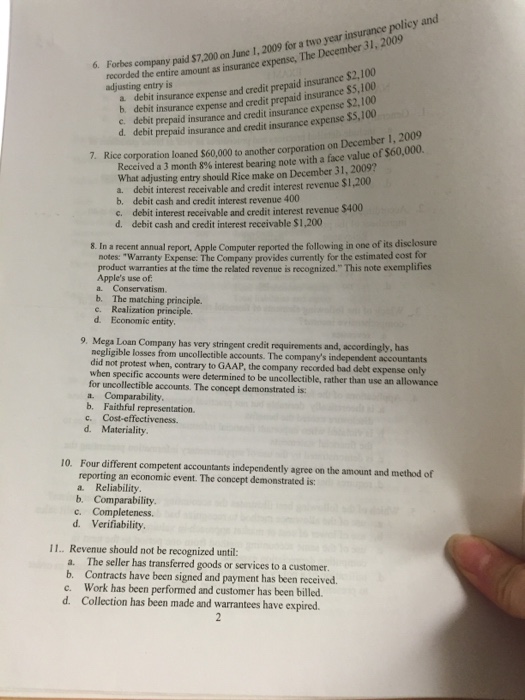

Forbes company paid $7, 200 on June 1, 2009 for a two year insurance policy and recorded the entire amount as insurance expense, The December 31, 2009 adjusting entry is debit insurance expense and credit prepaid insurance $2, 100 debit insurance expense and credit prepaid insurance $5, 100 debit prepaid insurance and credit insurance expense $2, 100 debit prepaid insurance and credit insurance expense $5, 100 Rice corporation loaned $60,000 to another corporation on December 1, 2009 Received a 3 month 8% interest bearing note with a face value $60,000. What adjusting entry should Rice make on December 31, 2009? debit interest receivable and credit interest revenue $1, 200 debit cash and credit revenue 400 debit interest receivable and credit interest revenue $400 debit cash and credit interest receivable $1, 200 In a recent annual report, Apple computer reported the following in one of its disclosure notes: "Warranty Expense: The Company provides currently for the estimated cost for product warranties at the time the related revenue is recognized."This note exemplifies Apple's use of: Conservatism. The matching principle. Realization principle. Economic entity. Mega Loan Company has very stringent credit requirements and, accordingly, has negligible losses from uncollectible accounts. The company's independent accountants did not protest when, contrary to GAAP, the company recorded bad debt expense only when specific accounts were determined to be uncollectible, rather than use an allowance for uncollectible accounts. The concept demonstrated is: Comparability. Faithful representation. Cost-effectiveness. Materiality. Four different competent accountants independent agree on the amount and method of reporting an economic event. The concept demonstrated is: Reliability. Comparability. Completeness Verifiability. Revenue should not be recognized until: The seller has transferred goods or services to a customer. Contracts have been signed and payment has been received. Work has been performed and customer has been billed. Collection has been made and warrantees have expired