Question

Forecast 2020 income statement and balance sheet using the percent of sales method and the following assumptions: (1) sales in 2020 will be 12.5 million;

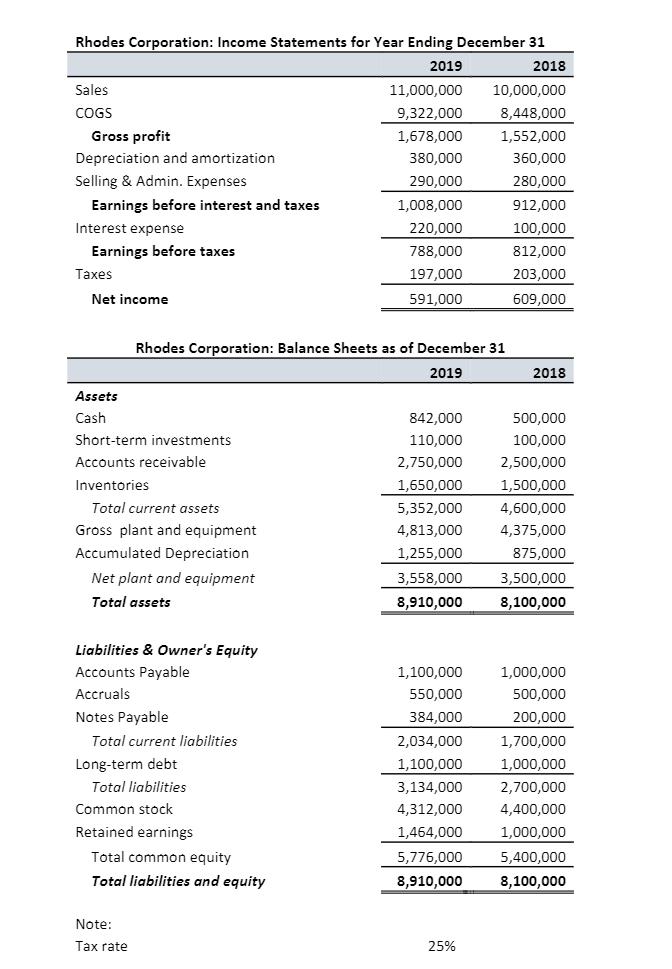

Forecast 2020 income statement and balance sheet using the percent of sales method and the following assumptions: (1) sales in 2020 will be 12.5 million; (2) tax rate keeps the same; (3) each item that changes with sales will be the 2-year average percentage of sales; (4) fixed asset will increase $1,000,000 with a 10-year straight-line depreciation schedule with 0 salvage value; (5) the common stock dividends will be $202,000; (6) interest rate on short-term and long-term debt will be 9%; (7) Cash, the short-term investment will be the same as 2019; (8) COGS, Selling G&A expenses, A/R, inventory, A/P, Accruals will change in proportion to sales; (9) Notes payable and long-term debt will keep the same; and if there is borrowing need, the company will borrow from long-term debt; (10) the company will not issue stocks in 2020.

a) What are the additional funds needed in 2020? Is this a surplus or deficit or balanced? (Without iteration, or borrowing happens on the last day of the year)

b) Assume that the AFN will be absorbed by long-term debt, set up an iterative worksheet to find the total accumulated AFN (borrowing happens during the year)

c) Why accumulated AFN increase in part b)? Please explain the phenomenon.

Rhodes Corporation: Income Statements for Year Ending December 31 2019 2018 Sales COGS Gross profit Depreciation and amortization Selling & Admin. Expenses Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net income Assets Cash Short-term investments ccou receivable Inventories Total current assets Gross plant and equipment Accumulated Depreciation Net plant and equipment Total assets Liabilities & Owner's Equity Accounts Payable Accruals Notes Payable Rhodes Corporation: Balance Sheets as of December 31 2019 Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity Note: Tax rate 11,000,000 9,322,000 1,678,000 380,000 290,000 1,008,000 220,000 788,000 197,000 591,000 842,000 110,000 2,750, 1,650,000 5,352,000 4,813,000 1,255,000 3,558,000 8,910,000 1,100,000 550,000 384,000 2,034,000 1,100,000 3,134,000 4,312,000 1,464,000 5,776,000 8,910,000 10,000,000 8,448,000 1,552,000 360,000 280,000 25% 912,000 100,000 812,000 203,000 609,000 2018 500,000 100,000 2,500,0 1,500,000 4,600,000 4,375,000 875,000 3,500,000 8,100,000 1,000,000 500,000 200,000 1,700,000 1,000,000 2,700,000 4,400,000 1,000,000 5,400,000 8,100,000

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Using the percent of sales method the additional funds needed AFN in 2020 can be calculated by tak...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started