Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forecast the separate financial statements of Green Company. Using Ms. Lakes assumptions and Greens 2021 financial statements, prepare pro forma 2022 financial statements for Green

- Forecast the separate financial statements of Green Company. Using Ms. Lake’s assumptions and Green’s 2021 financial statements, prepare pro forma 2022 financial statements for Green Company assuming that the acquisition is not attempted. Using the information below:

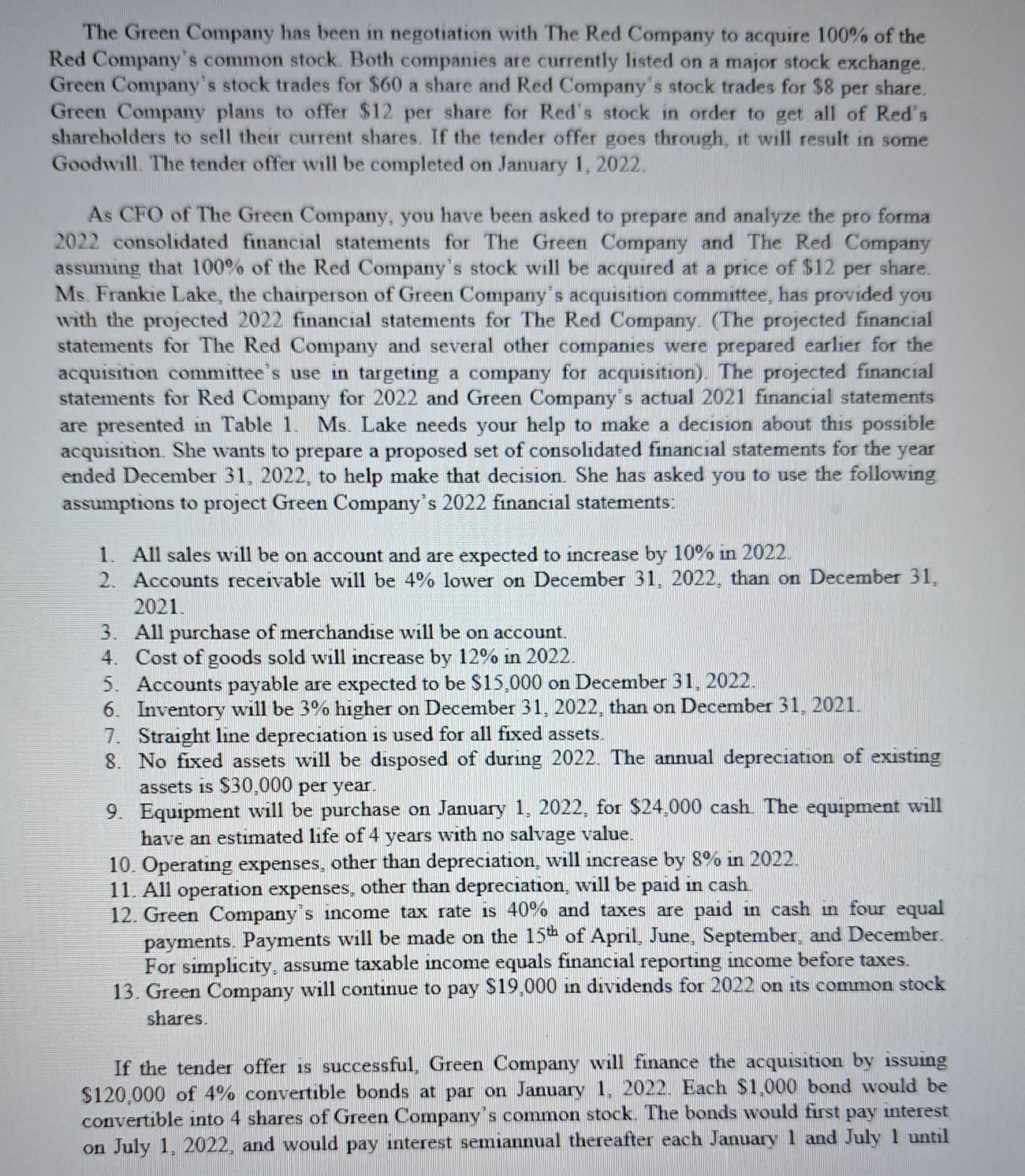

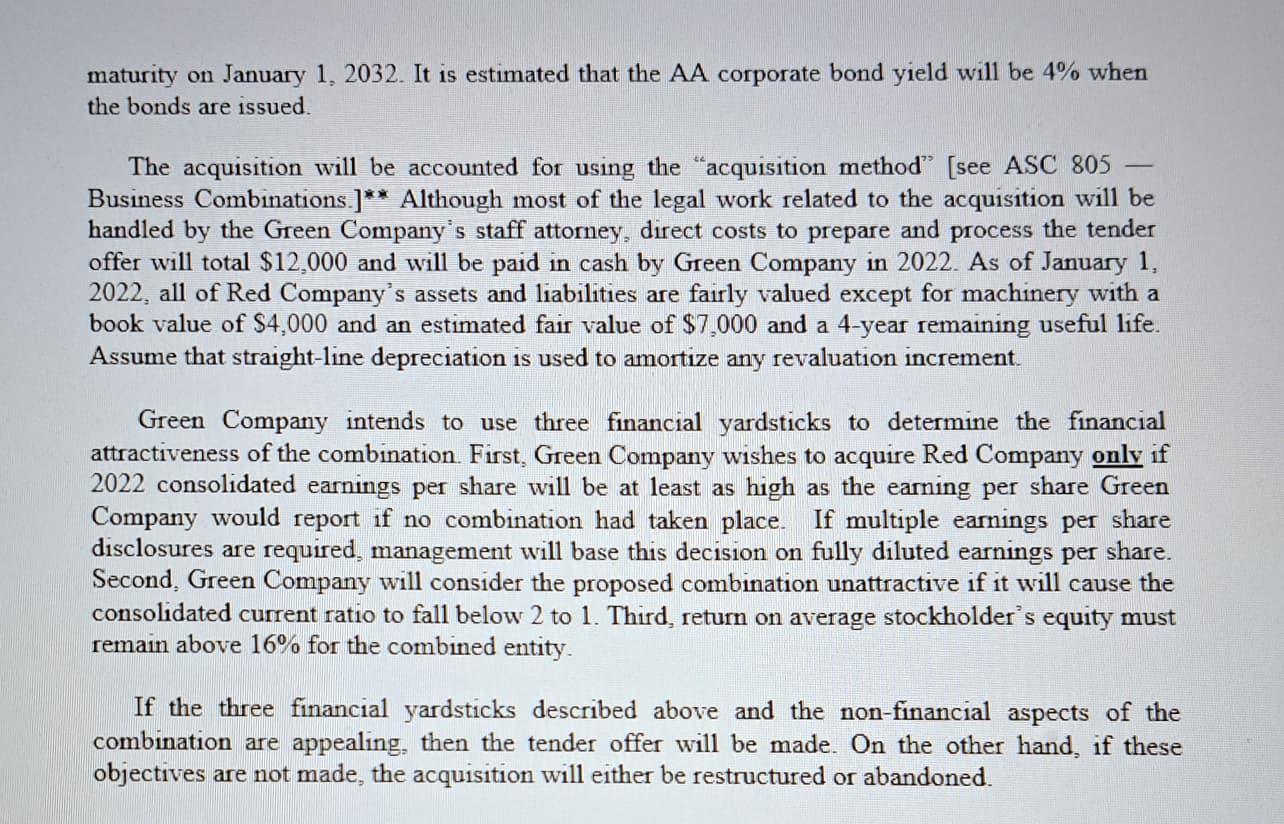

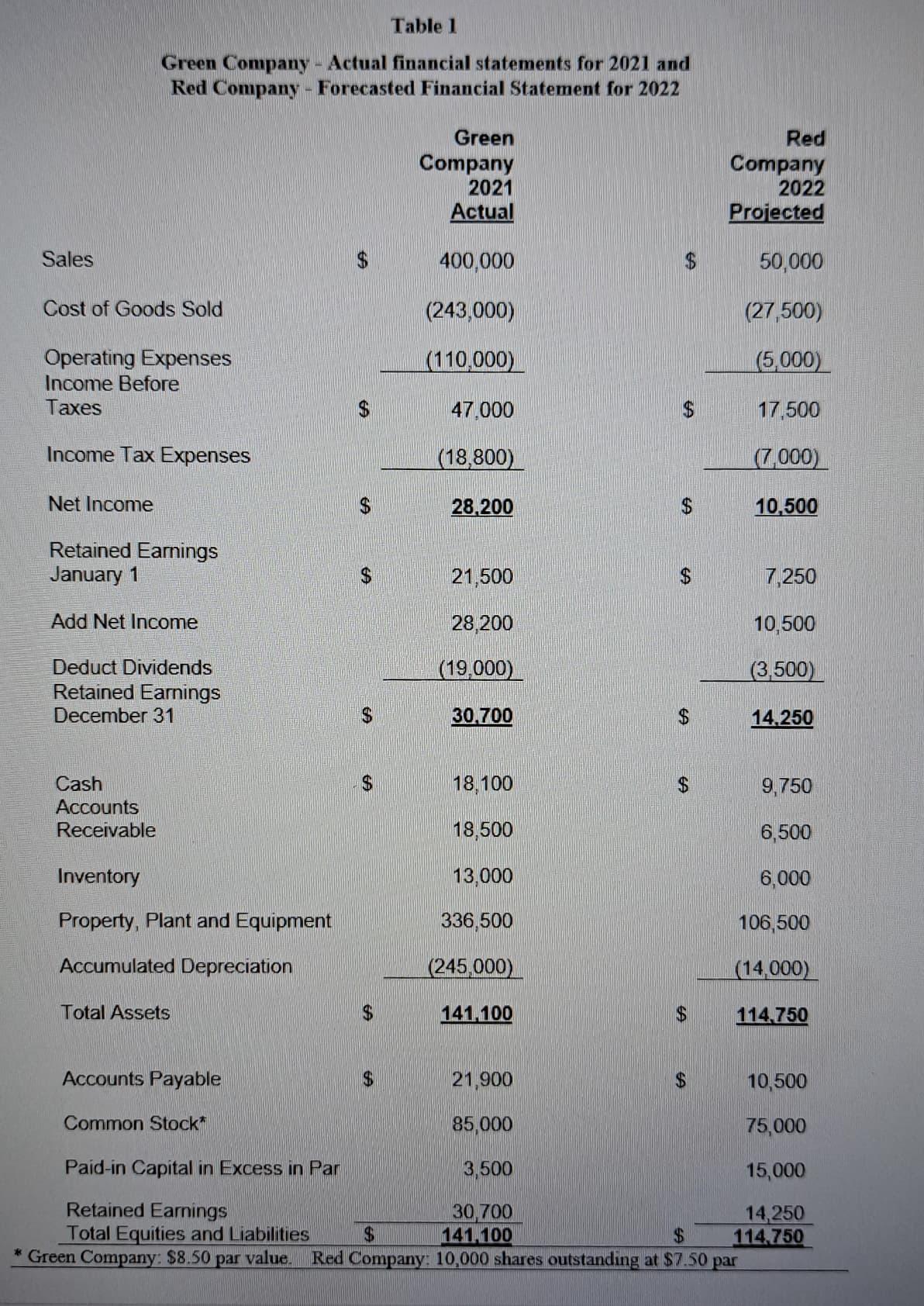

The Green Company has been in negotiation with The Red Company to acquire 100% of the Red Company's common stock. Both companies are currently listed on a major stock exchange. Green Company's stock trades for $60 a share and Red Company's stock trades for $8 per share. Green Company plans to offer $12 per share for Red's stock in order to get all of Red's shareholders to sell their current shares. If the tender offer goes through, it will result in some Goodwill. The tender offer will be completed on January 1, 2022. As CFO of The Green Company, you have been asked to prepare and analyze the pro forma 2022 consolidated financial statements for The Green Company and The Red Company assuming that 100% of the Red Company's stock will be acquired at a price of $12 per share. Ms. Frankie Lake, the chairperson of Green Company's acquisition committee, has provided you with the projected 2022 financial statements for The Red Company. (The projected financial statements for The Red Company and several other companies were prepared earlier for the acquisition committee's use in targeting a company for acquisition). The projected financial statements for Red Company for 2022 and Green Company's actual 2021 financial statements are presented in Table 1. Ms. Lake needs your help to make a decision about this possible acquisition. She wants to prepare a proposed set of consolidated financial statements for the year ended December 31, 2022, to help make that decision. She has asked you to use the following assumptions to project Green Company's 2022 financial statements: 1. All sales will be on account and are expected to increase by 10% in 2022. 2. Accounts receivable will be 4% lower on December 31, 2022, than on December 31, 2021. 3. All purchase of merchandise will be on account. 4. Cost of goods sold will increase by 12% in 2022. 5. Accounts payable are expected to be $15,000 on December 31, 2022. 6. Inventory will be 3% higher on December 31, 2022, than on December 31, 2021. 7. Straight line depreciation is used for all fixed assets. 8. No fixed assets will be disposed of during 2022. The annual depreciation of existing assets is $30,000 per year. 9. Equipment will be purchase on January 1, 2022, for $24,000 cash. The equipment will have an estimated life of 4 years with no salvage value. 10. Operating expenses, other than depreciation, will increase by 8% in 2022. 11. All operation expenses, other than depreciation, will be paid in cash. 12. Green Company's income tax rate is 40% and taxes are paid in cash in four equal payments. Payments will be made on the 15th of April, June, September, and December. For simplicity, assume taxable income equals financial reporting income before taxes. 13. Green Company will continue to pay $19,000 in dividends for 2022 on its common stock shares. If the tender offer is successful, Green Company will finance the acquisition by issuing $120,000 of 4% convertible bonds at par on January 1, 2022. Each $1,000 bond would be convertible into 4 shares of Green Company's common stock. The bonds would first pay interest on July 1, 2022, and would pay interest semiannual thereafter each January 1 and July 1 until

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Certainly to prepare pro forma consolidated financial statements for Green Company and Red Company l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started