Answered step by step

Verified Expert Solution

Question

1 Approved Answer

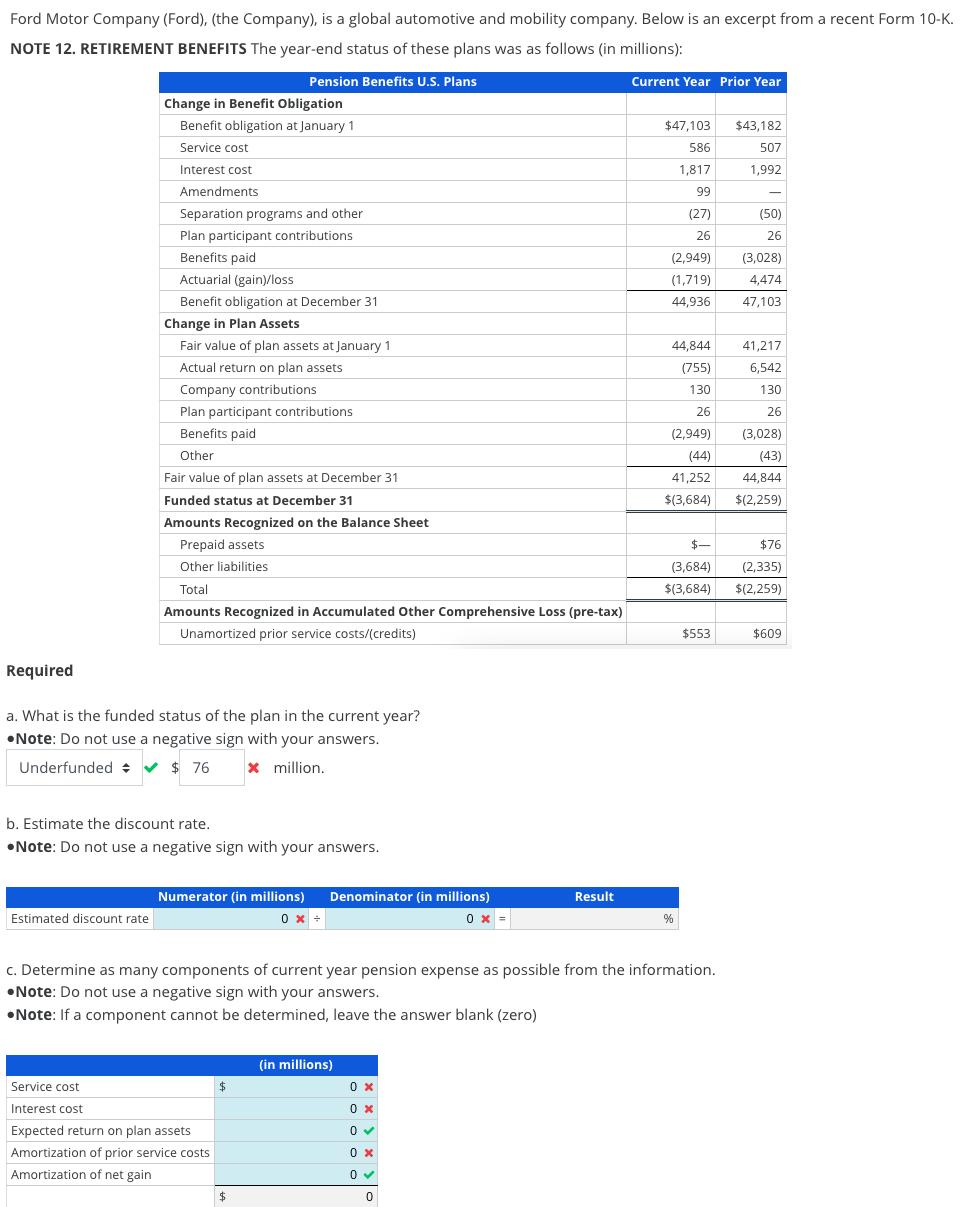

Ford Motor Company (Ford), (the Company), is a global automotive and mobility company. Below is an excerpt from a recent Form 10-K. NOTE 12.

Ford Motor Company (Ford), (the Company), is a global automotive and mobility company. Below is an excerpt from a recent Form 10-K. NOTE 12. RETIREMENT BENEFITS The year-end status of these plans was as follows (in millions): Pension Benefits U.S. Plans Current Year Prior Year Change in Benefit Obligation Benefit obligation at January 1 Service cost Interest cost Amendments Separation programs and other Plan participant contributions Benefits paid Actuarial (gain)/loss Benefit obligation at December 31 Estimated discount rate Change in Plan Assets Fair value of plan assets at January 1 Actual return on plan assets Company contributions Plan participant contributions Benefits paid Other Fair value of plan assets at December 31 Funded status at December 31 Amounts Recognized on the Balance Sheet Prepaid assets Other liabilities Total Amounts Recognized in Accumulated Other Comprehensive Loss (pre-tax) Unamortized prior service costs/(credits) Required a. What is the funded status of the plan in the current year? Note: Do not use a negative sign with your answers. x million. Underfunded $ 76 b. Estimate the discount rate. Note: Do not use a negative sign with your answers. Numerator (in millions) Denominator (in millions) 0 x + 0x = Service cost Interest cost Expected return on plan assets Amortization of prior service costs Amortization of net gain $ $ (in millions) Result 0x 0x 0 0x 0 0 $47,103 586 1,817 99 (27) 26 (2,949) (1,719) 44,936 44,844 (755) 130 26 c. Determine as many components of current year pension expense as possible from the information. Note: Do not use a negative sign with your answers. Note: If a component cannot be determined, leave the answer blank (zero) (2,949) (44) 41,252 $(3,684) % $553 $43,182 507 1,992 (50) 26 (3,028) 4,474 47,103 $- $76 (2,335) (3,684) $(3,684) $(2,259) 41,217 6,542 130 26 (3,028) (43) 44,844 $(2,259) $609

Step by Step Solution

★★★★★

3.21 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a The funded status of the plan in the current year is UNDERFUNDED by 76 million b To estimate the d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started