Question

Formulate the mathematical program model for selecting among three projects described below, using maximizing the sum of NPV's of the projects selected as the

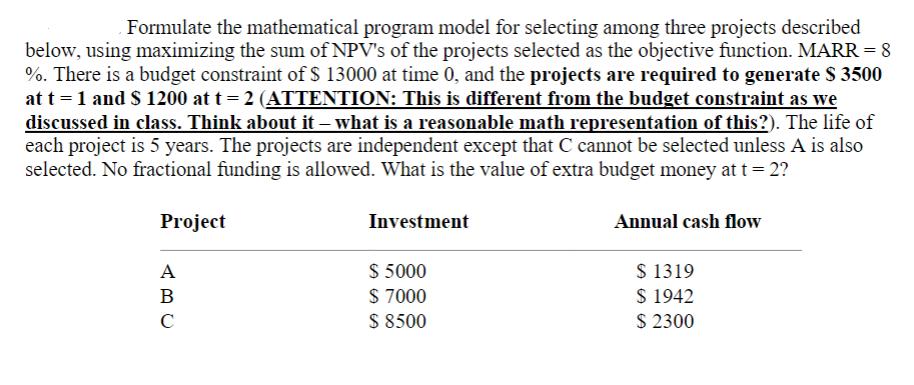

Formulate the mathematical program model for selecting among three projects described below, using maximizing the sum of NPV's of the projects selected as the objective function. MARR = 8 %. There is a budget constraint of $ 13000 at time 0, and the projects are required to generate $ 3500 at t = 1 and $ 1200 at t = 2 (ATTENTION: This is different from the budget constraint as we discussed in class. Think about it what is a reasonable math representation of this?). The life of each project is 5 years. The projects are independent except that C cannot be selected unless A is also selected. No fractional funding is allowed. What is the value of extra budget money at t = 2? Project A B C Investment $ 5000 $ 7000 $ 8500 Annual cash flow $ 1319 $ 1942 $ 2300

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction to Management Science Quantitative Approach to Decision Making

Authors: David R. Anderson, Dennis J. Sweeney, Thomas A. Williams, Jeffrey D. Camm, James J. Cochran

15th edition

978-1337406529

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App