Answered step by step

Verified Expert Solution

Question

1 Approved Answer

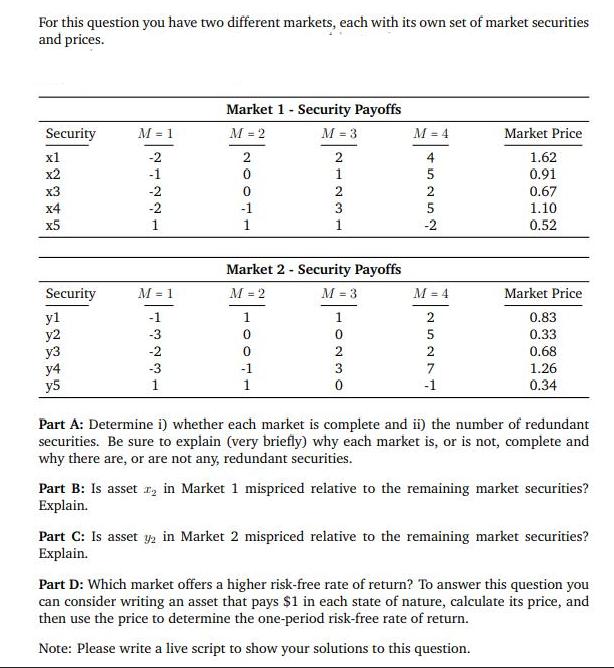

For this question you have two different markets, each with its own set of market securities and prices. Security x1 x2 x3 x4 x5

For this question you have two different markets, each with its own set of market securities and prices. Security x1 x2 x3 x4 x5 Security y1 y2 y3 y4 y5 M = 1 -2 -1 21171 -2 -2 1 M = 1 -1 -3 -2 -3 1 Market 1 - Security Payoffs M = 2 M = 3 2 0 1 1 Market 2 - Security Payoffs M = 2 M = 3 0 0 2123 -1 1 1 1 0 2 3 0 M = 4 45252 -2 M = 4 2527 -1 Market Price 1.62 0.91 0.67 1.10 0.52 Market Price 0.83 0.33 0.68 1.26 0.34 Part A: Determine i) whether each market is complete and ii) the number of redundant securities. Be sure to explain (very briefly) why each market is, or is not, complete and why there are, or are not any, redundant securities. Part B: Is asset in Market 1 mispriced relative to the remaining market securities? Explain. Part C: Is asset y2 in Market 2 mispriced relative to the remaining market securities? Explain. Part D: Which market offers a higher risk-free rate of return? To answer this question you can consider writing an asset that pays $1 in each state of nature, calculate its price, and then use the price to determine the one-period risk-free rate of return. Note: Please write a live script to show your solutions to this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the given question well go through each part one by one Part A Determining Market Completeness and Redundant Securities To determine whether each market is complete we need to check if the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started