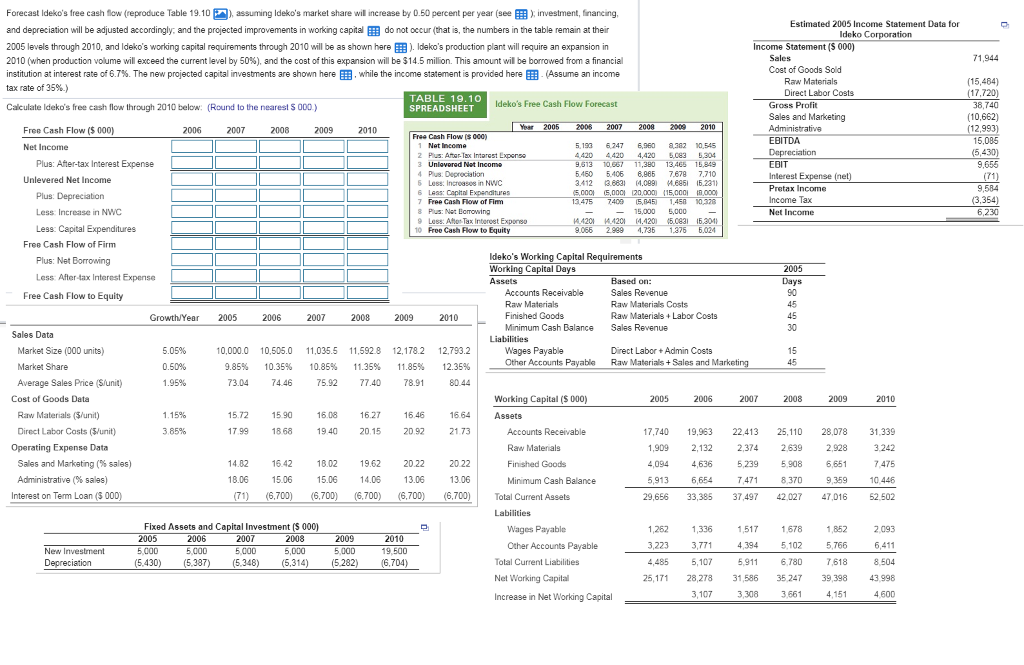

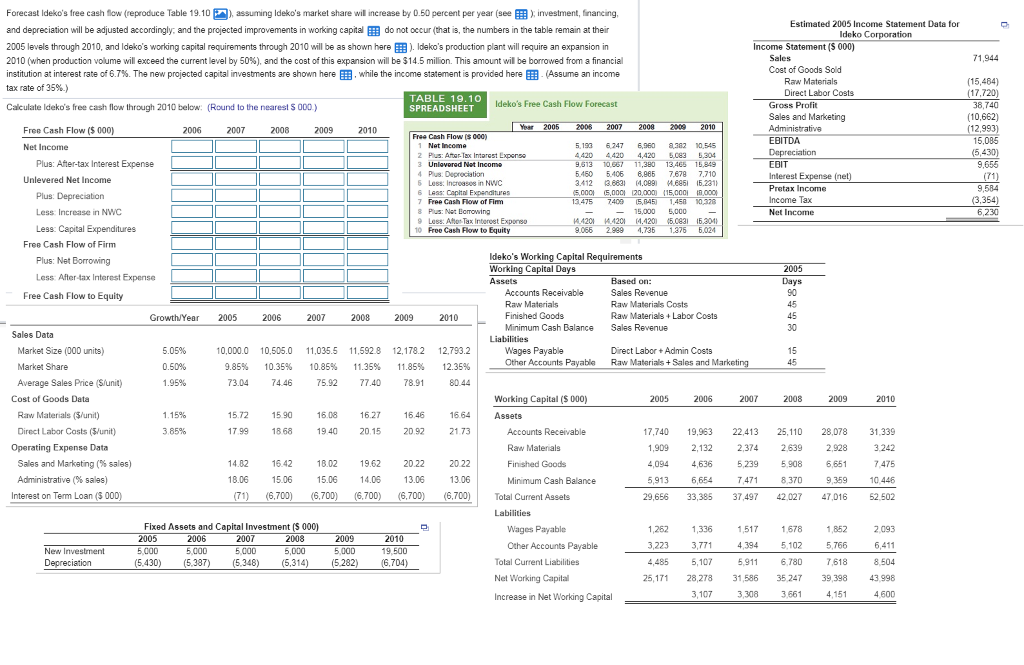

Forecast ldeko's free cash flow reproduce Table 19.10 ), assuming idek s market share wil increase by 0.50 percent per year see investment, fr areng and depreciation will be adjusted accordingly: and the projected improvements in working capital EEE do not occur (that is, the numbers in the table remain at their 2005 levels through 2010, and ldeko's working capital requirements through 2010 will be as shown here ldeko's production plant will require an expansion in 2010 when production volume will exceed the current level by 50% and the cost of this expansion will be $14.5 million. This amount wil be borrowed from a financial institution at interest rate o 6.7%. The new projected capital investments are shown here while the income statement s provided here (Assume an income tax rate of 35% Estimated 2005 Income Statement Data for Cost of Goods Sold Raw Materials Direct Labor Costs (15,484) TABLE 19.1O SPREADSHEET Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $ 000) Ideko's Free Cash Flow Forecast Profit Sales and Marketing Free Cash Flow ($ 000) 2006 2007 2008 Year 2005 2008 2007 2008 20 2010 (12,993) Free Cash Flow (s 000) EBITDA 5,193 6,247 6,960 8382 0545 420 4420 4,420 5,083 5,304 9,13 065 11,380 13465 15,849 5.460 5406 8,965 7.67 7.710 3.412 36631 4.099 16.231 5,000 5,000 20,000 15,000i ,000 13.475 740 5,B5 45328 Net Income Plus: After-tax Interest Expense 2 Plus: After-Tax Intarest Lxpenso 3 Unlavorad Net Income EBIT Interest Expense Pretax Income Unlevered Net Income Plus: Depreciation Less Increase in NWC Less Capital Expenditures 5 Less: Incroasos in NWC 6 Less: Capm1 Expenditures 7 Free Cash Flow of Firm 8 Plus: Ne: Earowving 9 Less: Aho Tax Interost Expone 10 Free Cash low to Equity Net Income 6,230 9.066 299 73 37 6.024 Free Cash Flow of Firm Plus: Net Borrowing Less After-tax Interest Expense Ideko's Working Capital Requirements Working Capital Days 2005 Accounts Receivable Raw Materials Finished Goods Minimum Cash Bae Sales Revenue Sales Revenue Raw Materials Costs Raw Materials + Labor Costs Free Cash Flow to Equity 2006 2007 2008 2009 30 Sales Data Market Size (000 units) Market Share Average Sales Price (Sunit) 0,000.0 10,505.0 11,035.5 11,592 8 12,178.2 12,793.2 Wages Payable Other Accounts Payable Direct LaborAdmin Costs 9.85% 10.35% 10.85% 11.35% 11.85% 12.35% Raw Materials Sales and Marketing 45 75.92 774078.91 Cost of Goods Data Working Capital (S 000) 2006 2009 Raw Materials (S/unit) Direct Labor Costs (S/unit) 15.72 15 90 16.08 16.27 16.46 1664Assets 3 85% 17.991868 19 40 20.15 2D92 21.73 Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance 7,74019,963 22,413 25,110 28,078 31,339 Expense Data ,9092,132 2,374 2,639 2 928 ,0944,636 5,239 5.908 6,651 5,913 6,654 7471 8,370 9,35910.446 Sales and Marketing (% sales) 14.82 642 18.02 9.622022 2022 Interest on Tem Loan (3 000) (71) (6,700) (6,700) (6,700) (6.700)