Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forbes magazine experts said they rarely liked acquisitions, in terms of the value they created for acquirers, and were often left disappointed by how

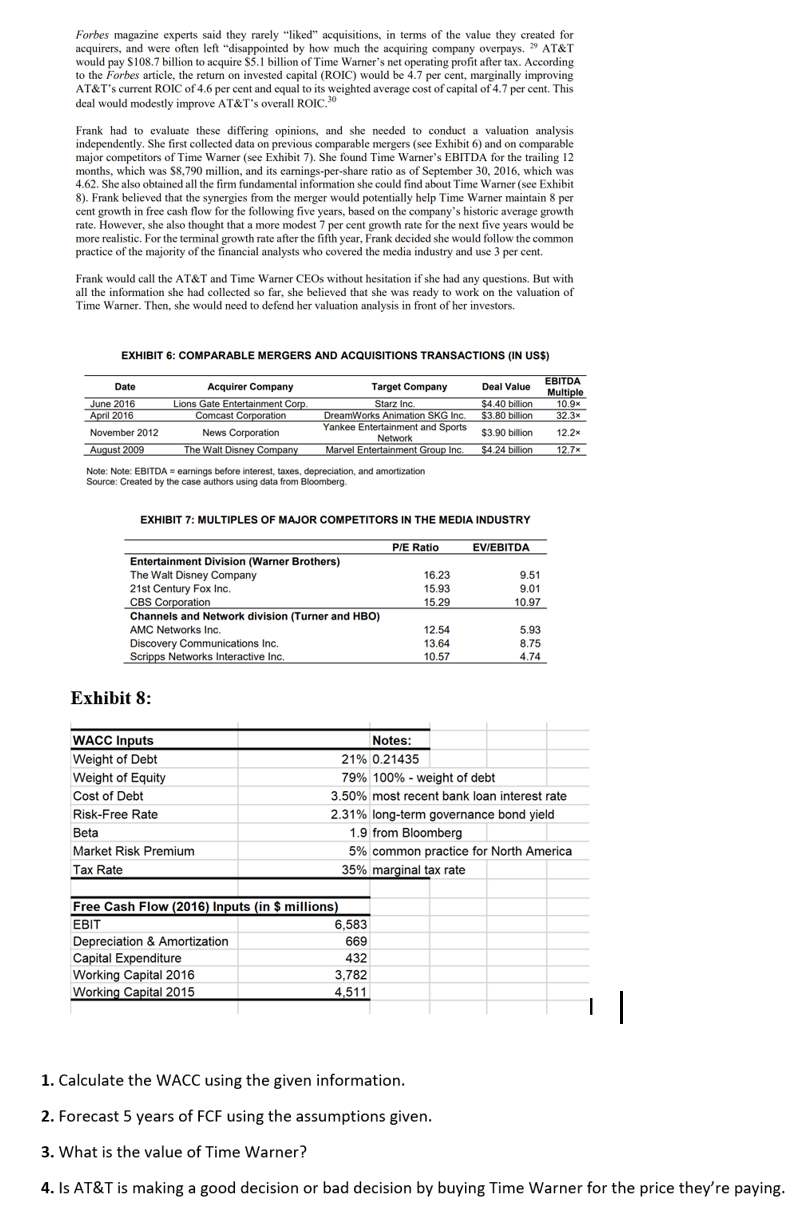

Forbes magazine experts said they rarely "liked" acquisitions, in terms of the value they created for acquirers, and were often left "disappointed by how much the acquiring company overpays. 29 AT&T would pay $108.7 billion to acquire $5.1 billion of Time Warner's net operating profit after tax. According to the Forbes article, the return on invested capital (ROIC) would be 4.7 per cent, marginally improving AT&T's current ROIC of 4.6 per cent and equal to its weighted average cost of capital of 4.7 per cent. This deal would modestly improve AT&T's overall ROIC.30 Frank had to evaluate these differing opinions, and she needed to conduct a valuation analysis independently. She first collected data on previous comparable mergers (see Exhibit 6) and on comparable major competitors of Time Warner (see Exhibit 7). She found Time Warner's EBITDA for the trailing 12 months, which was $8,790 million, and its earnings-per-share ratio as of September 30, 2016, which was 4.62. She also obtained all the firm fundamental information she could find about Time Warner (see Exhibit 8). Frank believed that the synergies from the merger would potentially help Time Warner maintain 8 per cent growth in free cash flow for the following five years, based on the company's historic average growth rate. However, she also thought that a more modest 7 per cent growth rate for the next five years would be more realistic. For the terminal growth rate after the fifth year, Frank decided she would follow the common practice of the majority of the financial analysts who covered the media industry and use 3 per cent. Frank would call the AT&T and Time Warner CEOS without hesitation if she had any questions. But with all the information she had collected so far, she believed that she was ready to work on the valuation of Time Warner. Then, she would need to defend her valuation analysis in front of her investors. Date June 2016 April 2016 Lions Gate Entertainment Corp. Comcast Corporation EXHIBIT 6: COMPARABLE MERGERS AND ACQUISITIONS TRANSACTIONS (IN US$) Acquirer Company Target Company Starz Inc. Deal Value $4.40 billion EBITDA Multiple 10.9x November 2012 News Corporation August 2009 The Walt Disney Company DreamWorks Animation SKG Inc. Yankee Entertainment and Sports Network Marvel Entertainment Group Inc. $3.80 billion 32.3x $3.90 billion 12.2x $4.24 billion 12.7x Note: Note: EBITDA = earnings before interest, taxes, depreciation, and amortization Source: Created by the case authors using data from Bloomberg. EXHIBIT 7: MULTIPLES OF MAJOR COMPETITORS IN THE MEDIA INDUSTRY P/E Ratio EV/EBITDA Entertainment Division (Warner Brothers) The Walt Disney Company 16.23 9.51 21st Century Fox Inc. 15.93 9.01 CBS Corporation 15.29 10.97 Channels and Network division (Turner and HBO) AMC Networks Inc. 12.54 5.93 Discovery Communications Inc. 13.64 8.75 Scripps Networks Interactive Inc. 10.57 4.74 Exhibit 8: WACC Inputs Weight of Debt Weight of Equity Cost of Debt Risk-Free Rate Beta Market Risk Premium Tax Rate Notes: 21% 0.21435 79% 100% - weight of debt 3.50% most recent bank loan interest rate 2.31% long-term governance bond yield Free Cash Flow (2016) Inputs (in $ millions) 1.9 from Bloomberg 5% common practice for North America 35% marginal tax rate EBIT Depreciation & Amortization Capital Expenditure Working Capital 2016 Working Capital 2015 6,583 669 432 3,782 4,511 1. Calculate the WACC using the given information. 2. Forecast 5 years of FCF using the assumptions given. 3. What is the value of Time Warner? 4. Is AT&T is making a good decision or bad decision by buying Time Warner for the price they're paying.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the Weighted Average Cost of Capital WACC we need to use the following inputs provided in Exhibit 8 Weight of Debt 21 Weight of Eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started