Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Form needed: 1120S, Schedule K-1 form 1120S, Form 4797 and 4562 2018 S CORPORATION TAX RETURN PROBLEM Facts William Spicer (SS# 123-45-5789) owns 80 percent

Form needed: 1120S, Schedule K-1 form 1120S, Form 4797 and 4562

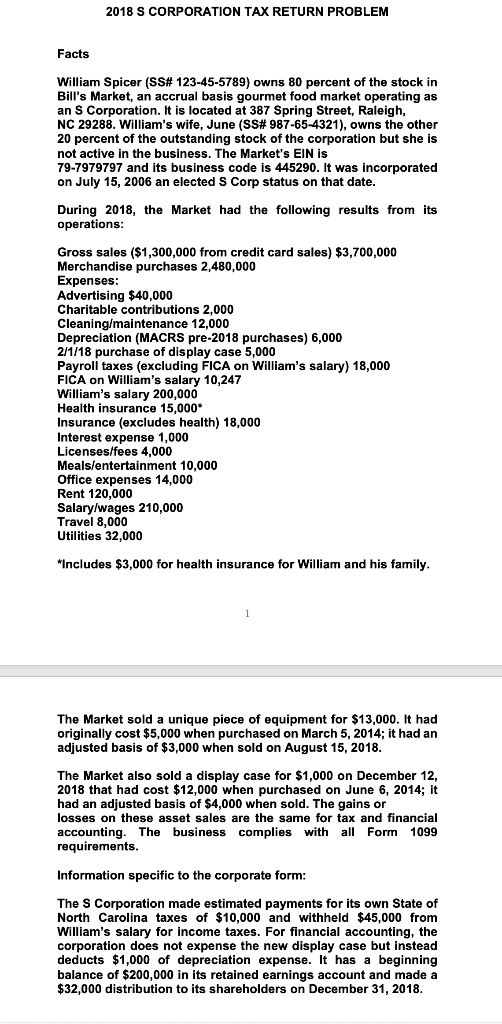

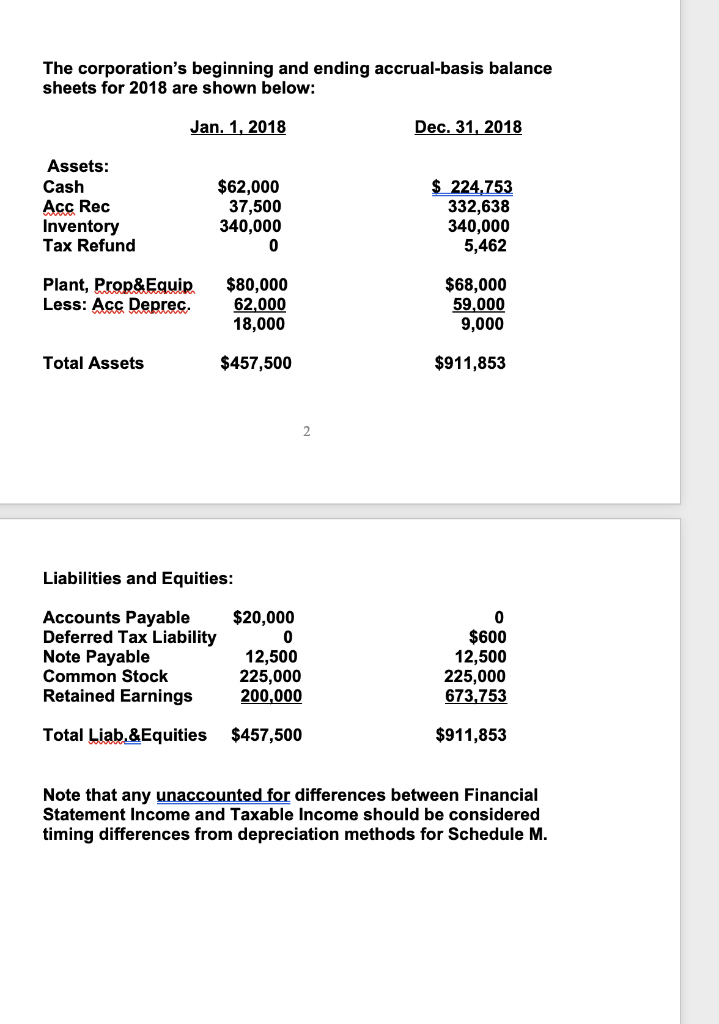

2018 S CORPORATION TAX RETURN PROBLEM Facts William Spicer (SS# 123-45-5789) owns 80 percent of the stock in Bill's Market, an accrual basis gourmet food market operating as an S Corporation. It is located at 387 Spring Street, Raleigh, NC 29288, William's wife, June (SS# 987-65-4321), owns the other 20 percent of the outstanding stock of the corporation but she is not active in the business. The Market's EIN is 79-7979797 and its business code is 445290. It was incorporated on July 15, 2006 an elected S Corp status on that date During 2018, the Market had the following results from its operations Gross sales ($1,300,000 from credit card sales) $3,700,000 Merchandise purchases 2,480,000 Expenses Advertising $40,000 Charitable contributions 2,000 Cleaning/maintenance 12,000 Depreciation (MACRS pre-2018 purchases) 6,000 2/1/18 purchase of display case 5,000 Payroll taxes (excluding FICA on William's salary) 18,000 FICA on William's salary 10,247 William's salary 200,000 Health insurance 15,000* Insurance (excludes health) 18,000 Interest expense 1,000 Licenses/fees 4,000 Mealslentertainment 10,000 Office expenses 14,000 Rent 120,000 Salarylwages 210,000 Travel 8,000 Utilities 32,000 "Includes $3,000 for health insurance for William and his family The Market sold a unique piece of equipment for $13,000. It hacd originally cost $5,000 when purchased on March 5, 2014; it had an adjusted basis of $3,000 when sold on August 15, 2018 The Market also sold a display case for $1,000 on December 12, 2018 that had cost $12,000 when purchased on June 6, 2014; it had an adjusted basis of $4,000 when sold. The gains or losses on these asset sales are the same for tax and financial accounting. The business complies with all Form 1099 requirements Information specific to the corporate form: The S Corporation made estimated payments for its own State of North Carolina taxes of $10,000 and withheld $45,000 from William's salary for income taxes. For financial accounting, the corporation does not expense the new display case but instead deducts $1,000 of depreciation expense. It has a beginning balance of $200,000 in its retained earnings account and made a $32,000 distribution to its shareholders on December 31, 2018 The corporation's beginning and ending accrual-basis balance sheets for 2018 are shown below: Jan. 1.2018 Dec. 31, 2018 Assets: Cash Acc Rec Inventory Tax Refund $62,000 37,500 340,000 $224,753 332,638 340,000 5,462 Plant, Prop&Eaup Less: Acc Deprec, $80,000 62,000 18,000 $68,000 59.000 9,000 Total Assets $457,500 $911,853 Liabilities and Equities: Accounts Payable$20,000 Deferred Tax Liability Note Payable Common Stock Retained Earnings 12,500 225,000 200,000 $600 12,500 225,000 673,753 Total Liab.&Equities $457,500 $911,853 Note that any unaccounted for differences between Financial Statement Income and Taxable Income should be considered timing differences from depreciation methods for Schedule MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started