Answered step by step

Verified Expert Solution

Question

1 Approved Answer

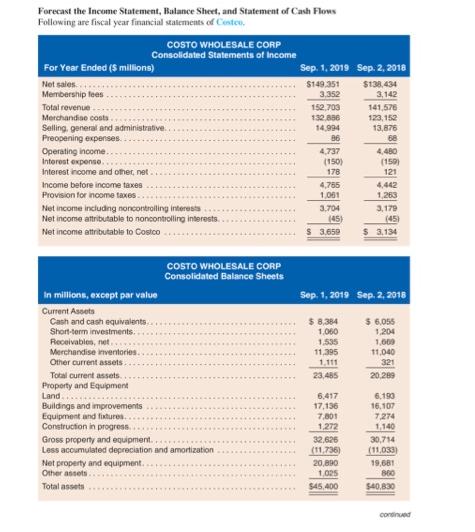

Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are fiscal year financial statements of Costco. For Year Ended ($ millions)

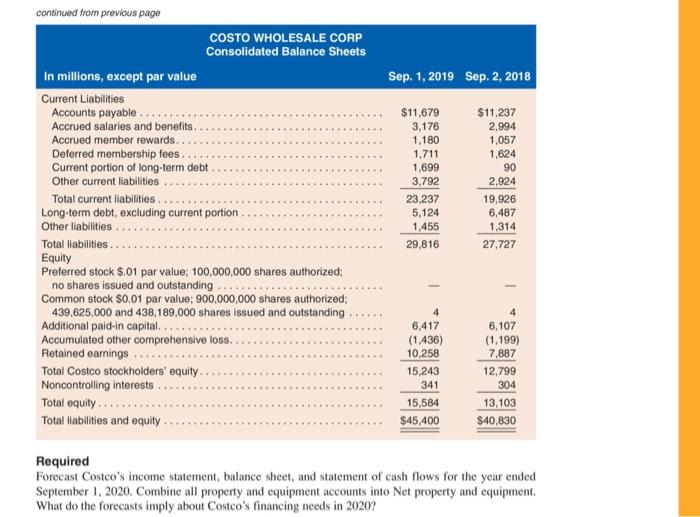

Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are fiscal year financial statements of Costco. For Year Ended ($ millions) Net sales. Membership fees. COSTO WHOLESALE CORP Consolidated Statements of Income Total revenue. Merchandise costs Selling, general and administrative. Preopening expenses. Operating income.. Interest expense... Interest income and other net. Income before income taxes Provision for income taxes.. Net income including noncontrolling interests Net income attributable to noncontrolling interests. Net income attributable to Costco In millions, except par value Current Assets Cash and cash equivalents.. Short-term investments... Receivables, net... Merchandise inventories... Other current assets. Total current assets. Property and Equipment Land.. Buildings and improvements Equipment and fixtures. Construction in progress... COSTO WHOLESALE CORP Consolidated Balance Sheets Gross property and equipment.... Less accumulated depreciation and amortization Net property and equipment... Other assets. Total assets Sep. 1, 2019 $149.351 3,352 152.703 132,856 14,994 86 4,737 (150) 178 4,765 1,061 3,704 (45) 3.659 $ 8,384 1,060 1,535 11,395 1,111 23,485 6,417 17,136 7,801 1,272 32,626 (11,736) Sep. 2, 2018 $138,434 3,142 20,890 1,025 $45,400 141,576 123,152 13,876 68 4,480 Sep. 1, 2019 Sep. 2, 2018 (159) 121 4,442 1,263 3,179 (45) $ 3,134 $ 6,055 1,204 1,609 11,040 321 20,289 6,190 16,107 7,274 1,140 30,714 (11,033) 19,681 860 $40,830 continued continued from previous page COSTO WHOLESALE CORP Consolidated Balance Sheets In millions, except par value Current Liabilities Accounts payable..... Accrued salaries and benefits.. Accrued member rewards.. Deferred membership fees. Current portion of long-term debt Other current liabilities. Total current liabilities... Long-term debt, excluding current portion Other liabilities Total liabilities.. Equity Preferred stock $.01 par value; 100,000,000 shares authorized; no shares issued and outstanding. Common stock $0.01 par value; 900,000,000 shares authorized: 439,625,000 and 438,189,000 shares issued and outstanding Additional paid-in capital........ Accumulated other comprehensive loss.. Retained earnings Total Costco stockholders' equity. Noncontrolling interests Total equity...... Total liabilities and equity Sep. 1, 2019 Sep. 2, 2018 $11,679 3,176 1,180 1,711 1,699 3,792 23,237 5,124 1,455 29,816 4 6,417 (1,436) 10,258 15,243 341 15,584 $45,400 $11,237 2,994 1,057 1,624 90 2,924 19,926 6,487 1,314 27,727 6,107 (1,199) 7,887 12,799 304 13,103 $40,830 Required Forecast Costco's income statement, balance sheet, and statement of cash flows for the year ended September 1, 2020. Combine all property and equipment accounts into Net property and equipment. What do the forecasts imply about Costco's financing needs in 2020?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

COSTO WHOLESALE CORP Consolidated Statement of income For the year ended in millions Sep 1 2020 Sep 1 2019 Sep 2 2018 Basis of estimation Change than last year Remarks Net Sales 161135 149351 138434 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started