Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forecast Sales Direct Material Costs Direct Labour Cost Variable Factory Overhead Fixed Factory Overhead Costs of Goods Sold Gross Profit Corporate Fixed Costs Operating

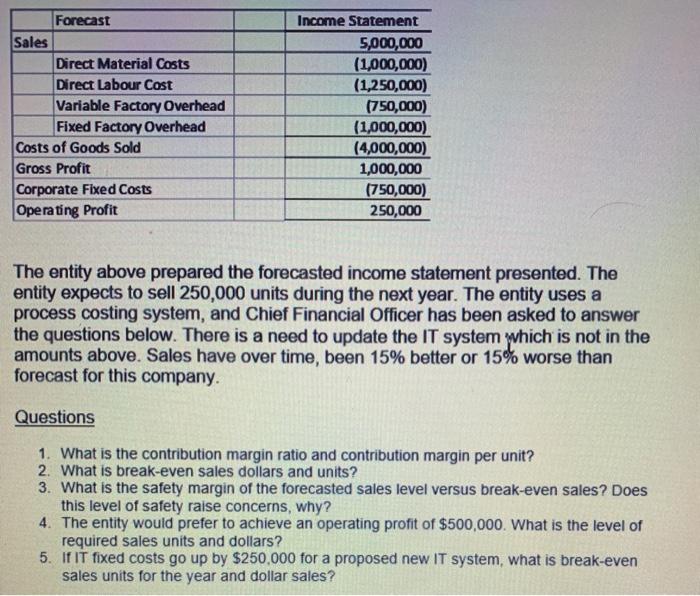

Forecast Sales Direct Material Costs Direct Labour Cost Variable Factory Overhead Fixed Factory Overhead Costs of Goods Sold Gross Profit Corporate Fixed Costs Operating Profit Income Statement 5,000,000 (1,000,000) (1,250,000) (750,000) (1,000,000) (4,000,000) 1,000,000 (750,000) 250,000 The entity above prepared the forecasted income statement presented. The entity expects to sell 250,000 units during the next year. The entity uses a process costing system, and Chief Financial Officer has been asked to answer the questions below. There is a need to update the IT system which is not in the amounts above. Sales have over time, been 15% better or 15% worse than forecast for this company. Questions 1. What is the contribution margin ratio and contribution margin per unit? 2. What is break-even sales dollars and units? 3. What is the safety margin of the forecasted sales level versus break-even sales? Does this level of safety raise concerns, why? 4. The entity would prefer to achieve an operating profit of $500,000. What is the level of required sales units and dollars? 5. If IT fixed costs go up by $250,000 for a proposed new IT system, what is break-even sales units for the year and dollar sales?

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Contribution Margin Ratio and Contribution per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started