Question

For this project you will have to contact a local bank and get information about their mortgage products. You would like to finance the purchase

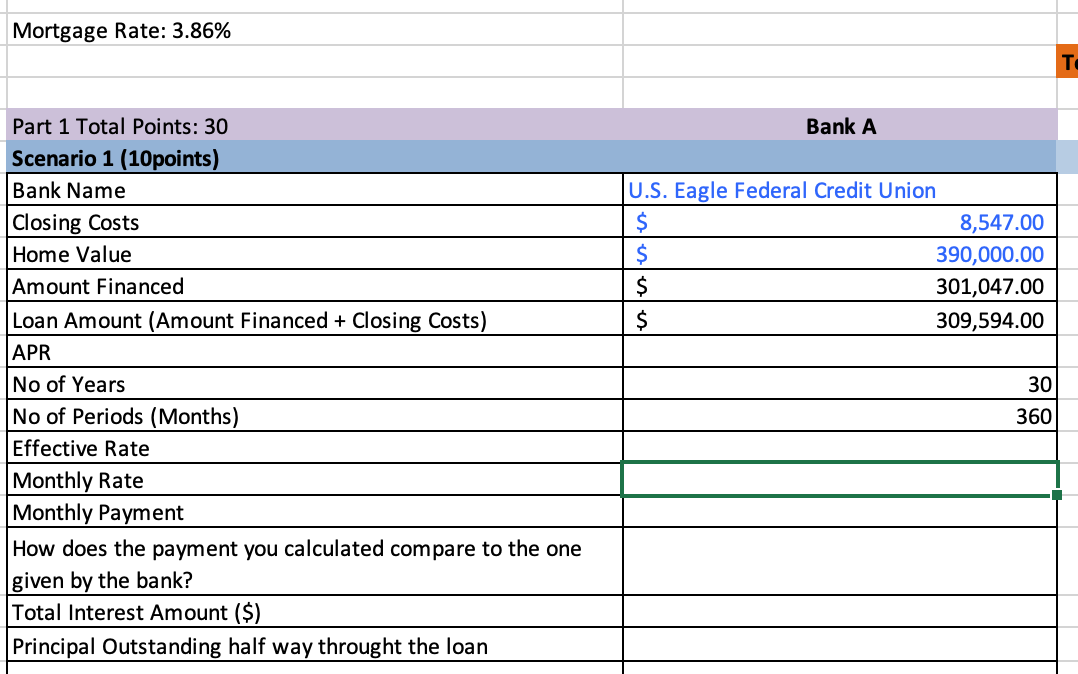

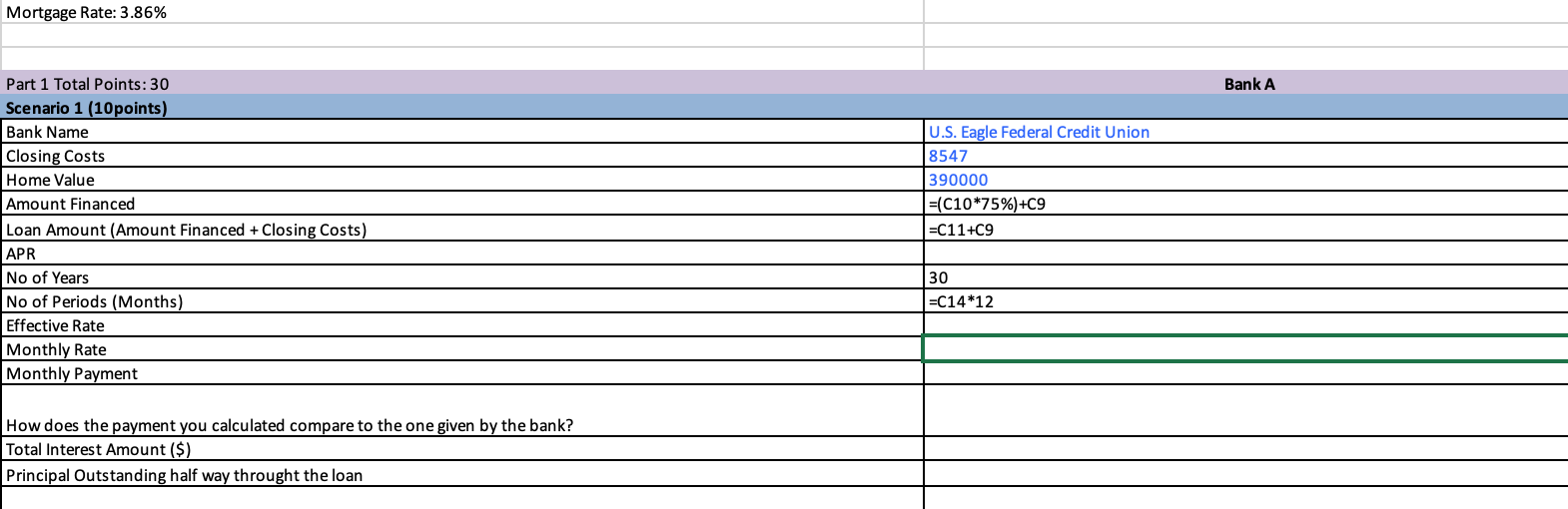

For this project you will have to contact a local bank and get information about their mortgage products. You would like to finance the purchase of a new house. The house is worth $390,000. And you want to finance it for 30 years (I know that the rates you get will depend on your credit score, but ask about the different products assuming you have outstanding credit. Do not give the banks any of your personal info.). You are putting down 25% of the house value. How does the payment compare to the one you calculated?

Loan Amount: Assume that you will finance 75% of the purchase of the home plus closing costs. (This means that to your loan amount (75% Value of the house + Closing Costs)

On an excel worksheet calculate the following:

SCENARIO 1

- Calculate the monthly rate that will be used to pay your loan. How does this compare to the amount given by the bank. Is it different or is it the same?

- Number of Periods

- Monthly Payment

- How much will you have to pay in interest payments throughout the life of the loan (total interest paid)?

- What is the effective Rate?

- What is the principal amount left to pay half way though the life of the loan (15 years)?

Please help with the missing parts of the chart. Is what I already have filled out in the chart correct?

Mortgage Rate: 3.86% Bank A U.S. Eagle Federal Credit Union 8,547.00 390,000.00 301,047.00 309,594.00 Part 1 Total Points: 30 Scenario 1 (10 points) Bank Name Closing Costs Home Value Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods (Months) Effective Rate Monthly Rate Monthly Payment How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loan 30 360 Mortgage Rate: 3.86% Bank A Part 1 Total Points: 30 Scenario 1 (10 points) Bank Name Closing Costs Home Value Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods (Months) Effective Rate Monthly Rate Monthly Payment U.S. Eagle Federal Credit Union 8547 390000 =(C10*75%)+C9 =C11+C9 30 =C14*12 How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loan Mortgage Rate: 3.86% Bank A U.S. Eagle Federal Credit Union 8,547.00 390,000.00 301,047.00 309,594.00 Part 1 Total Points: 30 Scenario 1 (10 points) Bank Name Closing Costs Home Value Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods (Months) Effective Rate Monthly Rate Monthly Payment How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loan 30 360 Mortgage Rate: 3.86% Bank A Part 1 Total Points: 30 Scenario 1 (10 points) Bank Name Closing Costs Home Value Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods (Months) Effective Rate Monthly Rate Monthly Payment U.S. Eagle Federal Credit Union 8547 390000 =(C10*75%)+C9 =C11+C9 30 =C14*12 How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started