Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Formulate and solve the Markowitz portfolio optimization model to minimize portfolio variance subject to a required expected return of 10 percent that was defined

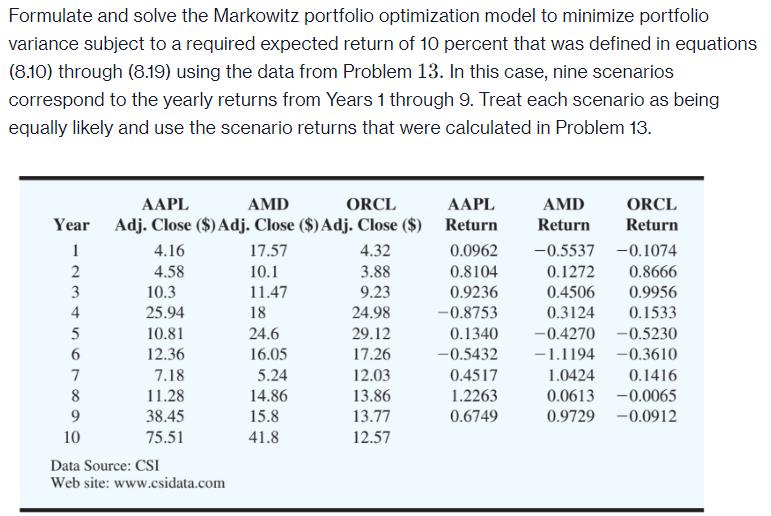

Formulate and solve the Markowitz portfolio optimization model to minimize portfolio variance subject to a required expected return of 10 percent that was defined in equations (8.10) through (8.19) using the data from Problem 13. In this case, nine scenarios correspond to the yearly returns from Years 1 through 9. Treat each scenario as being equally likely and use the scenario returns that were calculated in Problem 13. AAPL AMD ORCL Year Adj. Close ($) Adj. Close ($) Adj. Close ($) AAPL Return AMD ORCL Return Return 10 1234567899 4.16 17.57 4.32 0.0962 -0.5537 -0.1074 4.58 10.1 3.88 0.8104 0.1272 0.8666 10.3 11.47 9.23 0.9236 0.4506 0.9956 25.94 18 24.98 -0.8753 0.3124 0.1533 10.81 24.6 29.12 0.1340 -0.4270 -0.5230 12.36 16.05 17.26 -0.5432 -1.1194 -0.3610 7.18 5.24 12.03 0.4517 1.0424 0.1416 11.28 14.86 13.86 1.2263 0.0613 -0.0065 38.45 15.8 13.77 0.6749 0.9729 -0.0912 75.51 41.8 12.57 Data Source: CSI Web site: www.csidata.com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started