Answered step by step

Verified Expert Solution

Question

1 Approved Answer

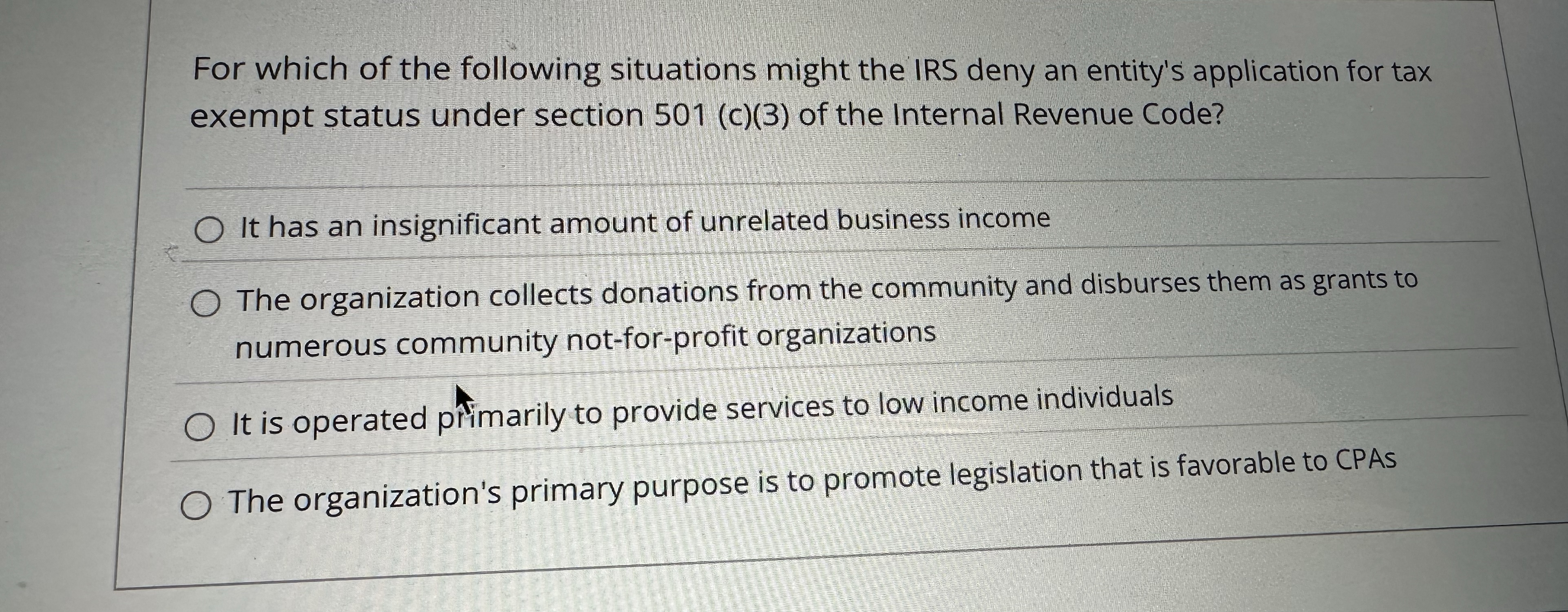

For which of the following situations might the IRS deny an entity's application for tax exempt status under section 5 0 1 ( c )

For which of the following situations might the IRS deny an entity's application for tax

exempt status under section c of the Internal Revenue Code?

It has an insignificant amount of unrelated business income

The organization collects donations from the community and disburses them as grants to

numerous community notforprofit organizations

It is operated pimarily to provide services to low income individuals

The organization's primary purpose is to promote legislation that is favorable to CPAs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started