Answered step by step

Verified Expert Solution

Question

1 Approved Answer

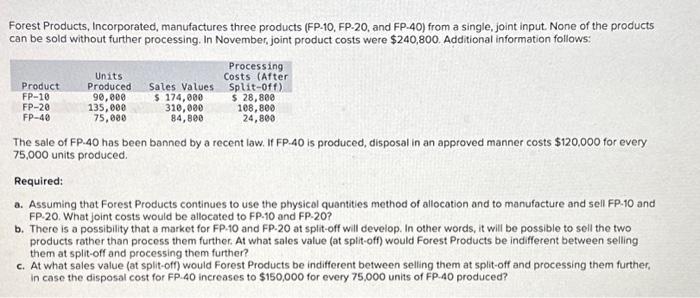

Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing.

Forest Products, Incorporated, manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $240,800. Additional information follows: Product FP-10 FP-20 FP-40 Units Produced 90,000 135,000 75,000 Sales Values $ 174,000 310,000 84,800 Processing Costs (After Split-Off) $ 28,800 108,800 24,800 The sale of FP-40 has been banned by a recent law. If FP-40 is produced, disposal in an approved manner costs $120,000 for every 75,000 units produced.

Required:

a. Assuming that Forest Products continues to use the physical quantities method of allocation and to manufacture and sell FP-10 and FP-20. What joint costs would be allocated to FP-10 and FP-20?

b. There is a possibility that a market for FP-10 and FP-20 at split-off will develop. In other words, it will be possible to sell the two products rather than process them further. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further?

c. At what sales value (at split-off) would Forest Products be indifferent between selling them at split-off and processing them further, in case the disposal cost for FP-40 increases to $150,000 for every 75,000 units of FP-40 produced?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started