Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forrest Corporation manufactures parts that are used in the production of washers and dryers. The following costs are associated with part no. 65: Direct

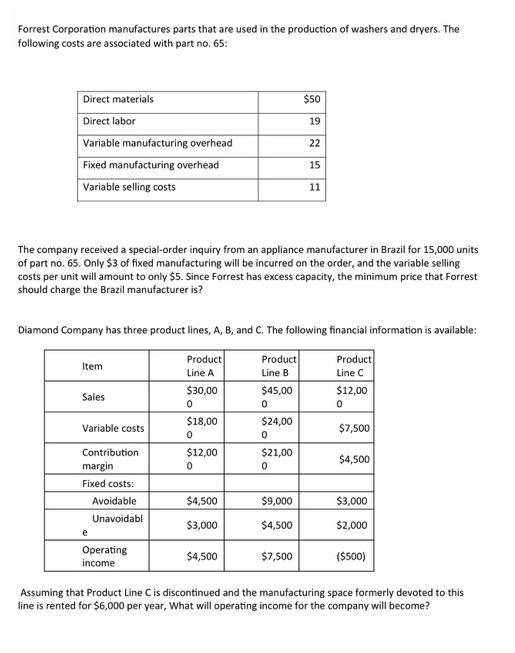

Forrest Corporation manufactures parts that are used in the production of washers and dryers. The following costs are associated with part no. 65: Direct materials Direct labor Variable manufacturing overhead $50 19 22 Fixed manufacturing overhead Variable selling costs 15 11 The company received a special-order inquiry from an appliance manufacturer in Brazil for 15,000 units of part no. 65. Only $3 of fixed manufacturing will be incurred on the order, and the variable selling costs per unit will amount to only $5. Since Forrest has excess capacity, the minimum price that Forrest should charge the Brazil manufacturer is? Diamond Company has three product lines, A, B, and C. The following financial information is available: Product Product Product Item Line A Line B Line C $30,00 $45,00 $12,00 Sales $18,00 $24,00 Variable costs $7,500 Contribution $12,00 $21,00 $4,500 margin Fixed costs: Avoidable $4,500 $9,000 $3,000 Unavoidabl $3,000 $4,500 $2,000 e Operating $4,500 $7,500 ($500) income Assuming that Product Line Cis discontinued and the manufacturing space formerly devoted to this line is rented for $6,000 per year, What will operating income for the company will become?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

4 When the new orders are to be accepted the most important cost in decision making are r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started