, Gateway purchased 2,000 units of inventory on account, at a cost of $5 each. Payment is due to supplier within 45 days. - On October 16, Gateway received $600 from customers on account for sales that were completed prior to October 1. - On October 18, Gateway purchased $1,400 of supplies on account. Payment is due to supplier within 45 days. - On October 21, Gateway sold 500 units of inventory on account for a sales price of $20,000. Payment is due from customers within 60 days. - On October 22, Gateway completed services for XYZ Company. The services were billed at $10,000. Payment is due from XYZ within 60 days. - On October 24, Gateway paid $3,400 to employees for wages earned during the month of October. - On October 31, Gateway paid a $1.25 per share cash dividend to all stockholders. Additional Information - The 9/30/2021 inventory balance consists of 1,000 units purchased at a cost of $4 each. Gateway uses the FIFO inventory method (also know how to calculate LIFO and weighted average, if I ask that). - The $78,000 machinery owned as of 9/30/2021 was acquired 10/1/2016. It was estimated to have a 10-year useful life and $3,000 salvage value. - On October 31, a count of supplies revealed that the company had $300 of supplies remaining on hand. - On October 31, Gateway owed $1,100 to its employees for work performed during October. The next payday is November 7. - As expected, Gateway performed 1/3 of the services ABC Company paid for in advance on October 2 On October 31, management reviewed all of the accounts receivable and estimates that 1% will be uncollectible. - The interest rate on the $20,000 Note Payable is 12% per year (1% per month). Interest is paid annually, on January 2 of each year. The $20,000 loan principal is due to be repaid January 2, 2030. Page 2 of 2