Question

For Your reference St. John's Healthcare was established in 1917 by a group of philanthropists and concerned citizens with two goals in mind: To make

For Your reference

St. John's Healthcare was established in 1917 by a group of philanthropists and concerned citizens with two goals in mind: To make healthcare services readily available to all people, regardless of race, color or creed, or their ability to pay, and to create a hospital where physicians would be allowed to practice medicine without fear of discrimination. More than 100 years later, it remained a not-for-profit hospital that provides vital health care services to all citizens. Through the years, they have steadily gained the expertise, resources and facilities necessary to serve an ever-expanding population of people in need.

St John's includes 10 acute care and specialty (heart, children's, orthopedic and rehab) hospitals, more than 200 physician practices and outpatient facilities, 10,000 co-workers and more than 500 Clinic physicians in Kansa Kansas, Missouri and Louisiana.

St. John's Virtual Care Center is dedicated to care outside its own walls, monitoring patients 24/7/365 across the country, using high-speed data and video connections and medically intervening when and where patients need it with a comprehensive team approach.

St. John's Healthcare's ten outpatient diagnostic centers provide convenient access to some of the most common outpatient services. Offering advanced technology for same-day screening and diagnosis.

Much has been written about the impact that healthcare industry reform is having on hospitals and health systems. And with the challenge of reduced reimbursements looming, Finance teams understand that realizing the bottom-line benefits of cost containment and process improvement initiatives is becoming a business imperative. However, as organizations critically evaluate their financial management capabilities, many realize they have ineffective approaches designed around antiquated tools that aren't up to the task.

In addition, hospitals have seen their prices growing at a slower rate than inflation. Revenues from private insurance have not fully offset the reductions in Medicare payments stemming from the Affordable Care Act and federal budget sequestration initiated in 2012. Many hospitals and health systems strove to gain market share at the expense of competitors by deeply discounting their rates for new "narrow network" health plans targeted at public and private health exchanges, enrollments from which have far underperformed expectations.

Mr. John Smith, President & CEO of the St. John's Healthcare system is concerned about the future of St. John's financial stability with all the recent changes including ACA and sequestration cut. Although financially System is doing well but they have fallen short of budgeted results. One of his concern is organizations' lack of discipline in managing the size of their workforces, which account for roughly half of all hospital expenses.

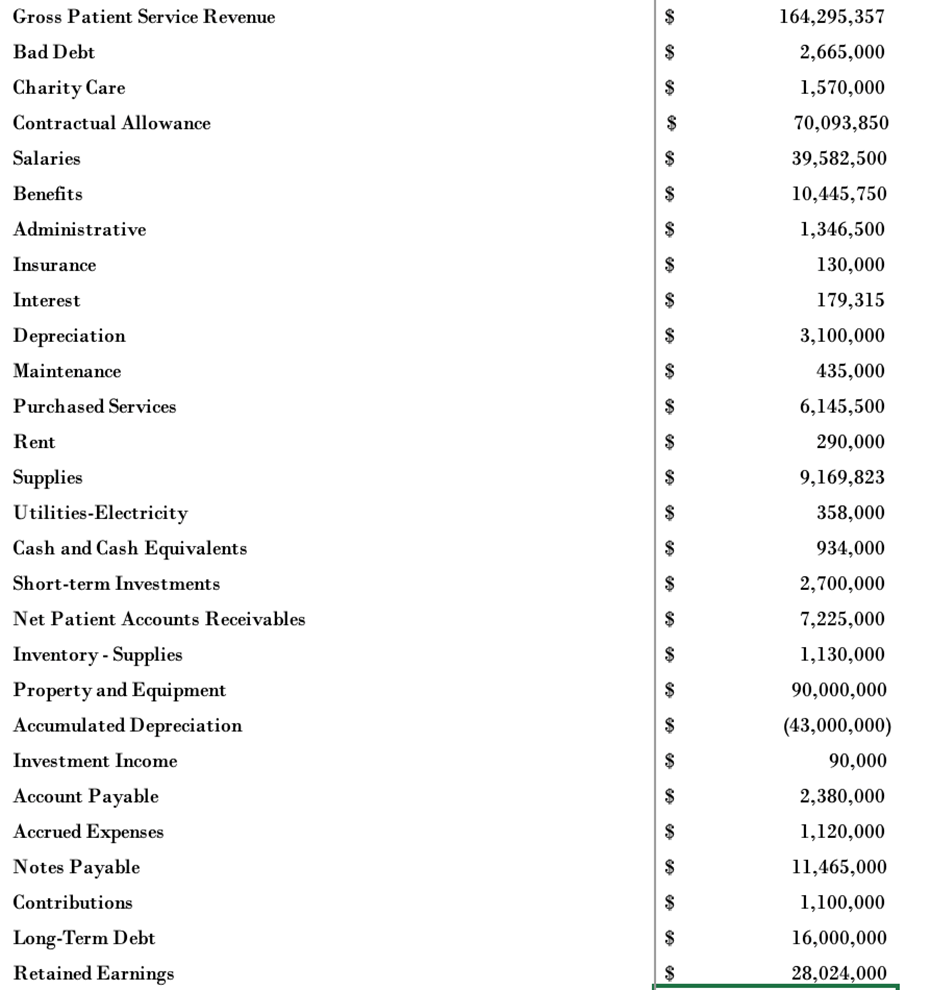

St. John's is one of the 10 hospitals which is not performing well compared to other hospitals in the system due increased competition from the neighboring county hospital. St. John's is a small 40 bed community hospital. St. John's CFO is retiring and you are one of the finalists for this job. Mr. John Smith has provided all the finalists with the Year-End December 31, 2018 trial balance of St. John's.

You will be using this information to analyze the financial health of St. John's to prepare for the final interview. This will help you to examine past and current financial data so that the hospital's performance and financial position can be evaluated and future risks and potential can be estimated.

Besides Income Statement and Balance Sheet, you will also be using key financial ratios to analyze the financial position of the hospital system.

St. John's provides general medical and surgical inpatient services, emergency room care and outpatient services, including same day surgery. St. John's provides full time employment to 325 people in the community.

When completing the case study please use cell referencing to pull your numbers from the general ledger to the income statement or the balance sheet. This does not mean you need to write or enter the cell location on the spreadsheet. To use cell reference, use the equal sign (like you are starting a formula) and highlight the number from the general ledger (in the weekly WebEx we will illustrate). We will be checking for formulas in subtotals and totals on the statements, students will be penalized for not using a formula wherever possible. If you need help please check the following link:

https://support.office.com/en-us/article/create-or-change-a-cell-reference-c7b8b95d-c594-4488-947e-c835903cebaa

Please review your case study before submitting as I will be grading on correct answers, written explanations, and easy to read and understand analysis and presentation. You should make sure each tab prints to one page even though we are not printing. Please wrap text on discussion questions. Two decimal points on all ratios. Let's practice how we submit our work for the CEO to review. You would not ask the CEO to hunt around for answers and read sentences that never end.

Contractual Allowance is the difference between what hospitals bill and what they will receive in payment from third party payers, including government programs. This difference between Billed Charges and expected Net Patient Revenue is called the ContractualAllowance or adjustment.

St. John's Healthcare offers Financial Assistance (Charity care) programs that allow patients to receive medically necessary care at no charge or at a reduced charge when they meet financial eligibility requirements. This program provides financial relief to patients who qualify based on a comparison of their financial resources and/or income to the Federal Poverty Guidelines. This program also assists St. John's in maintaining their Tax-Exempt Status.

Under existing GAAP, a healthcare service provider records revenue on internal statements using the amount it bills for a service, even if it does not expect to collect that amount given the Hospitals experience on collecting from self-pay patients. The difference between what is billed (Gross) and collected (Net) from patients (even if it is nothing) is subtracted on the income statement as a provision for bad debt expense.

All Three (Contractual Allowance, Charity Care and Bad Debt) of these line items are reductions from Gross Patient Revenues (Billed Charges) and reduce the Gross to Net Patient Revenues (Collection). The Contractual Allowance, Charity Care deductions and Bad debt write offs reduce Gross Patient Revenue to Net Patient revenues. Net Patient revenues will reflect on Financial Statements what the HealthCare organization actually expects to collect.

With reference to the context I provided up above these question now need to be answered in excel

- Using the information given above, construct the Income Statement and Balance Sheet for the Fiscal Year ended December 31, 2022.

- What is the difference between gross patient service revenue and the net patient service revenue in the hospital accounting? Please explain your understanding of this difference, what it is comprised of, and why it is important to a Hospital.

- What is the Operating Margin (both definition and in words)? If the benchmark for operating income is 2.7% for the Health Care industry, how does St. John's compare to this benchmark? Why is managing the Operating Margin so important for all Health Care Organizations? What are the implications to St. John's of this ratio?

- What is the Profit Margin (both definition and in words)? If the benchmark for operating income is 4.67% for the Health Care industry, how does St. John's compare to this benchmark? What are the implications to St. John's of this ratio?

- What is the difference between operating income (margin) and net income and why is it important to manage both?

- What is the estimated Cash Flow, or the actual amount of cash generated during the FY 2022? (Cash Flow=Net Income + Noncash expenses). Why is this calculation important to Manage?

- What is the ratio of Benefits to Salaries Expense? Why is this calculation important to understand?

- What is the Debt to Asset Ratio (both definition and in words)? What does it measure and why is it important? What is St. John's Debt-to-asset ratio? If the Healthcare industry benchmark is 0.4 for this measure, how does this ratio compare to the benchmark?

- Based on the information provided, would you accept the job if offered to you? Please provide 3-5 reasons why you would or wouldn't accept the job.

Gross Patient Service Revenue Bad Debt Charity Care Contractual Allowance Salaries Benefits Administrative Insurance Interest Depreciation Maintenance Purchased Services Rent Supplies Utilities-Electricity Cash and Cash Equivalents Short-term Investments Net Patient Accounts Receivables Inventory - Supplies Property and Equipment Accumulated Depreciation Investment Income Account Payable Accrued Expenses Notes Payable Contributions Long-Term Debt Retained Earnings $ $ $ $ 164,295,357 2,665,000 1,570,000 70,093,850 39,582,500 10,445,750 1,346,500 130,000 179,315 3,100,000 435,000 6,145,500 290,000 9,169,823 358,000 934,000 2,700,000 7,225,000 1,130,000 90,000,000 (43,000,000) 90,000 2,380,000 1,120,000 11,465,000 1,100,000 16,000,000 28,024,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

St Johns Healthcare Financial Analysis Introduction This report analyzes the financial health of St Johns Healthcare based on the provided YearEnd December 31 2018 trial balance We will examine the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started