Question

Form 1065. (Obj. 5) On January 3, 2014, Ellen Elvers (SSN 299-84-1945) and Jack Ford form Elvers and Ford general partnership (EIN 31-0960341). Elvers and

Form 1065. (Obj. 5) On January 3, 2014, Ellen Elvers (SSN 299-84-1945) and Jack Ford form Elvers and Ford general partnership (EIN 31-0960341). Elvers and Ford operate a business that sells various types of merchandise (business code 5963) at 1425 Tyron Street, Charlotte, North Carolina 28201. To form the partnership, Ellen contributes $24,000; Jack contributes $16,000. The agreement provides that Ellen will participate in the partnership on a full-time basis and Jack on a part-time basis. The agreement further provides that Ellen and Jack will receive guaranteed annual payments of $34,000 and $18,000, respectively. The remaining profits go 60% to Ellen and 40% to Jack.

Form 1065. (Obj. 5) On January 3, 2014, Ellen Elvers (SSN 299-84-1945) and Jack Ford form Elvers and Ford general partnership (EIN 31-0960341). Elvers and Ford operate a business that sells various types of merchandise (business code 5963) at 1425 Tyron Street, Charlotte, North Carolina 28201. To form the partnership, Ellen contributes $24,000; Jack contributes $16,000. The agreement provides that Ellen will participate in the partnership on a full-time basis and Jack on a part-time basis. The agreement further provides that Ellen and Jack will receive guaranteed annual payments of $34,000 and $18,000, respectively. The remaining profits go 60% to Ellen and 40% to Jack.

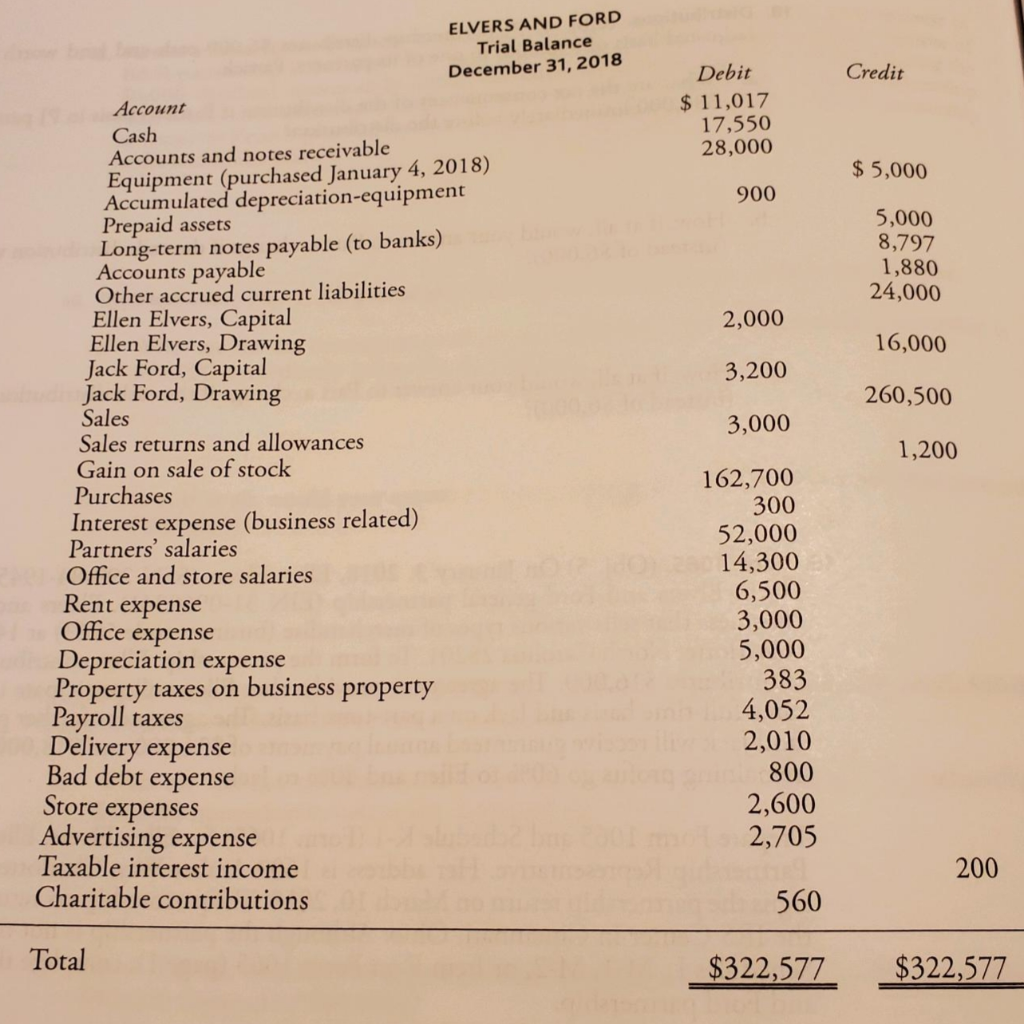

Prepare Form 1065 and Schedule K-1 (Form 1065) for Ellen Elvers. Ellen is the Designated Tax Matters Partner. Her address is 1609 Amber Way, Charlotte, NC 28201. Ellen signs the partnership return on April 10, 2015. The partnership tax return will be filed with the IRS Center in Cincinnati, Ohio. Although the partnership is not required to complete Schedules L, M-1, M-2, or Item F on Form 1065 (page 1), complete these items for Elvers and Ford partnership. The trial balance that follows was prepared as of December 31 after all necessary adjustments. Merchandise inventory is an exception. Total purchases of inventory during the year were $162,700. The ending balance in inventory was $22,000. Also, the partners capital accounts do not reflect the partners distributive shares of income and loss for the year. The accounts for the partners Drawings represent withdrawals in addition to their respective guaranteed payments. Net income per books (Schedule M-1, line 1) is $23,990. The partnership uses the accrual method of accounting. Worthless accounts totaling to $800 were written off directly to bad debt expense during the year. The partnership calculates depreciation using (accelerated) MACRS. The equipment was the only personal property purchased during 2014. The partnership does not elect Section 179. Book depreciation is reported on the trial balance. Book depreciation is based on a different method than MACRS. Charitable contributions are subject to the 50% limitation. On October 3, 2014, 50 shares of common stock in ZMT Corporation were sold for $2,900. The stock was purchased for $1,700 on March 29, 2014. For purposes of preparing Form 1065, assume that Form 4562 and Schedule D have been properly prepared.

ELVERS AND FORD Trial Balance Credit December 31, 2018 Debit $11,017 17,550 28,000 Account Cash Accounts and notes receivable Equipment (purchased January 4, 2018) Accumulated depreciation-equipment Prepaid assets Long-term notes payable (to banks) Accounts payable Other accrued current liabilities Ellen Elvers, Capital Ellen Elvers, Drawing Jack Ford, Capital Jack Ford, Drawing Sales Sales returns and allowances Gain on sale of stock Purchases Interest expense (business related) Partners' salaries Office and store salaries Rent expense Office expense $ 5,000 900 5,000 8,797 1,880 24,000 2,000 16,000 3,200 260,500 3,000 1,200 162,700 300 52,000 14,300 6,500 3,000 5,000 383 4,052 2,010 800 2,600 2,705 Depreciation expense Property taxes on business property Payroll taxes Delivery expense Bad debt expense Store expenses Advertising expense Taxable interest income Charitable contributions 200 560 Total $322,577 $322,577 ELVERS AND FORD Trial Balance Credit December 31, 2018 Debit $11,017 17,550 28,000 Account Cash Accounts and notes receivable Equipment (purchased January 4, 2018) Accumulated depreciation-equipment Prepaid assets Long-term notes payable (to banks) Accounts payable Other accrued current liabilities Ellen Elvers, Capital Ellen Elvers, Drawing Jack Ford, Capital Jack Ford, Drawing Sales Sales returns and allowances Gain on sale of stock Purchases Interest expense (business related) Partners' salaries Office and store salaries Rent expense Office expense $ 5,000 900 5,000 8,797 1,880 24,000 2,000 16,000 3,200 260,500 3,000 1,200 162,700 300 52,000 14,300 6,500 3,000 5,000 383 4,052 2,010 800 2,600 2,705 Depreciation expense Property taxes on business property Payroll taxes Delivery expense Bad debt expense Store expenses Advertising expense Taxable interest income Charitable contributions 200 560 Total $322,577 $322,577Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started