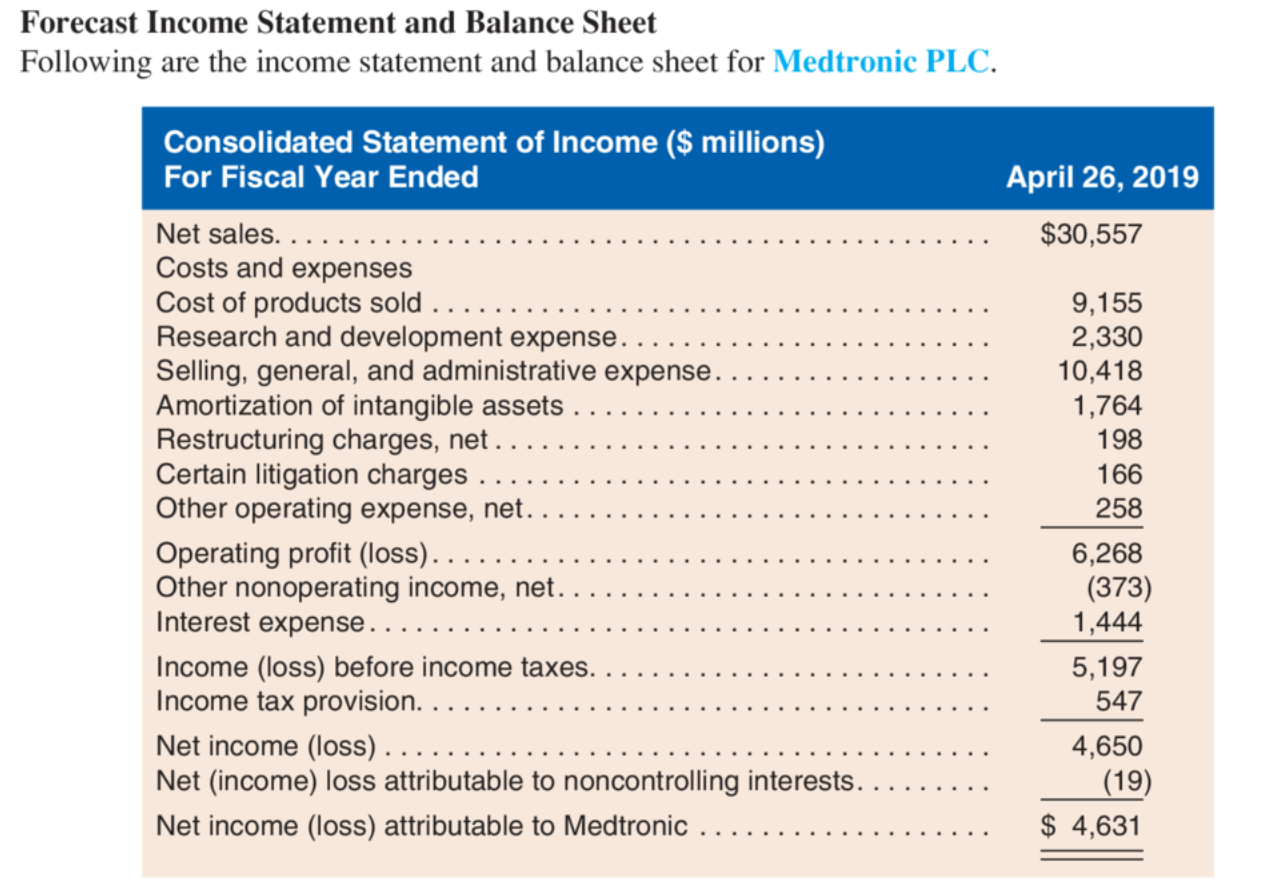

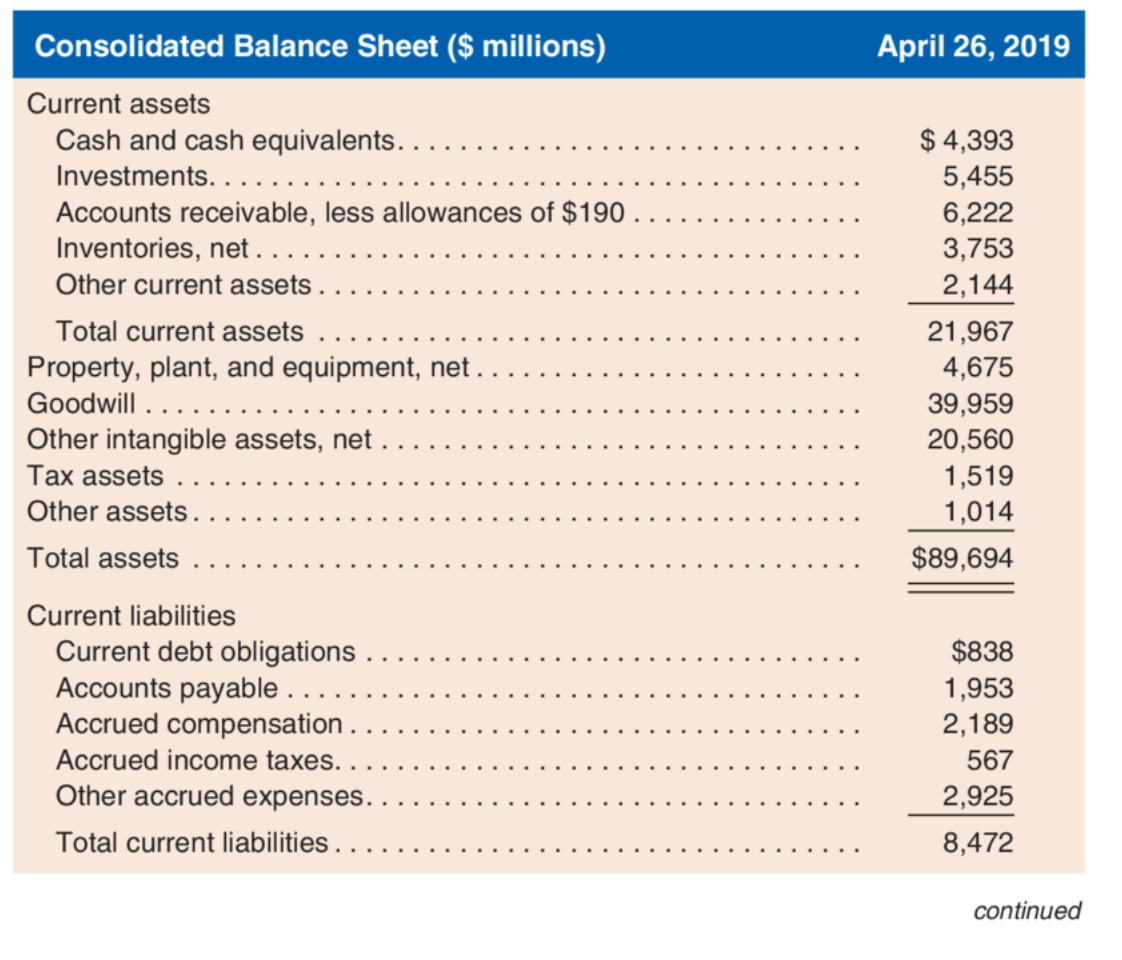

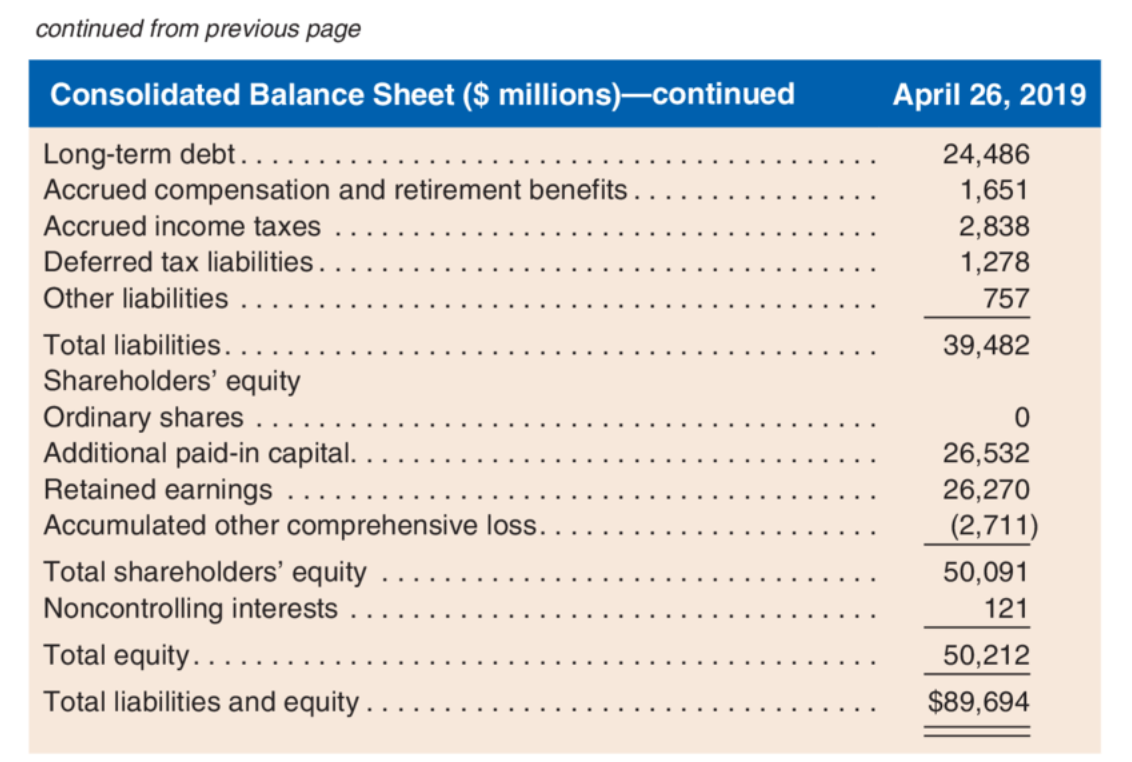

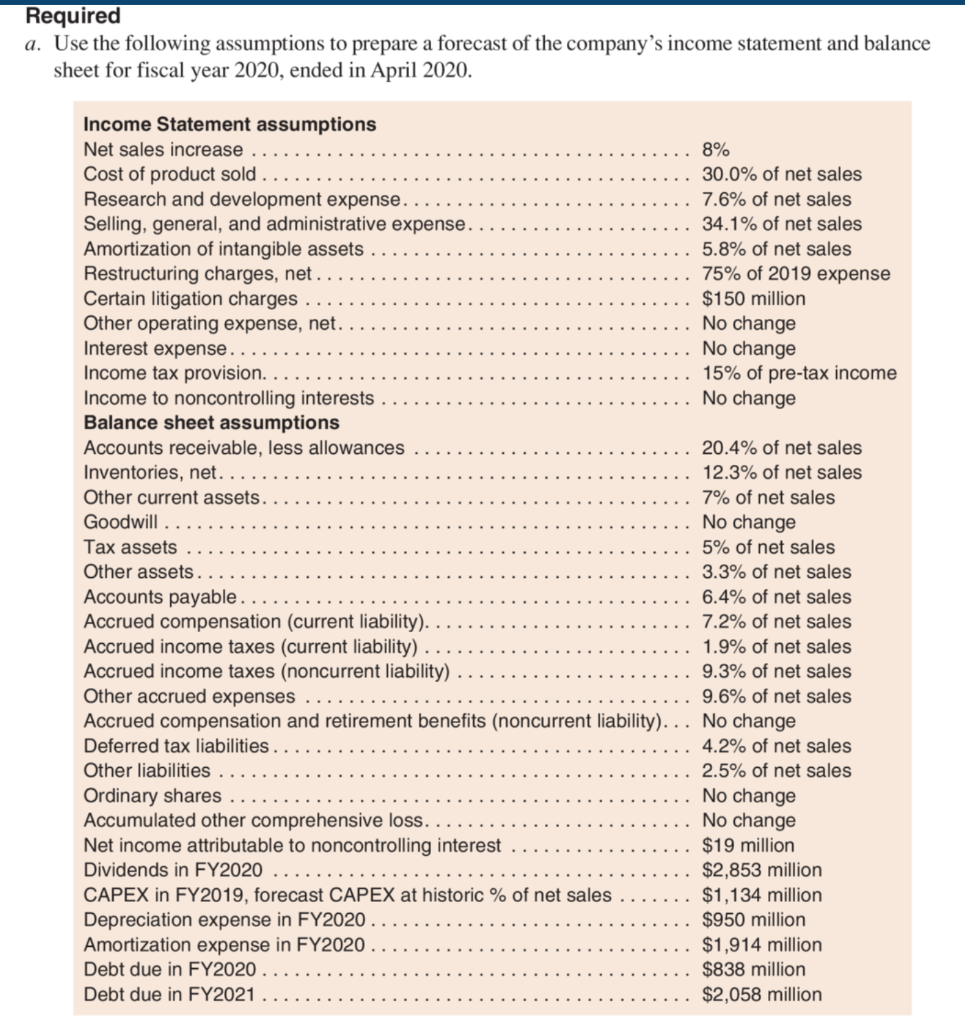

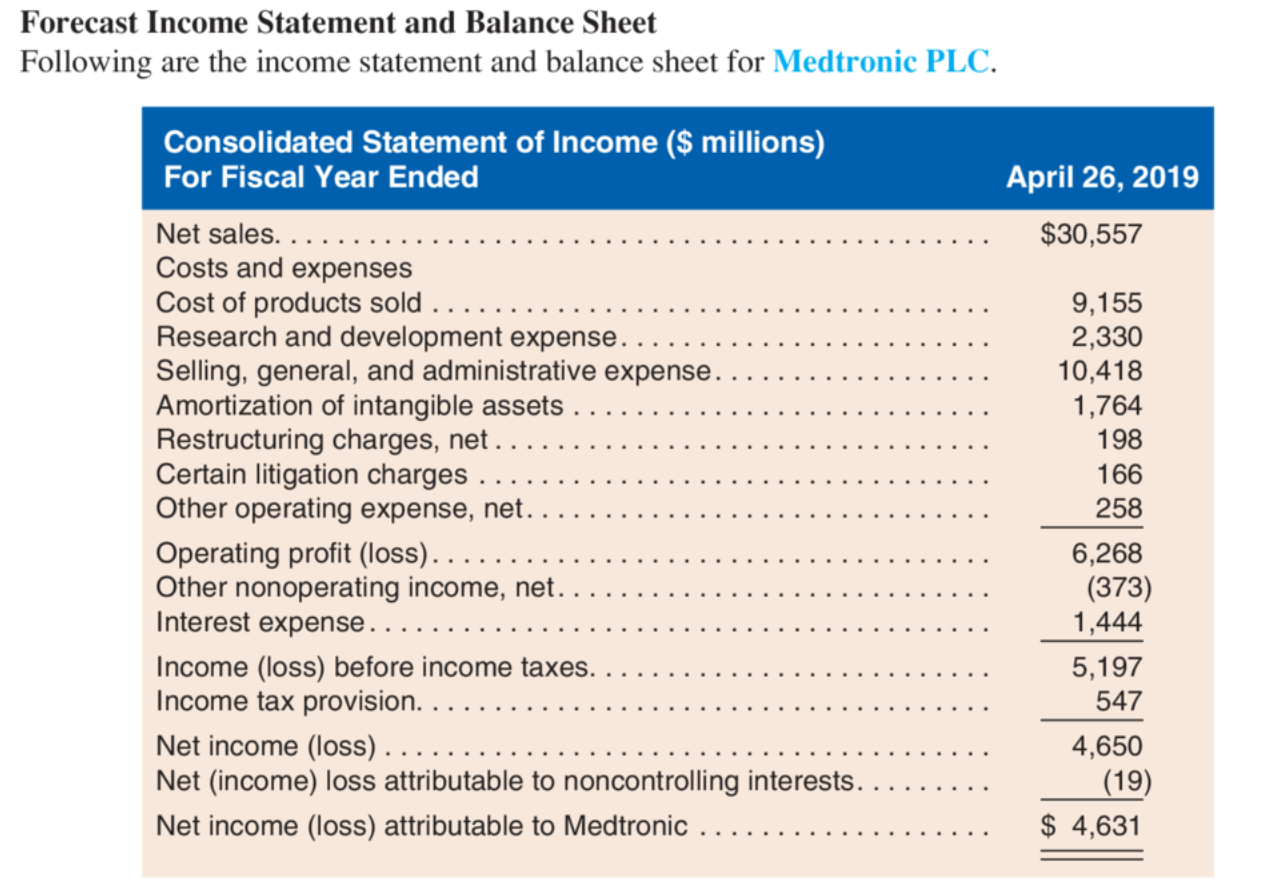

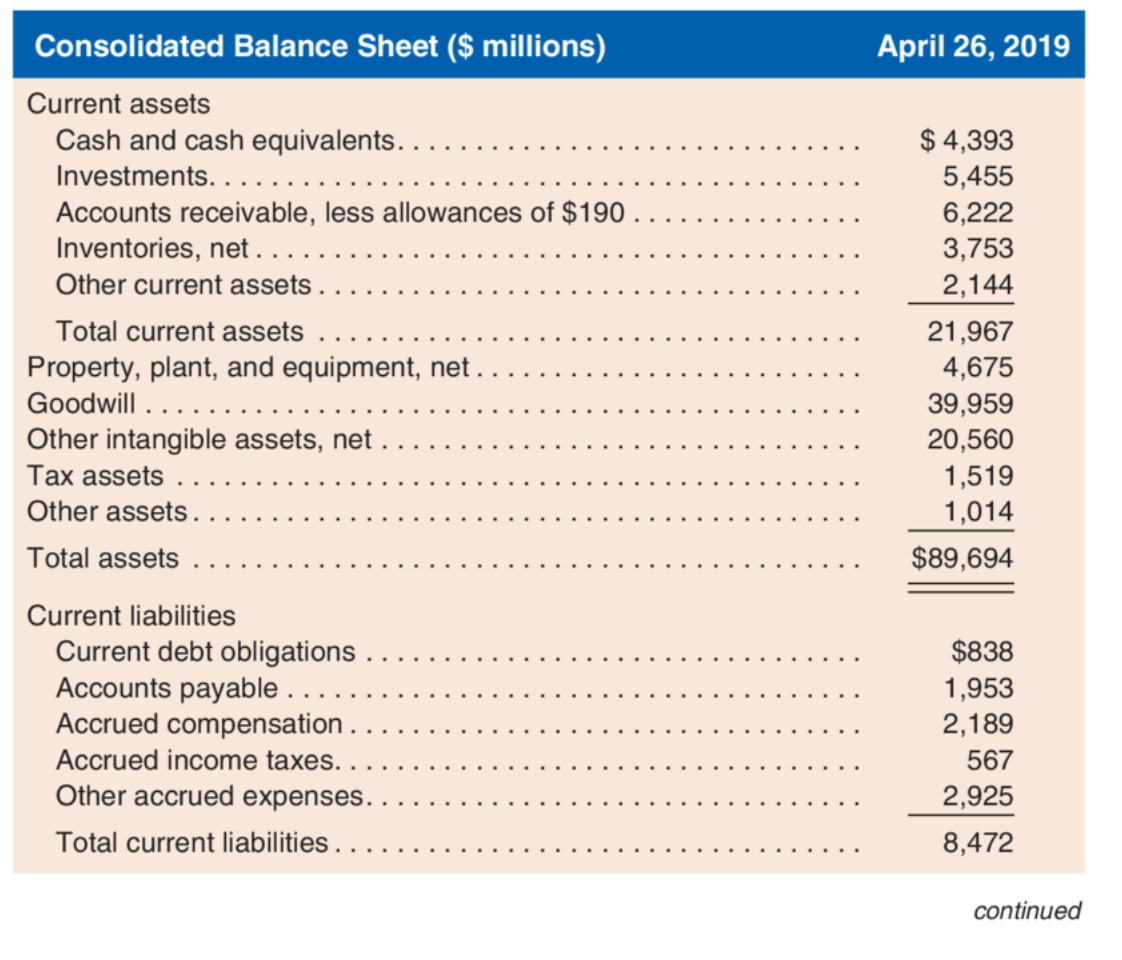

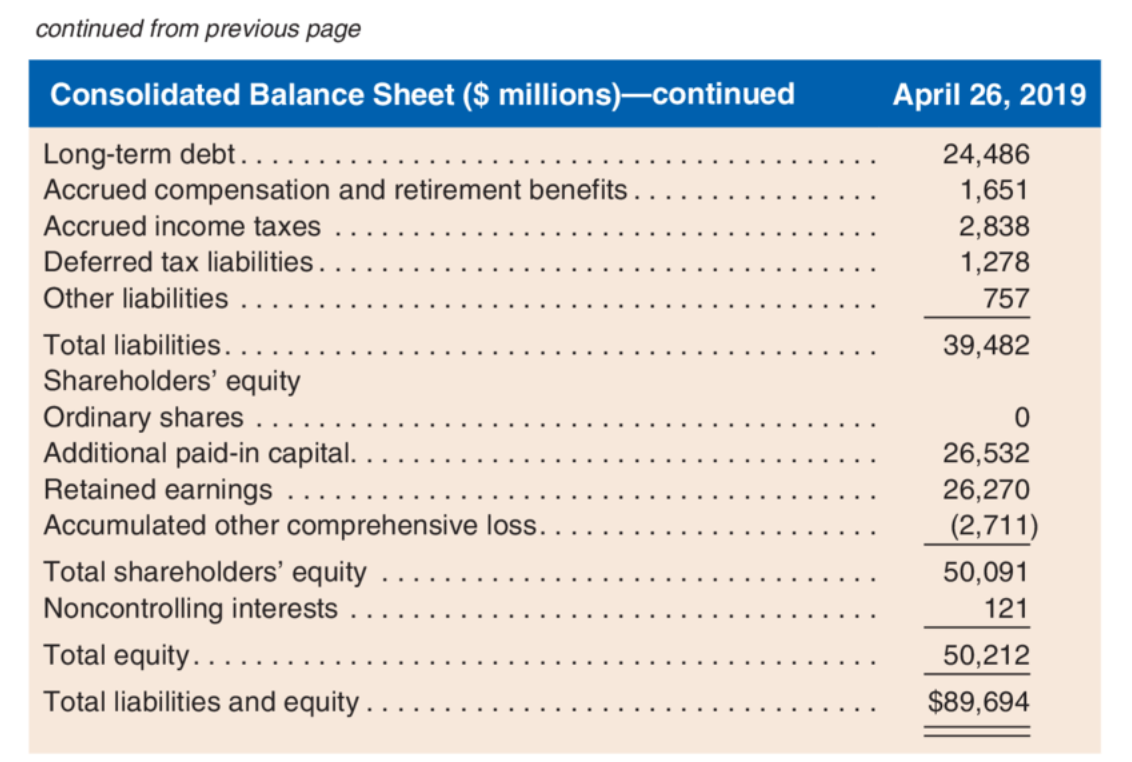

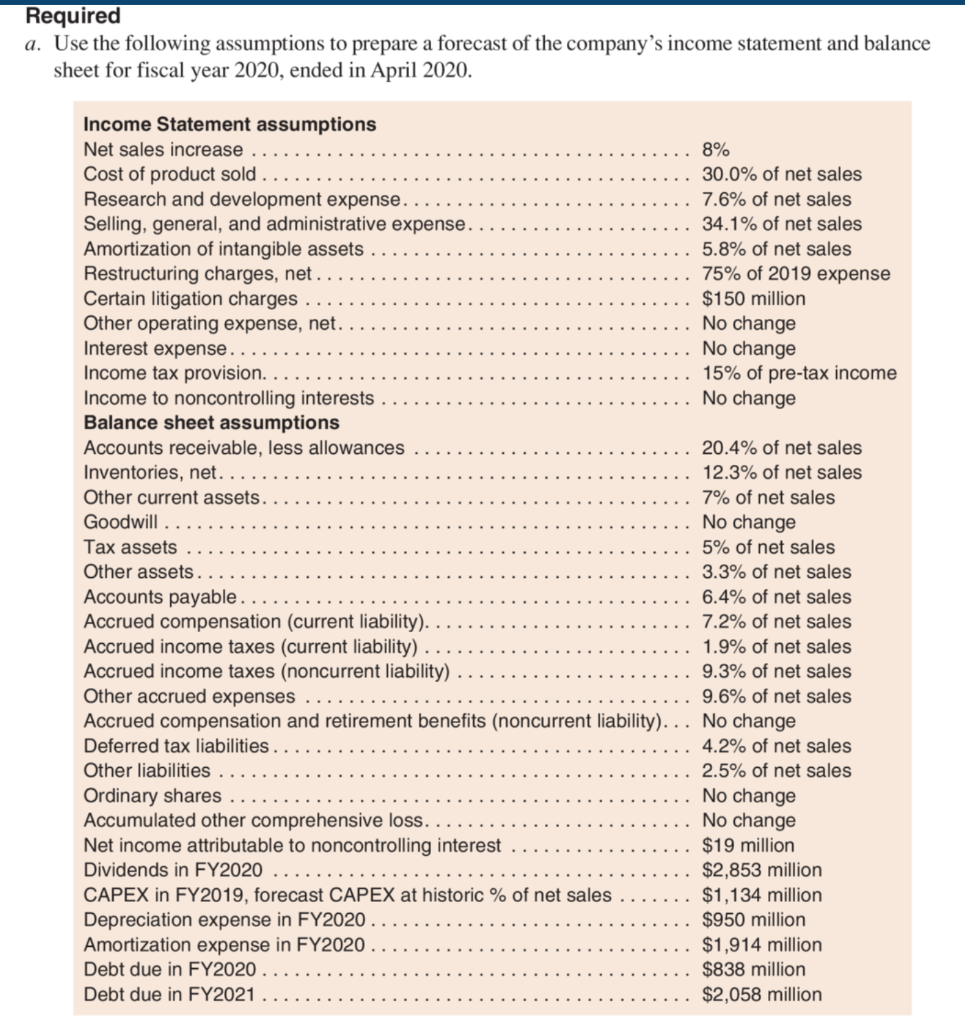

Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. April 26, 2019 $30,557 Consolidated Statement of Income ($ millions) For Fiscal Year Ended Net sales. ... Costs and expenses Cost of products sold ..., Research and development expense. Selling, general, and administrative expense. Amortization of intangible assets Restructuring charges, net. Certain litigation charges. Other operating expense, net. Operating profit (loss).... Other nonoperating income, net. Interest expense. . Income (loss) before income taxes. Income tax provision. .... Net income (loss). Net (income) loss attributable to noncontrolling interests. Net income (loss) attributable to Medtronic 9,155 2,330 10,418 1,764 198 166 258 6,268 (373) 1,444 5,197 547 4,650 (19) $ 4,631 April 26, 2019 Consolidated Balance Sheet ($ millions) Current assets Cash and cash equivalents..... Investments. ... Accounts receivable, less allowances of $190 Inventories, net. Other current assets. Total current assets Property, plant, and equipment, net Goodwill .. Other intangible assets, net Tax assets Other assets. Total assets $ 4,393 5,455 6,222 3,753 2,144 21,967 4,675 39,959 20,560 1,519 1,014 $89,694 Current liabilities Current debt obligations Accounts payable .. Accrued compensation . Accrued income taxes.. Other accrued expenses. Total current liabilities.. $838 1,953 2,189 567 2,925 8,472 continued continued from previous page April 26, 2019 24,486 1,651 2,838 1,278 757 39,482 Consolidated Balance Sheet ($ millions)continued Long-term debt...... Accrued compensation and retirement benefits .. Accrued income taxes Deferred tax liabilities. Other liabilities Total liabilities. Shareholders' equity Ordinary shares . Additional paid-in capital. Retained earnings Accumulated other comprehensive loss. Total shareholders' equity Noncontrolling interests Total equity. ..... Total liabilities and equity .. 0 26,532 26,270 (2,711) 50,091 121 50,212 $89,694 Required a. Use the following assumptions to prepare a forecast of the company's income statement and balance sheet for fiscal year 2020, ended in April 2020. Income Statement assumptions Net sales increase 8% Cost of product sold. 30.0% of net sales Research and development expense. . 7.6% of net sales Selling, general, and administrative expense. 34.1% of net sales Amortization of intangible assets 5.8% of net sales Restructuring charges, net.. 75% of 2019 expense Certain litigation charges $150 million Other operating expense, net. No change Interest expense. No change Income tax provision. .. 15% of pre-tax income Income to noncontrolling interests No change Balance sheet assumptions Accounts receivable, less allowances 20.4% of net sales Inventories, net.. 12.3% of net sales Other current assets. 7% of net sales Goodwill. No change Tax assets 5% of net sales Other assets. 3.3% of net sales Accounts payable. . 6.4% of net sales Accrued compensation (current liability). 7.2% of net sales Accrued income taxes (current liability) 1.9% of net sales Accrued income taxes (noncurrent liability) 9.3% of net sales Other accrued expenses 9.6% of net sales Accrued compensation and retirement benefits (noncurrent liability). .. No change Deferred tax liabilities. 4.2% of net sales Other liabilities 2.5% of net sales Ordinary shares No change Accumulated other comprehensive loss. No change Net income attributable to noncontrolling interest $19 million Dividends in FY2020 $2,853 million CAPEX in FY2019, forecast CAPEX at historic % of net sales $1,134 million Depreciation expense in FY2020 $950 million Amortization expense in FY2020 $1,914 million Debt due in FY2020 $838 million Debt due in FY2021 $2,058 million