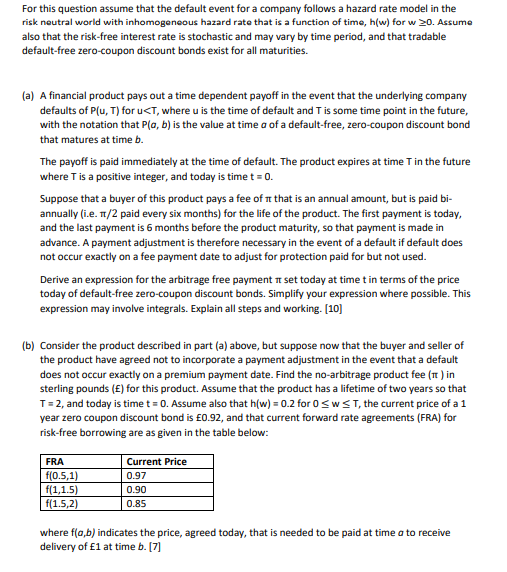

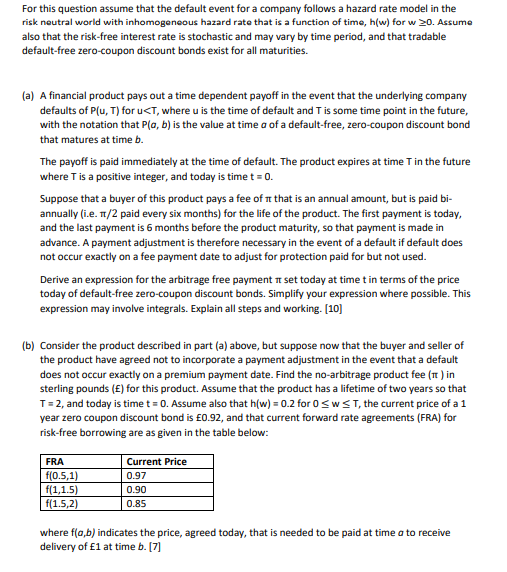

For this question assume that the default event for a company follows a hazard rate model in the risk neutral world with inhomogeneous hazard rate that is a function of time, h(w) forw >0. Assume also that the risk-free interest rate is stochastic and may vary by time period, and that tradable default-free zero-coupon discount bonds exist for all maturities. (a) A financial product pays out a time dependent payoff in the event that the underlying company defaults of Plu, T) for uCT, where u is the time of default and T is some time point in the future, with the notation that Pla, b) is the value at time a of a default-free, zero-coupon discount bond that matures at time b. The payoff is paid immediately at the time of default. The product expires at time I in the future where is a positive integer, and today is time t = 0. Suppose that a buyer of this product pays a fee of it that is an annual amount, but is paid bi- annually (i.e. 1/2 paid every six months) for the life of the product. The first payment is today, and the last payment is 6 months before the product maturity, so that payment is made in advance. A payment adjustment is therefore necessary in the event of a default if default does not occur exactly on a fee payment date to adjust for protection paid for but not used. Derive an expression for the arbitrage free payment it set today at time t in terms of the price today of default-free zero-coupon discount bonds. Simplify your expression where possible. This expression may involve integrals. Explain all steps and working. [10] (b) Consider the product described in part (a) above, but suppose now that the buyer and seller of the product have agreed not to incorporate a payment adjustment in the event that a default does not occur exactly on a premium payment date. Find the no-arbitrage product fee (1 ) in sterling pounds (E) for this product. Assume that the product has a lifetime of two years so that T = 2, and today is time t = 0. Assume also that h(w) = 0.2 for 0 SWST, the current price of a 1 year zero coupon discount bond is 0.92, and that current forward rate agreements (FRA) for risk-free borrowing are as given in the table below: FRA f(0.5,1) f(1,1.5) f(1.5,2) Current Price 0.97 0.90 0.85 where f(a,b) indicates the price, agreed today, that is needed to be paid at time a to receive delivery of 1 at time b. [7] For this question assume that the default event for a company follows a hazard rate model in the risk neutral world with inhomogeneous hazard rate that is a function of time, h(w) forw >0. Assume also that the risk-free interest rate is stochastic and may vary by time period, and that tradable default-free zero-coupon discount bonds exist for all maturities. (a) A financial product pays out a time dependent payoff in the event that the underlying company defaults of Plu, T) for uCT, where u is the time of default and T is some time point in the future, with the notation that Pla, b) is the value at time a of a default-free, zero-coupon discount bond that matures at time b. The payoff is paid immediately at the time of default. The product expires at time I in the future where is a positive integer, and today is time t = 0. Suppose that a buyer of this product pays a fee of it that is an annual amount, but is paid bi- annually (i.e. 1/2 paid every six months) for the life of the product. The first payment is today, and the last payment is 6 months before the product maturity, so that payment is made in advance. A payment adjustment is therefore necessary in the event of a default if default does not occur exactly on a fee payment date to adjust for protection paid for but not used. Derive an expression for the arbitrage free payment it set today at time t in terms of the price today of default-free zero-coupon discount bonds. Simplify your expression where possible. This expression may involve integrals. Explain all steps and working. [10] (b) Consider the product described in part (a) above, but suppose now that the buyer and seller of the product have agreed not to incorporate a payment adjustment in the event that a default does not occur exactly on a premium payment date. Find the no-arbitrage product fee (1 ) in sterling pounds (E) for this product. Assume that the product has a lifetime of two years so that T = 2, and today is time t = 0. Assume also that h(w) = 0.2 for 0 SWST, the current price of a 1 year zero coupon discount bond is 0.92, and that current forward rate agreements (FRA) for risk-free borrowing are as given in the table below: FRA f(0.5,1) f(1,1.5) f(1.5,2) Current Price 0.97 0.90 0.85 where f(a,b) indicates the price, agreed today, that is needed to be paid at time a to receive delivery of 1 at time b. [7]