Answered step by step

Verified Expert Solution

Question

1 Approved Answer

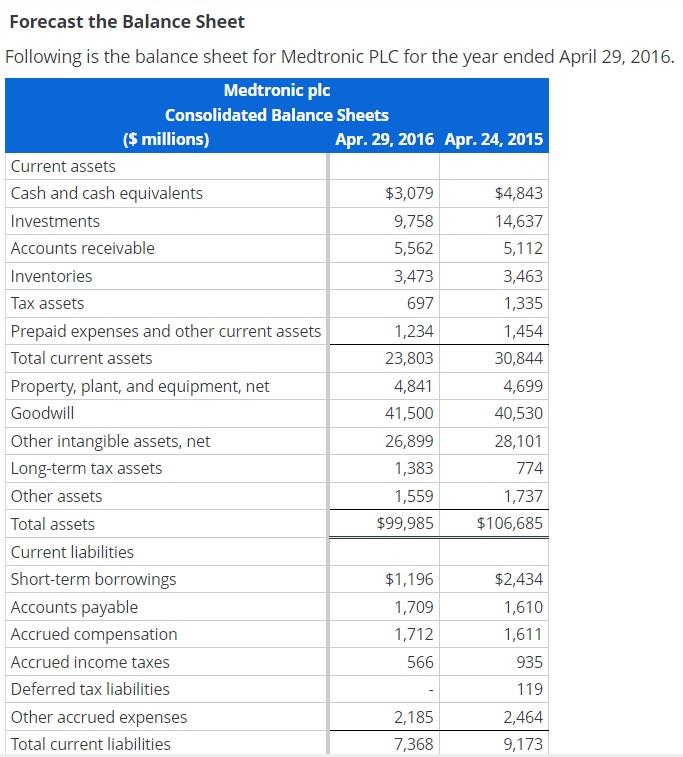

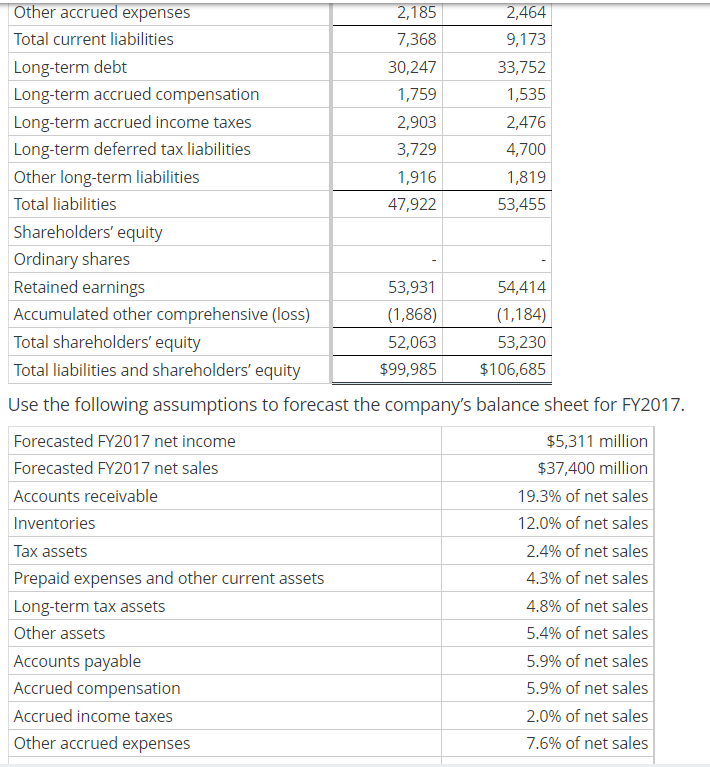

Forecast the Balance Sheet ril 29, 2016. begin{tabular}{|l|r|r|} hline Other accrued expenses & 2,185 & 2,464 hline Total current liabilities & 7,368 & 9,173

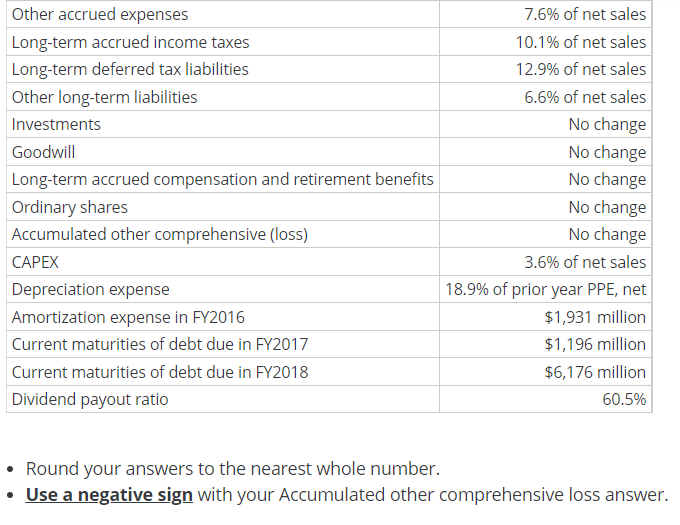

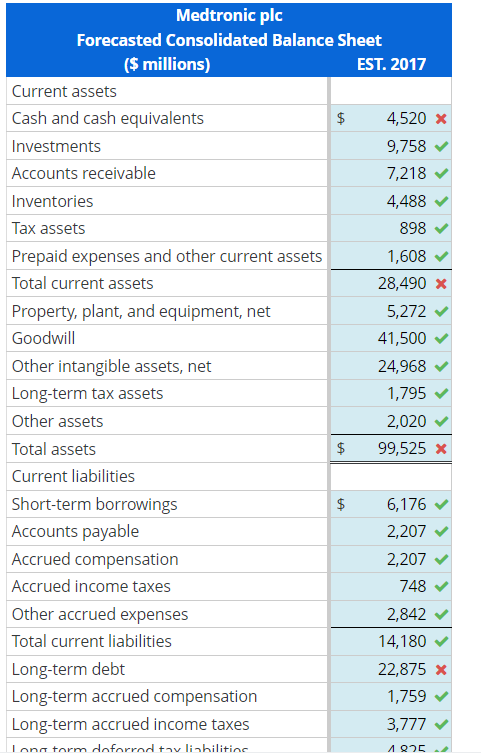

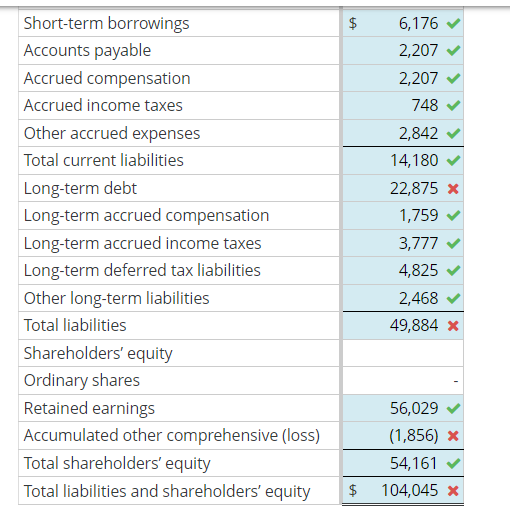

Forecast the Balance Sheet ril 29, 2016. \begin{tabular}{|l|r|r|} \hline Other accrued expenses & 2,185 & 2,464 \\ \hline Total current liabilities & 7,368 & 9,173 \\ \hline Long-term debt & 30,247 & 33,752 \\ \hline Long-term accrued compensation & 1,759 & 1,535 \\ \hline Long-term accrued income taxes & 2,903 & 2,476 \\ \hline Long-term deferred tax liabilities & 3,729 & 4,700 \\ \hline Other long-term liabilities & 1,916 & 1,819 \\ \hline Total liabilities & 47,922 & 53,455 \\ \hline Shareholders' equity & & \\ \hline Ordinary shares & - & \\ \hline Retained earnings & 53,931 & 54,414 \\ \hline Accumulated other comprehensive (loss) & (1,868) & (1,184) \\ \hline Total shareholders' equity & 52,063 & 53,230 \\ \hline Total liabilities and shareholders' equity & $99,985 & $106,685 \\ \hline \hline \end{tabular} Use the following assumptions to forecast the company's balance sheet for FY2017. \begin{tabular}{|l|r|} \hline Forecasted FY2017 net income & $5,311 million \\ \hline Forecasted FY2017 net sales & $37,400 million \\ \hline Accounts receivable & 19.3% of net sales \\ \hline Inventories & 12.0% of net sales \\ \hline Tax assets & 2.4% of net sales \\ \hline Prepaid expenses and other current assets & 4.3% of net sales \\ \hline Long-term tax assets & 4.8% of net sales \\ \hline Other assets & 5.4% of net sales \\ \hline Accounts payable & 5.9% of net sales \\ \hline Accrued compensation & 5.9% of net sales \\ \hline Accrued income taxes & 2.0% of net sales \\ \hline Other accrued expenses & 7.6% of net sales \\ \hline \end{tabular} - Round your answers to the nearest whole number. - Use a negative sign with your Accumulated other comprehensive loss answer. \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{c} Medtronic plc \\ Forecasted Consolidated Balance Sheet \end{tabular}} \\ \hline (\$ millions) & EST. 2017 \\ \hline \multicolumn{2}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & 4,520 \\ \hline Investments & 9,758 \\ \hline Accounts receivable & 7,218 \\ \hline Inventories & 4,488 \\ \hline Tax assets & 898 \\ \hline Prepaid expenses and other current assets & 1,608 \\ \hline Total current assets & 28,490 \\ \hline Property, plant, and equipment, net & 5,272 \\ \hline Goodwill & 41,500 \\ \hline Other intangible assets, net & 24,968 \\ \hline Long-term tax assets & 1,795 \\ \hline Other assets & 2,020 \\ \hline Total assets & 99,525 \\ \hline \multicolumn{2}{|l|}{ Current liabilities } \\ \hline Short-term borrowings & 6,176 \\ \hline Accounts payable & 2,207 \\ \hline Accrued compensation & 2,207 \\ \hline Accrued income taxes & 748 \\ \hline Other accrued expenses & 2,842 \\ \hline Total current liabilities & 14,180 \\ \hline Long-term debt & 22,875 \\ \hline Long-term accrued compensation & 1,759 \\ \hline Long-term accrued income taxes & 3,777 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Short-term borrowings & $ & 6,176 \\ \hline Accounts payable & & 2,207 \\ \hline Accrued compensation & & 2,207 \\ \hline Accrued income taxes & & 748 \\ \hline Other accrued expenses & & 2,842 \\ \hline Total current liabilities & & 14,180 \\ \hline Long-term debt & & 22,875 \\ \hline Long-term accrued compensation & & 1,759 \\ \hline Long-term accrued income taxes & & 3,777 \\ \hline Long-term deferred tax liabilities & & 4,825 \\ \hline Other long-term liabilities & & 2,468 \\ \hline Total liabilities & & 49,884 \\ \hline \multicolumn{3}{|l|}{ Shareholders' equity } \\ \hline Ordinary shares & & - \\ \hline Retained earnings & & 56,029 \\ \hline Accumulated other comprehensive (loss) & & (1,856) \\ \hline Total shareholders' equity & & 54,161 \\ \hline Total liabilities and shareholders' equity & $ & 104,045 \\ \hline \end{tabular}

Forecast the Balance Sheet ril 29, 2016. \begin{tabular}{|l|r|r|} \hline Other accrued expenses & 2,185 & 2,464 \\ \hline Total current liabilities & 7,368 & 9,173 \\ \hline Long-term debt & 30,247 & 33,752 \\ \hline Long-term accrued compensation & 1,759 & 1,535 \\ \hline Long-term accrued income taxes & 2,903 & 2,476 \\ \hline Long-term deferred tax liabilities & 3,729 & 4,700 \\ \hline Other long-term liabilities & 1,916 & 1,819 \\ \hline Total liabilities & 47,922 & 53,455 \\ \hline Shareholders' equity & & \\ \hline Ordinary shares & - & \\ \hline Retained earnings & 53,931 & 54,414 \\ \hline Accumulated other comprehensive (loss) & (1,868) & (1,184) \\ \hline Total shareholders' equity & 52,063 & 53,230 \\ \hline Total liabilities and shareholders' equity & $99,985 & $106,685 \\ \hline \hline \end{tabular} Use the following assumptions to forecast the company's balance sheet for FY2017. \begin{tabular}{|l|r|} \hline Forecasted FY2017 net income & $5,311 million \\ \hline Forecasted FY2017 net sales & $37,400 million \\ \hline Accounts receivable & 19.3% of net sales \\ \hline Inventories & 12.0% of net sales \\ \hline Tax assets & 2.4% of net sales \\ \hline Prepaid expenses and other current assets & 4.3% of net sales \\ \hline Long-term tax assets & 4.8% of net sales \\ \hline Other assets & 5.4% of net sales \\ \hline Accounts payable & 5.9% of net sales \\ \hline Accrued compensation & 5.9% of net sales \\ \hline Accrued income taxes & 2.0% of net sales \\ \hline Other accrued expenses & 7.6% of net sales \\ \hline \end{tabular} - Round your answers to the nearest whole number. - Use a negative sign with your Accumulated other comprehensive loss answer. \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{c} Medtronic plc \\ Forecasted Consolidated Balance Sheet \end{tabular}} \\ \hline (\$ millions) & EST. 2017 \\ \hline \multicolumn{2}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & 4,520 \\ \hline Investments & 9,758 \\ \hline Accounts receivable & 7,218 \\ \hline Inventories & 4,488 \\ \hline Tax assets & 898 \\ \hline Prepaid expenses and other current assets & 1,608 \\ \hline Total current assets & 28,490 \\ \hline Property, plant, and equipment, net & 5,272 \\ \hline Goodwill & 41,500 \\ \hline Other intangible assets, net & 24,968 \\ \hline Long-term tax assets & 1,795 \\ \hline Other assets & 2,020 \\ \hline Total assets & 99,525 \\ \hline \multicolumn{2}{|l|}{ Current liabilities } \\ \hline Short-term borrowings & 6,176 \\ \hline Accounts payable & 2,207 \\ \hline Accrued compensation & 2,207 \\ \hline Accrued income taxes & 748 \\ \hline Other accrued expenses & 2,842 \\ \hline Total current liabilities & 14,180 \\ \hline Long-term debt & 22,875 \\ \hline Long-term accrued compensation & 1,759 \\ \hline Long-term accrued income taxes & 3,777 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Short-term borrowings & $ & 6,176 \\ \hline Accounts payable & & 2,207 \\ \hline Accrued compensation & & 2,207 \\ \hline Accrued income taxes & & 748 \\ \hline Other accrued expenses & & 2,842 \\ \hline Total current liabilities & & 14,180 \\ \hline Long-term debt & & 22,875 \\ \hline Long-term accrued compensation & & 1,759 \\ \hline Long-term accrued income taxes & & 3,777 \\ \hline Long-term deferred tax liabilities & & 4,825 \\ \hline Other long-term liabilities & & 2,468 \\ \hline Total liabilities & & 49,884 \\ \hline \multicolumn{3}{|l|}{ Shareholders' equity } \\ \hline Ordinary shares & & - \\ \hline Retained earnings & & 56,029 \\ \hline Accumulated other comprehensive (loss) & & (1,856) \\ \hline Total shareholders' equity & & 54,161 \\ \hline Total liabilities and shareholders' equity & $ & 104,045 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started