Question

For your convenience, the summary of transactions from the previous question is duplicated below. Sample Cafe Transactions Item Notes 7,400 medium cups of coffee sold

For your convenience, the summary of transactions from the previous question is duplicated below.

Sample Cafe Transactions

| Item | Notes |

|---|---|

| 7,400 medium cups of coffee sold at $3.00 each | Includes 600 medium cups medium cups sold to the college and delivered to a reception that has been invoiced, but not yet paid. |

| 3,800 large cups of coffee sold at $4.00 each | |

| Espresso maker purchased last year for $11,400 | 5-year life |

| $720 premium for business insurance | Premium for full year |

| $3,800 for rent | Includes $1,900 in rent deposits. |

| $2,300 for coffee beans | Includes coffee discarded valued at $100 |

| $1,700 for coffee cups | 0 cups in inventory at the beginning of January. $600 worth of cups still in inventory at the end of month. |

| $15,700 to employees for payroll | $2,500 owed in payroll taxes |

| $100 of interest on loan | Paid mid-month |

| $1,000 for electricity and water | Includes $400 in utility deposits |

| $13,200 in advertising | $3,300 per week billed monthly |

Use the Accrual-Based Income Statement you created above to answer the following questions

1. Using the Accrual Basis Income Statement, what is the gross margin percent for Sample Cafe?

2. For each cup of coffee sold, what is the average contribution margin using the Accrual Basis Income Statement?

3. Using the Accrual Basis Income Statement, what are salaries and wages as a percent of revenue?

4. Using the Accrual Basis Income Statement, what is the net income as a percent of revenue?

5. If Sample Cafe had given employees a 10% raise at the beginning of January, what would net income have been presuming taxes increase at the same rate as wages? Use the Accrual Basis Income Statement.

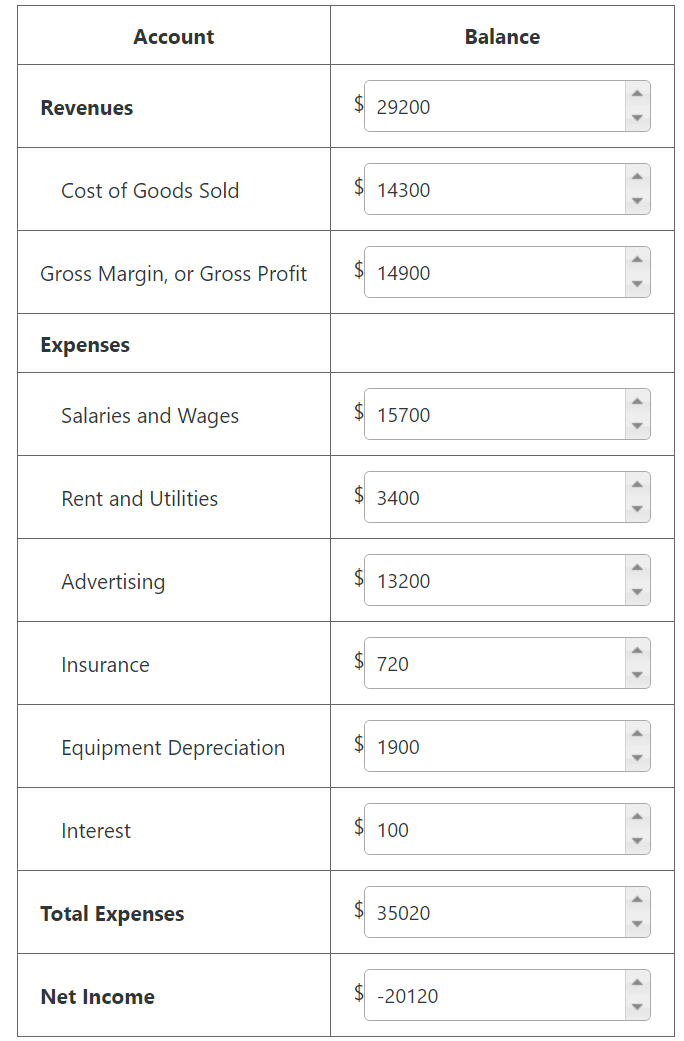

\begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Account } & \multicolumn{1}{|c|}{ Balance } \\ \hline Revenues & $29200 \\ \hline Cost of Goods Sold & $14300 \\ \hline Gross Margin, or Gross Profit & $14900 \\ \hline Expenses & \\ \hline Salaries and Wages & $15700 \\ \hline Rent and Utilities & $3400 \\ \hline Advertising & $35020 \\ \hline Total Expenses & $13200 \\ \hline Interest & $720 \\ \hline Insurance & $1900 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started