Answered step by step

Verified Expert Solution

Question

1 Approved Answer

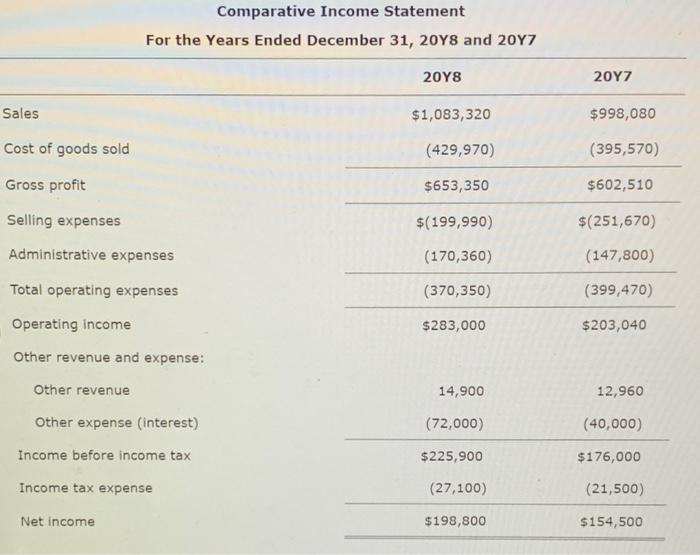

for year 20Y8 market share = $55 Comparative Income Statement For the Years Ended December 31, 20 Y8 and 20Y7 Sales $1,083,320$998,080 Cost of goods

for year 20Y8

market share = $55

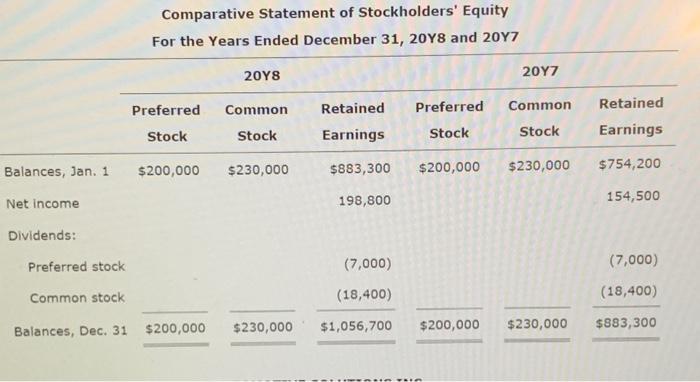

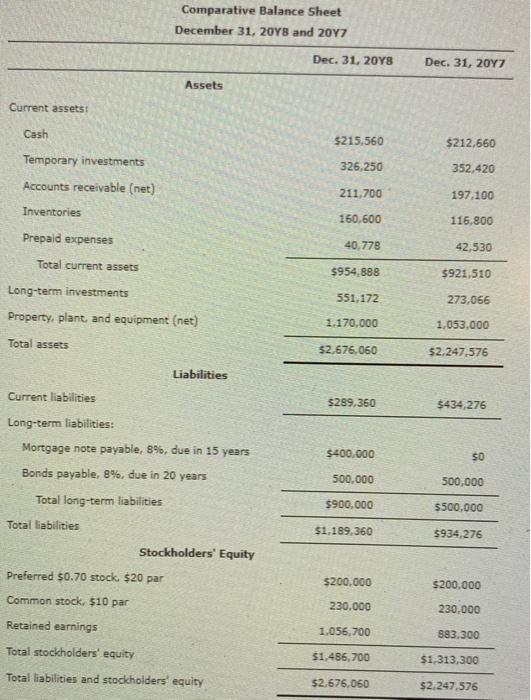

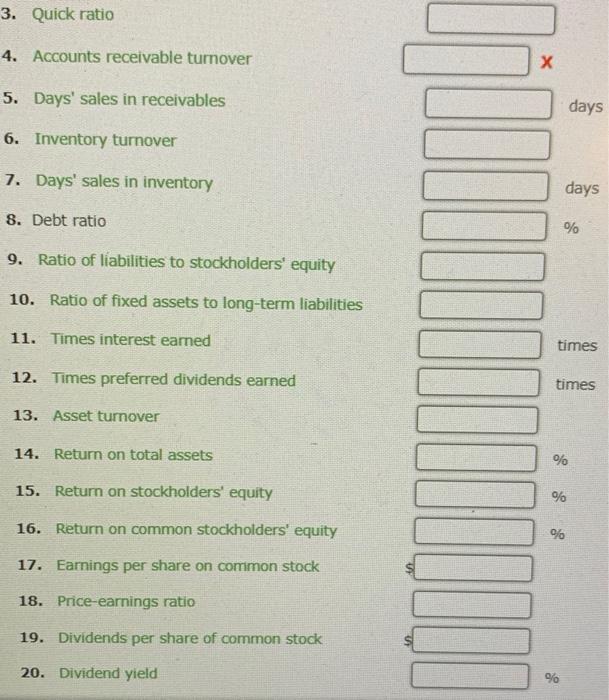

Comparative Income Statement For the Years Ended December 31, 20 Y8 and 20Y7 Sales $1,083,320$998,080 Cost of goods sold Gross profit Selling expenses \begin{tabular}{cc} (429,970) & (395,570) \\ \hline$653,350 & $602,510 \\ \hline$(199,990) & $(251,670) \end{tabular} Administrative expenses Total operating expenses Operating income \begin{tabular}{cc} (170,360) & (147,800) \\ \hline(370,350) & (399,470) \\ \hline$283,000 & $203,040 \end{tabular} Other revenue and expense: Other revenue 14,90012,960 Other expense (interest) Income before income tax Income tax expense Net income \begin{tabular}{rr} (72,000) & (40,000) \\ \hline$225,900 & $176,000 \\ (27,100) & (21,500) \\ \hline$198,800 & $154,500 \\ \hline \hline \end{tabular} Comparative Statement of Stockholders' Equity For the Years Ended December 31, 20 Y8 and 20Y7 Comparative Balance Sheet December 31,20Y8 and 20Y7 3. Quick ratio 4. Accounts receivable turnover x 5. Days' sales in receivables days 6. Inventory turnover 7. Days' sales in inventory days 8. Debt ratio % 9. Ratio of liabilities to stockholders' equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest eamed times 12. Times preferred dividends earned times 13. Asset turnover 14. Return on total assets % 15. Return on stockholders' equity % 16. Return on common stockholders' equity % 17. Eamings per share on common stock 18. Price-earnings ratio 19. Dividends per share of common stock 20. Dividend yield % Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started