Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Formation Mark is a Radiologist and maintains a radiology practice (X-Ray). Jennifer is an Information Systems Specialist and has created a computer program for the

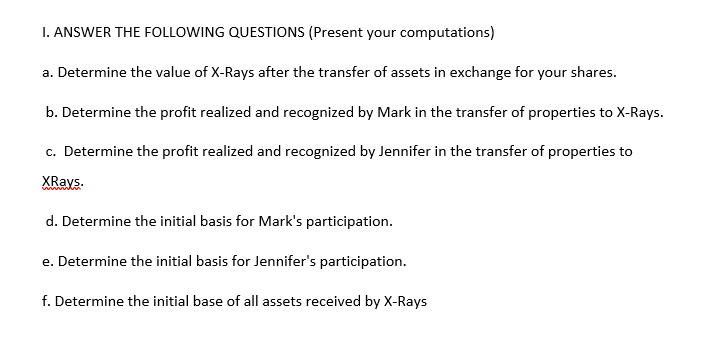

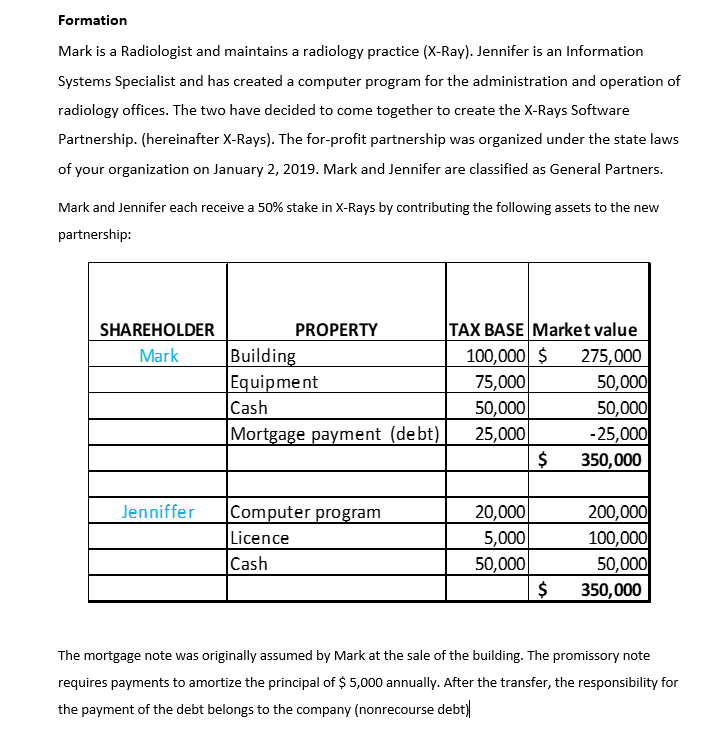

Formation Mark is a Radiologist and maintains a radiology practice (X-Ray). Jennifer is an Information Systems Specialist and has created a computer program for the administration and operation of radiology offices. The two have decided to come together to create the X-Rays Software Partnership. (hereinafter X-Rays). The for-profit partnership was organized under the state laws of your organization on January 2, 2019. Mark and Jennifer are classified as General Partners. Mark and Jennifer each receive a 50% stake in X-Rays by contributing the following assets to the new partnership: SHAREHOLDER Mark 50.00 PROPERTY TAX BASE Market value Building 100,000 $ 275,000 Equipment 75,000 50,000 Cash 50,000 50,000 Mortgage payment (debt) 25,000 - 25,000 $ 350,000 Jenniffer Computer program Licence Cash 20,000 5,000 50,000 200,000 100,000 50,000 350,000 $ The mortgage note was originally assumed by Mark at the sale of the building. The promissory note requires payments to amortize the principal of $ 5,000 annually. After the transfer, the responsibility for the payment of the debt belongs to the company (nonrecourse debt) I. ANSWER THE FOLLOWING QUESTIONS (Present your computations) a. Determine the value of X-Rays after the transfer of assets in exchange for your shares. b. Determine the profit realized and recognized by Mark in the transfer of properties to X-Rays. c. Determine the profit realized and recognized by Jennifer in the transfer of properties to XRays: d. Determine the initial basis for Mark's participation. e. Determine the initial basis for Jennifer's participation. f. Determine the initial base of all assets received by X-Rays

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started