Answered step by step

Verified Expert Solution

Question

1 Approved Answer

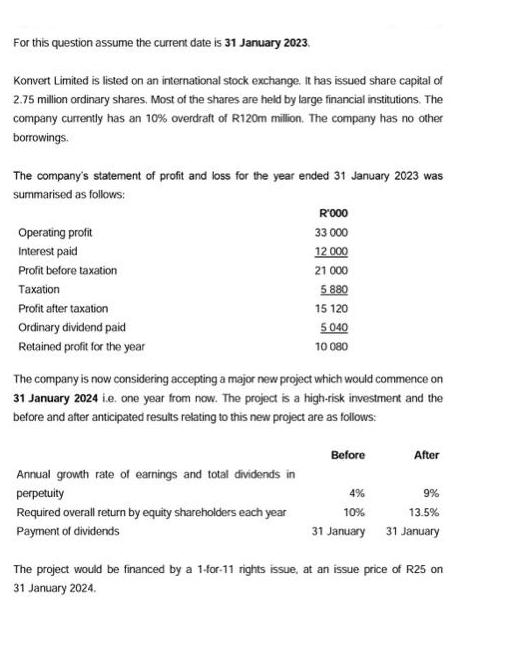

For this question assume the current date is 31 January 2023. Konvert Limited is listed on an international stock exchange. It has issued share

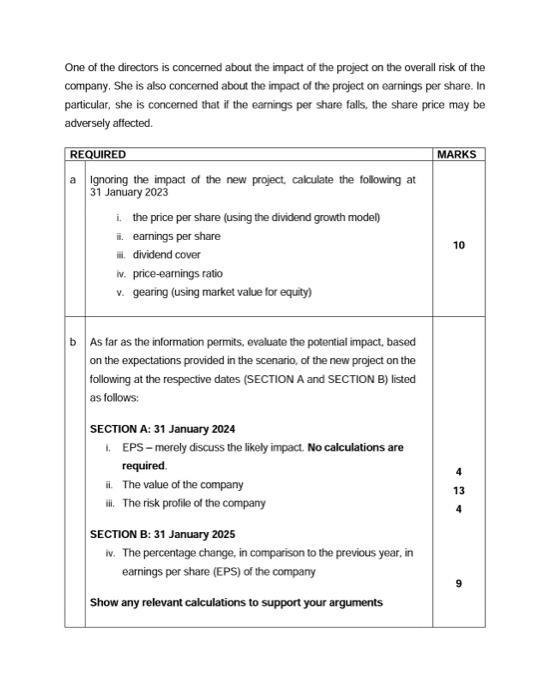

For this question assume the current date is 31 January 2023. Konvert Limited is listed on an international stock exchange. It has issued share capital of 2.75 million ordinary shares. Most of the shares are held by large financial institutions. The company currently has an 10% overdraft of R120m million. The company has no other borrowings. The company's statement of profit and loss for the year ended 31 January 2023 was summarised as follows: Operating profit Interest paid Profit before taxation Taxation Profit after taxation Ordinary dividend paid Retained profit for the year R'000 33 000 12 000 21 000 5 880 15 120 5040 10 080 The company is now considering accepting a major new project which would commence on 31 January 2024 i.e. one year from now. The project is a high-risk investment and the before and after anticipated results relating to this new project are as follows: Annual growth rate of earnings and total dividends in perpetuity Required overall return by equity shareholders each year Payment of dividends Before After 4% 9% 10% 13.5% 31 January 31 January The project would be financed by a 1-for-11 rights issue, at an issue price of R25 on 31 January 2024. One of the directors is concerned about the impact of the project on the overall risk of the company. She is also concerned about the impact of the project on earnings per share. In particular, she is concerned that if the earnings per share falls, the share price may be adversely affected. REQUIRED a ignoring the impact of the new project, calculate the following at 31 January 2023 i. the price per share (using the dividend growth model) ii. earnings per share III dividend cover iv. price-earnings ratio v. gearing (using market value for equity) b As far as the information permits, evaluate the potential impact, based on the expectations provided in the scenario, of the new project on the following at the respective dates (SECTION A and SECTION B) listed as follows: SECTION A: 31 January 2024 1. EPS-merely discuss the likely impact. No calculations are required. ii. The value of the company ii. The risk profile of the company SECTION B: 31 January 2025 iv. The percentage change, in comparison to the previous year, in earnings per share (EPS) of the company Show any relevant calculations to support your arguments MARKS 10 4 13 4

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started