Question

For this question Macro Corporation issued 50-year $80million of face value bonds that have a coupon rate of 6% paid semi-annually. The bonds were issued

For this question "Macro Corporation issued 50-year $80million of face value bonds that have a coupon rate of 6% paid semi-annually. The bonds were issued at 97. Given this information, calculate the yield to maturity."

Can someone please show me step-by-step how to find the YTM (yield to maturity) algebraically??

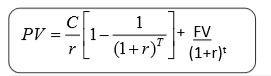

The formula I will be using for this question is attached in an image with this question. Please solve the question based on that formula because that's what I am supposed to be doing. The r in this case would be the YTM I'm looking for.

PV = r 1 1 + FV (1+r) (1+r)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The formula for calculating the yield to maturity YTM of a bond is as follows Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

2nd Edition

1118443969, 978-1118443965

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App