Question

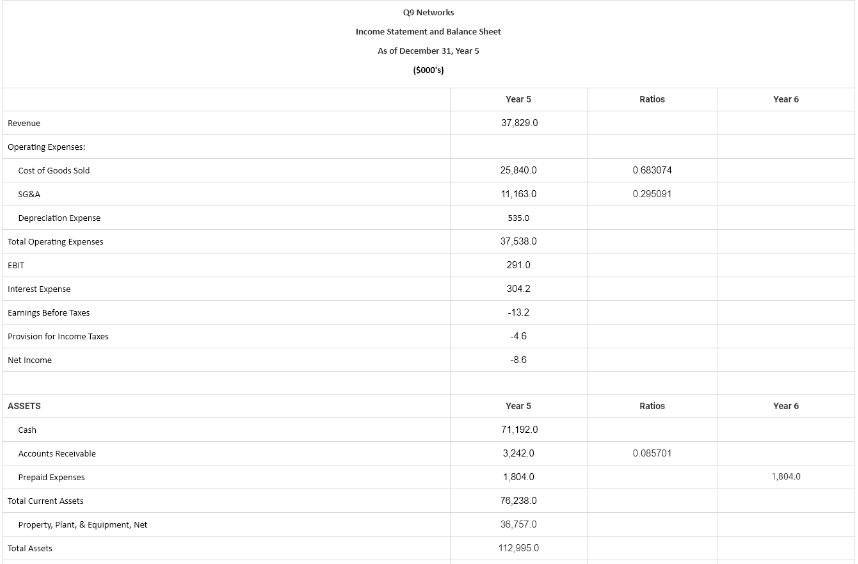

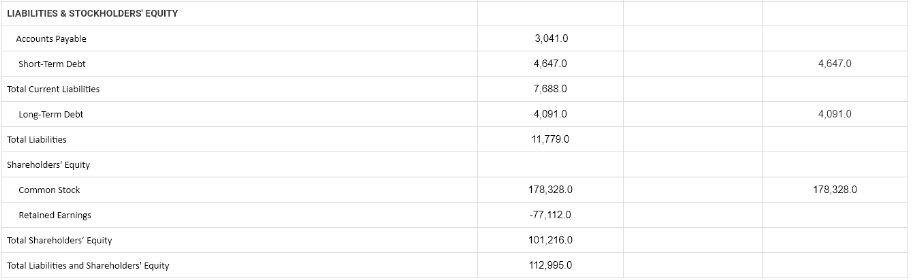

Forecast the financial statements for Q9 Networks Inc. for Year 6 based on the Year 5 historic financial statements and the assumptions listed below. Then

Forecast the financial statements for Q9 Networks Inc. for Year 6 based on the Year 5 historic financial statements and the assumptions listed below. Then answer the questions that follow.

1. Sales growth = 20%

2. Cost of debt = 4 %

3. Tax rate = 35%

4. Depreciation rate = 5%

5. CAPEX = $4,000,000

6. Accounts held constant: prepaid expenses, short-term debt, long-term debt, common stock

7. Cash is the plug account.

8. No dividends

In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund.

What are retained earnings and the total for the plug variable in Year 6?

Q9 Networks Income Statement and Balance Sheet As of December 31, Year 5 (5000's) Year 5 Ratios Year 6 Revenue 37 829.0 Operating Expenses Cost of Goods Sold 25,840.0 0.683074 SG&A 11, 1630 0.295091 Depreciation Expense 535.0 Total Operating Expenses 37,538.0 EBIT 2910 Interest Expense 3042 Earings Before Taxes -13.2 Provision for Income Taxes -46 Net Income -8.6 ASSETS Year 5 Ratios Year 6 Cash 71.192.0 Accounts Receivable 3,242.0 0.085701 Prepaid Expenses 1.804.0 1,804,0 Total Current Assets 78 238.0 Property, plant, & Equipment, Net 36,757.0 Total Assets 112 995 0 LIABILITIES & STOCKHOLDERS' EQUITY Accounts Payable 3,041.0 4.647.0 4,647.0 Short-Term Debt Total Current Liabilities 7,688.0 Long-Term Debt 40910 4,091.0 Total Liabilities 11.779.0 Shareholders' Equity Common Stock 178,328.0 178,328.0 Retained Earnings -77,1120 Total Shareholders' Equity 101,216.0 Total Liabilities and Shareholders' Equity 112,9950Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started