Answered step by step

Verified Expert Solution

Question

1 Approved Answer

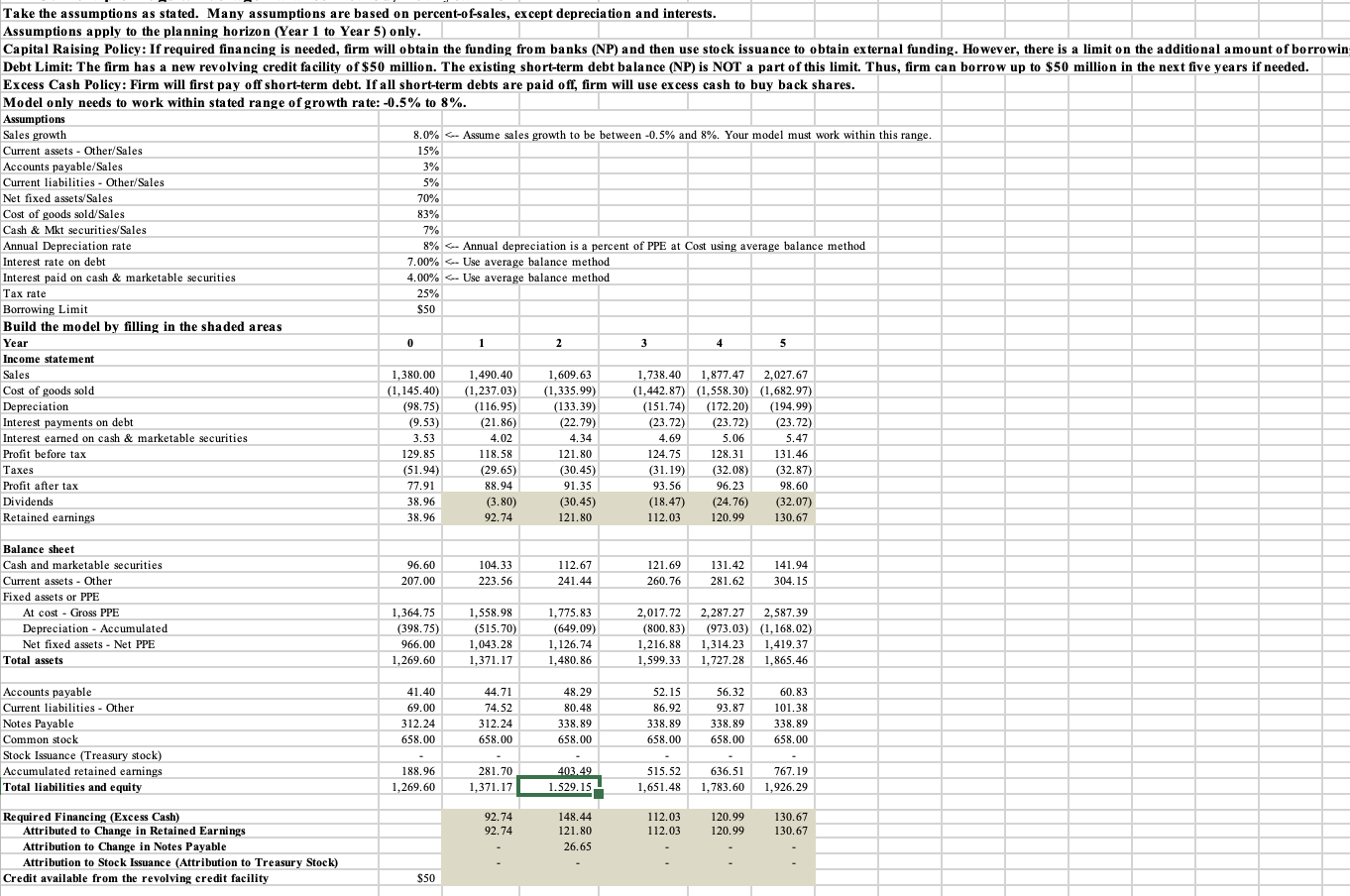

Formulas for only the shaded section are needed Take the assumptions as stated. Many assumptions are based on percent-of-sales, except depreciation and interests. Assumptions apply

Formulas for only the shaded section are needed

Take the assumptions as stated. Many assumptions are based on percent-of-sales, except depreciation and interests. Assumptions apply to the planning horizon (Year 1 to Year 5) only. Capital Raising Policy: If required financing is needed, firm will obtain the funding from banks (NP) and then use stock issuance to obtain external funding. However, there is a limit on the additional amount of borrowin Debt Limit: The firm has a new revolving credit facility of $50 million. The existing short-term debt balance (NP) is NOT a part of this limit. Thus, firm can borrow up to $50 million in the next five years if needed. Excess Cash Policy: Firm will first pay off short-term debt. If all short-term debts are paid off, firm will use excess cash to buy back shares. Model only needs to work within stated range of growth rate: -0.5% to 8%. Assumptions Sales growth 8.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started