Answered step by step

Verified Expert Solution

Question

1 Approved Answer

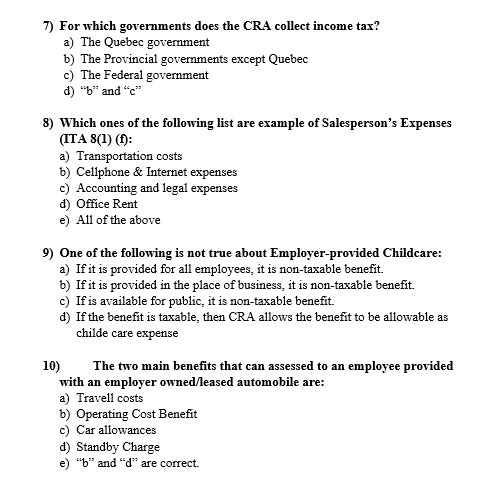

For which governments does the CRA collect income tax? a ) The Quebec government b ) The Provincial governments except Quebec c ) The Federal

For which governments does the CRA collect income tax?

a The Quebec government

b The Provincial governments except Quebec

c The Federal government

db and c

Which ones of the following list are example of Salesperson's Expenses ITA f:

a Transportation costs

b Cellphone & Internet expenses

c Accounting and legal expenses

d Office Rent

e All of the above

One of the following is not true about Employerprovided Childcare:

a If it is provided for all employees, it is nontaxable benefit.

b If it is provided in the place of business, it is nontaxable benefit.

c If is available for public, it is nontaxable benefit.

d If the benefit is taxable, then CRA allows the benefit to be allowable as childe care expense

The two main benefits that can assessed to an employee provided with an employer ownedleased automobile are:

a Travell costs

b Operating Cost Benefit

c Car allowances

d Standby Charge

eb and d are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started