For this question, I have read and analyzed the cash flow and balance sheet statements to fill in the table that is provided below. Please read thoroughly and fill in the table. Thank You.

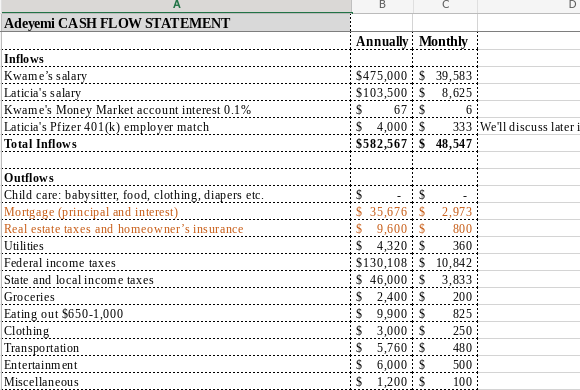

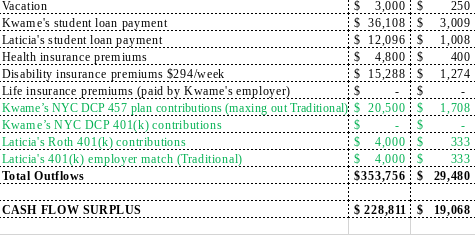

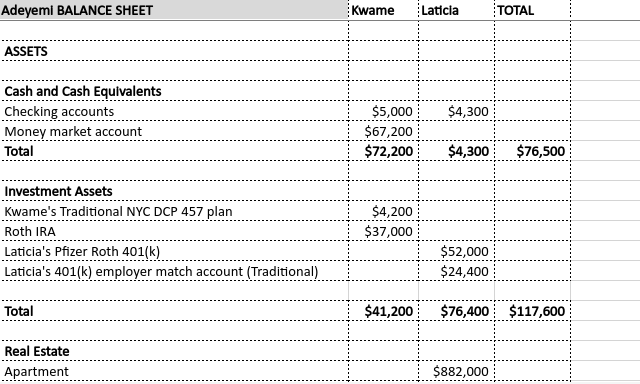

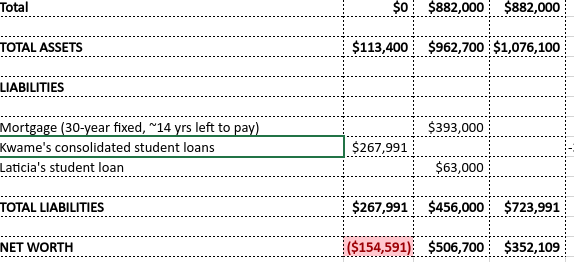

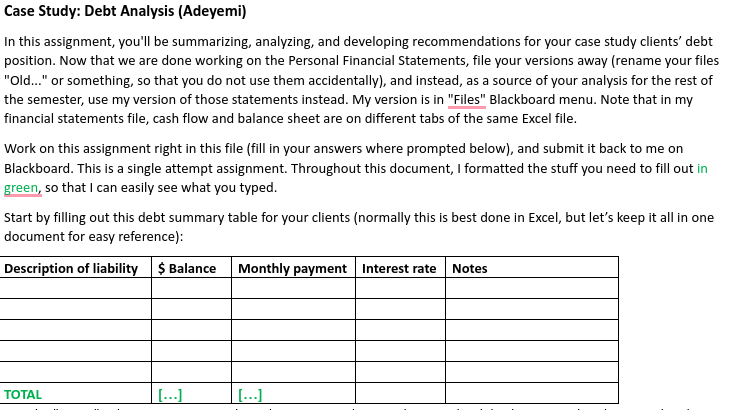

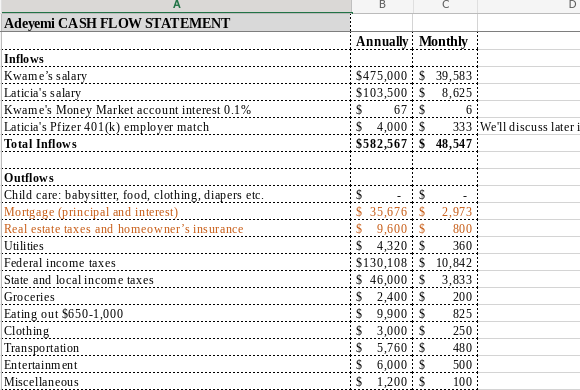

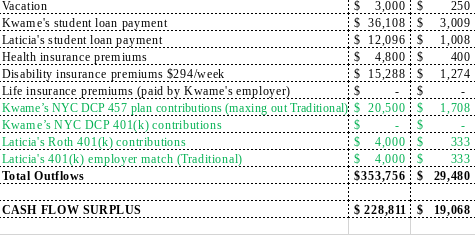

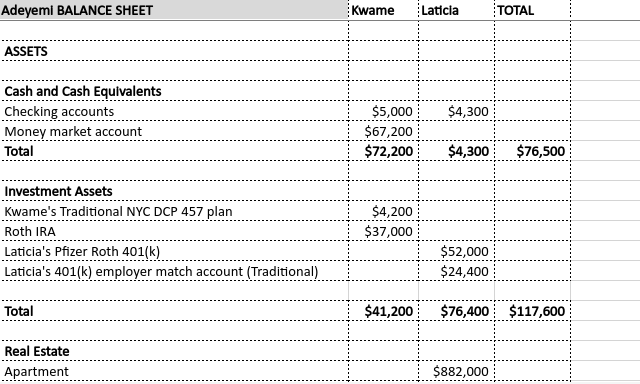

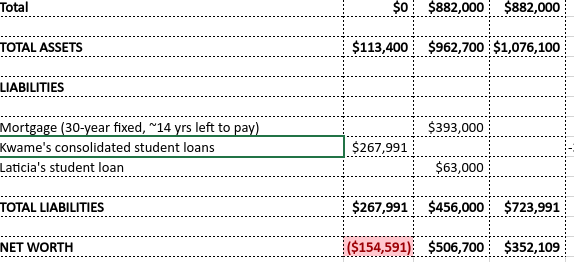

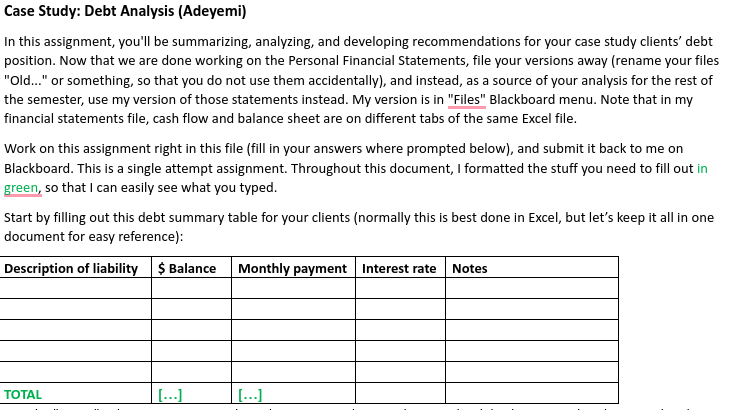

Adeyemi CASH FLOW STATEMENT Annually: Monthly Inflows Kwame's salary Laticia's salary Kwame's Money Market account interest 0.1% Laticia's Pfizer 401(k) employer match Total Inflows $475,000 $ 39,583 : $103,500 $ 8,625 $ 67: $ 6 :$ 4,000 $ 333 We'll discuss later i $582,567 $ 48,547 Outflows Child care: babysitter, food, clothing, diapers etc. Mortgage (principal and interest) Real estate taxes and homeowner's insurance Utilities Federal income taxes State and local income taxes Groceries Eating out $650-1,000 Clothing. Transportation Entertainment Miscellaneous $ 35,6765 2.973 $ 9,600$ 800 $ 4,320$ 360 $130,108 S 10,842 $ 46,000 $ 3,833 $ 2,400 200 $ 9,900 $ 825 $ 3,000 $ 250 $ 5,760 S 480 $ 6,000 $ 500 $ 1,200 $ 100 Vacation $ 3,000 $ 250 Kwame's student loan payment S 36,108 $ 3,009 Laticia's student loan payment $ 12,096 $ 1,008 Health insurance premiums $ 4,800 $ 400 Dis ability insurance premiums $294/week S 15,288 $ 1,274 $ S Life insurance premiums (paid by Kwame's employer) $ $ Kwame's NYC DCP 457 plan contributions (maxing out Traditional) S 20,500S 1,708 Kwame's NYC DCP 401(k) contributions $ Laticia's Roth 401(k) contributions $ 4,000 $ 333 Laticia's 401(k) employer match (Traditional) $ 4,000 $ 333 Total Outflows $353,756 $ 29,480 CASH FLOW SUR PLUS $ 228,811 : $ 19,068 Adeyemi BALANCE SHEET Kwame Laticia TOTAL ASSETS $4,300 Cash and Cash Equivalents Checking accounts Money market account Total $5,000 $67,200 $72,200 $4,300 $76,500 Investment Assets Kwame's Traditional NYC DCP 457 plan Roth IRA Laticia's Pfizer Roth 401(k) Laticia's 401(k) employer match account (Traditional) $4,200 $37,000 $52,000 $24,400 Total $41,200 $76,400 $117,600 Real Estate Apartment $882,000 Total $0 $882,000 $882,000 TOTAL ASSETS $113,400 $962,700 $1,076,100 LIABILITIES $393,000 Mortgage (30-year fixed, "14 yrs left to pay) Kwame's consolidated student loans Laticia's student loan $267,991 $63,000 TOTAL LIABILITIES $267,991 $456,000 $723,991 NET WORTH ($154,591) $506,700 $352,109 Case Study: Debt Analysis (Adeyemi) In this assignment, you'll be summarizing, analyzing, and developing recommendations for your case study clients' debt position. Now that we are done working on the Personal Financial Statements, file your versions away (rename your files "Old..." or something, so that you do not use them accidentally), and instead, as a source of your analysis for the rest of the semester, use my version of those statements instead. My version is in "Files" Blackboard menu. Note that in my financial statements file, cash flow and balance sheet are on different tabs of the same Excel file. Work on this assignment right in this file (fill in your answers where prompted below), and submit it back to me on Blackboard. This is a single attempt assignment. Throughout this document, I formatted the stuff you need to fill out in green, so that I can easily see what you typed. Start by filling out this debt summary table for your clients (normally this is best done in Excel, but let's keep it all in one document for easy reference): Description of liability $ Balance Monthly payment Interest rate Notes TOTAL [...] [...] Adeyemi CASH FLOW STATEMENT Annually: Monthly Inflows Kwame's salary Laticia's salary Kwame's Money Market account interest 0.1% Laticia's Pfizer 401(k) employer match Total Inflows $475,000 $ 39,583 : $103,500 $ 8,625 $ 67: $ 6 :$ 4,000 $ 333 We'll discuss later i $582,567 $ 48,547 Outflows Child care: babysitter, food, clothing, diapers etc. Mortgage (principal and interest) Real estate taxes and homeowner's insurance Utilities Federal income taxes State and local income taxes Groceries Eating out $650-1,000 Clothing. Transportation Entertainment Miscellaneous $ 35,6765 2.973 $ 9,600$ 800 $ 4,320$ 360 $130,108 S 10,842 $ 46,000 $ 3,833 $ 2,400 200 $ 9,900 $ 825 $ 3,000 $ 250 $ 5,760 S 480 $ 6,000 $ 500 $ 1,200 $ 100 Vacation $ 3,000 $ 250 Kwame's student loan payment S 36,108 $ 3,009 Laticia's student loan payment $ 12,096 $ 1,008 Health insurance premiums $ 4,800 $ 400 Dis ability insurance premiums $294/week S 15,288 $ 1,274 $ S Life insurance premiums (paid by Kwame's employer) $ $ Kwame's NYC DCP 457 plan contributions (maxing out Traditional) S 20,500S 1,708 Kwame's NYC DCP 401(k) contributions $ Laticia's Roth 401(k) contributions $ 4,000 $ 333 Laticia's 401(k) employer match (Traditional) $ 4,000 $ 333 Total Outflows $353,756 $ 29,480 CASH FLOW SUR PLUS $ 228,811 : $ 19,068 Adeyemi BALANCE SHEET Kwame Laticia TOTAL ASSETS $4,300 Cash and Cash Equivalents Checking accounts Money market account Total $5,000 $67,200 $72,200 $4,300 $76,500 Investment Assets Kwame's Traditional NYC DCP 457 plan Roth IRA Laticia's Pfizer Roth 401(k) Laticia's 401(k) employer match account (Traditional) $4,200 $37,000 $52,000 $24,400 Total $41,200 $76,400 $117,600 Real Estate Apartment $882,000 Total $0 $882,000 $882,000 TOTAL ASSETS $113,400 $962,700 $1,076,100 LIABILITIES $393,000 Mortgage (30-year fixed, "14 yrs left to pay) Kwame's consolidated student loans Laticia's student loan $267,991 $63,000 TOTAL LIABILITIES $267,991 $456,000 $723,991 NET WORTH ($154,591) $506,700 $352,109 Case Study: Debt Analysis (Adeyemi) In this assignment, you'll be summarizing, analyzing, and developing recommendations for your case study clients' debt position. Now that we are done working on the Personal Financial Statements, file your versions away (rename your files "Old..." or something, so that you do not use them accidentally), and instead, as a source of your analysis for the rest of the semester, use my version of those statements instead. My version is in "Files" Blackboard menu. Note that in my financial statements file, cash flow and balance sheet are on different tabs of the same Excel file. Work on this assignment right in this file (fill in your answers where prompted below), and submit it back to me on Blackboard. This is a single attempt assignment. Throughout this document, I formatted the stuff you need to fill out in green, so that I can easily see what you typed. Start by filling out this debt summary table for your clients (normally this is best done in Excel, but let's keep it all in one document for easy reference): Description of liability $ Balance Monthly payment Interest rate Notes TOTAL [...] [...]