Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FOR YEARS 2019 and 2020 Calculate; a) Cash flow to creditors b) Cash flow to stockholders c) free cash flows/ cash flow from assets d)

FOR YEARS 2019 and 2020 Calculate;

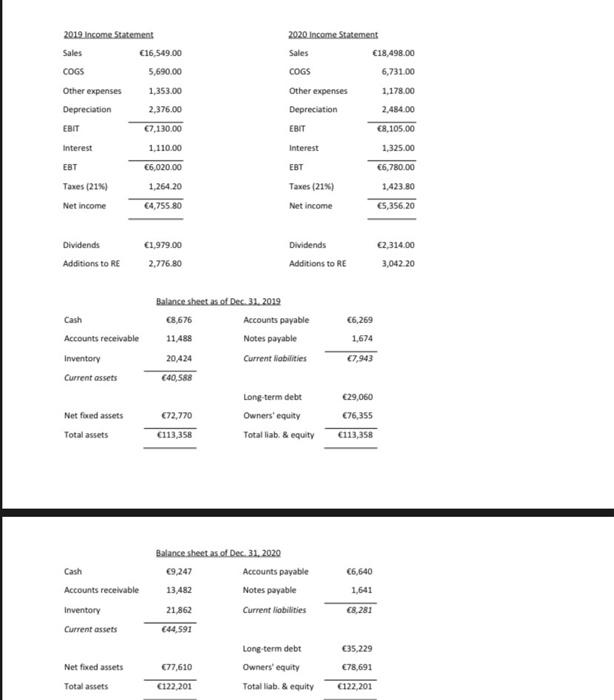

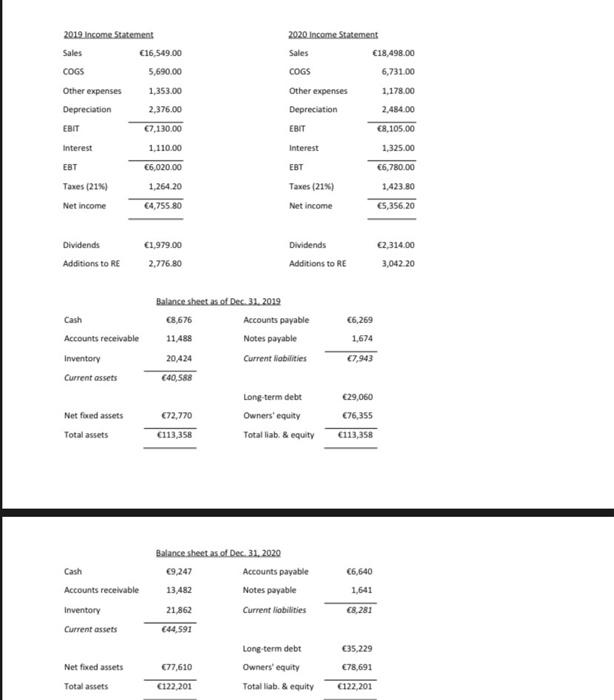

2019 Income Statement Sales 16.549.00 COGS 5,690.00 Other expenses 1,353.00 Depreciation 2.376.00 EBIT 07.130.00 Interest 1.110.00 EBT 6,020.00 Taxes (21%) 1,264.20 2020.Income Statement Sales 18,498.00 COGS 6,731.00 Other expenses 1.178.00 Depreciation 2.484.00 8,105.00 Interest 1,325.00 EBT 6,780.00 Taxes (21%) 1.423.80 Net Income 5,356,20 EBIT Net income 4,755.80 1.979.00 02,314.00 Dividends Additions to RE Dividends Additions to RE 2,776.80 3,042 20 Cash Accounts receivable Inventory Current assets 6,269 1,674 7,943 Balance sheet as of Dec. 31. 2019 68,676 Accounts payable 11488 Notes payable 20,424 Current abilities 40,588 Long-term debt 72,770 Owners' equity 113,358 Total liab. & equity 29,060 76,355 Net foed assets Total assets 113,358 Balance sheet as of Dec 31, 2020 9,247 Accounts payable 13,482 Notes payable 21.862 Current liabilities 6,640 1,641 Cash Accounts receivable Inventory Current assets 8,281 44.591 Long term debt 35.229 Net fixed assets 077,610 78.691 Total assets Owners' equity Total liab. & equity 122,201 122,201 a) Cash flow to creditors

b) Cash flow to stockholders

c) free cash flows/ cash flow from assets

d) make conclusions about the changes in the company cash flows in year 2020 in comparison to year 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started