Answered step by step

Verified Expert Solution

Question

1 Approved Answer

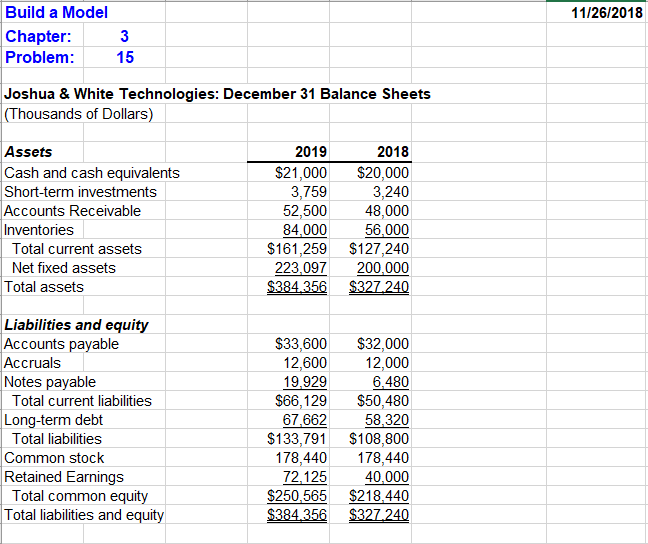

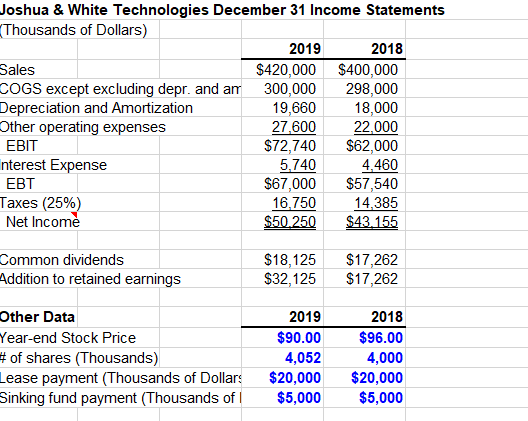

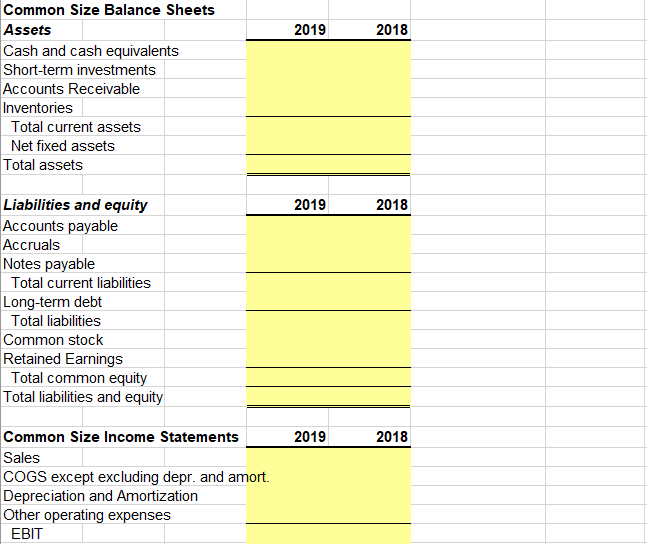

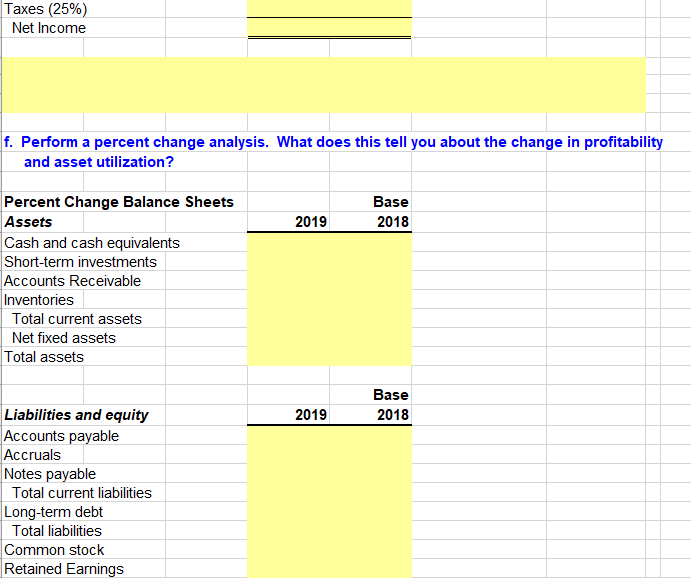

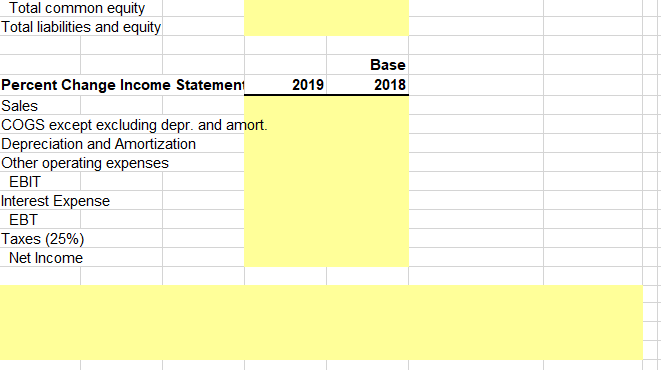

Formulas needed? I am baffled. begin{tabular}{|l|c|} hline Build a Model hline Chapter: & 3 hline Problem: & 15 hline end{tabular} Joshua &

Formulas needed? I am baffled.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started