Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ford Motor Company has developed a new electric utility van for use by maintenance crews at college campuses. It can go into production for an

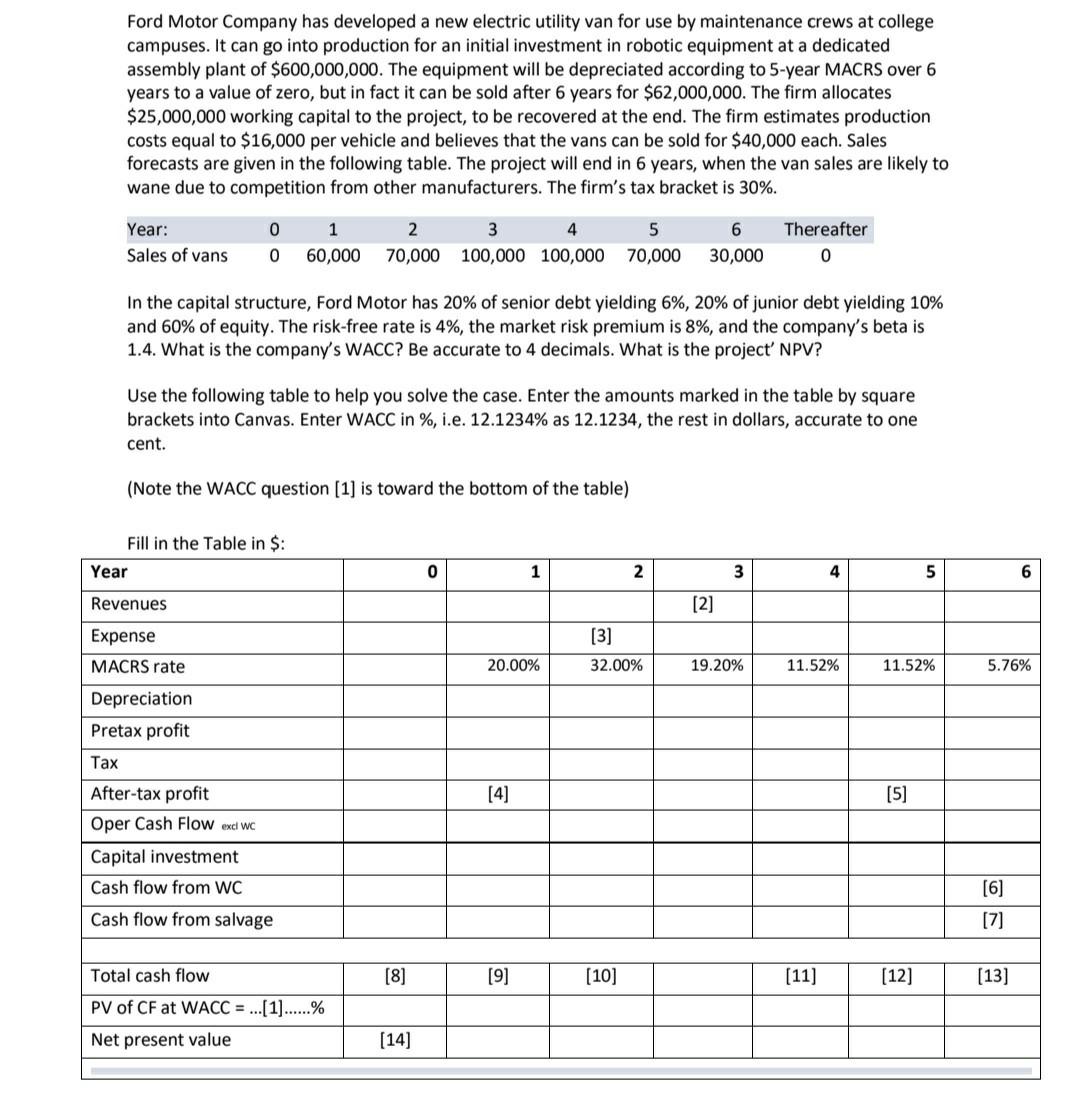

Ford Motor Company has developed a new electric utility van for use by maintenance crews at college campuses. It can go into production for an initial investment in robotic equipment at a dedicated assembly plant of $600,000,000. The equipment will be depreciated according to 5-year MACRS Over 6 years to a value of zero, but in fact it can be sold after 6 years for $62,000,000. The firm allocates $25,000,000 working capital to the project, to be recovered at the end. The firm estimates production costs equal to $16,000 per vehicle and believes that the vans can be sold for $40,000 each. Sales forecasts are given in the following table. The project will end in 6 years, when the van sales are likely to wane due to competition from other manufacturers. The firm's tax bracket is 30%. 0 6 Year: Sales of vans 1 2 3 4 5 60,000 70,000 100,000 100,000 70,000 Thereafter 0 0 30,000 In the capital structure, Ford Motor has 20% of senior debt yielding 6%, 20% of junior debt yielding 10% and 60% of equity. The risk-free rate is 4%, the market risk premium is 8%, and the company's beta is 1.4. What is the company's WACC? Be accurate to 4 decimals. What is the project' NPV? Use the following table to help you solve the case. Enter the amounts marked in the table by square brackets into Canvas. Enter WACC in %, i.e. 12.1234% as 12.1234, the rest in dollars, accurate to one cent. (Note the WACC question [1] is toward the bottom of the table) Fill in the Table in $: Year 0 1 2 3 4 5 6 Revenues [2] [3] Expense MACRS rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% Depreciation Pretax profit Tax [4] [5] After-tax profit Oper Cash Flow excl wc Capital investment Cash flow from WC Cash flow from salvage [6] [7] [8] [9] [10] (11) (12) (13] Total cash flow PV of CF at WACC = ...(1)......% Net present value [14]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started