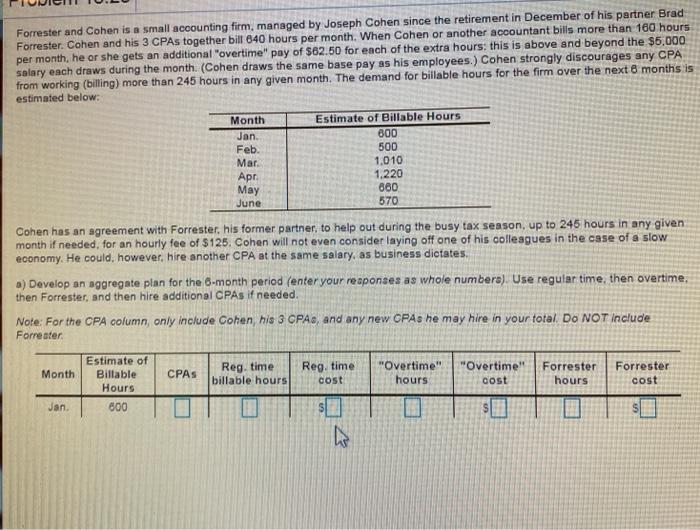

Forrester and Cohen is a small accounting firm, managed by Joseph Cohen since the retirement in December of his partner Brad Forrester. Cohen and his 3 CPAs together bill 840 hours per month. When Cohen or another accountant bills more than 100 hours per month, he or she gets an additional "overtime" pay of $62.50 for each of the extra hours: this is above and beyond the $6,000 salary each draws during the month. (Cohen draws the same base pay as his employees.) Cohen strongly discourages any CPA from working (billing) more than 245 hours in any given month. The demand for billable hours for the firm over the next 8 months is estimated below: Month Estimate of Billable Hours Jan. 800 Feb. 500 Mar 1.010 Apr 1.220 May 860 June 570 Cohen has an agreement with Forrester, his former partner, to help out during the busy tax season, up to 245 hours in any given month if needed, for an hourly fee of $125. Cohen will not even consider laying off one of his colleagues in the case of a slow economy. He could, however, hire another CPA at the same salary, as business dictates a) Develop an aggregate plan for the 6-month period (enter your reaponses as whole numbers). Use regular time, then overtime, then Forrester, and then hire additional CPAs if needed. Note For the CPA column only include Cohen, his 3 CPAs, and any new CPAs he may hire in your total. Do NOT include Forrester Month CPAS Estimate of Billable Hours 800 Reg. time billable hours Reg. time cost "Overtime" hours "Overtime" cost Forrester hours Forrester cost Jan SL Forrester and Cohen is a small accounting firm, managed by Joseph Cohen since the retirement in December of his partner Brad Forrester. Cohen and his 3 CPAs together bill 840 hours per month. When Cohen or another accountant bills more than 100 hours per month, he or she gets an additional "overtime" pay of $62.50 for each of the extra hours: this is above and beyond the $6,000 salary each draws during the month. (Cohen draws the same base pay as his employees.) Cohen strongly discourages any CPA from working (billing) more than 245 hours in any given month. The demand for billable hours for the firm over the next 8 months is estimated below: Month Estimate of Billable Hours Jan. 800 Feb. 500 Mar 1.010 Apr 1.220 May 860 June 570 Cohen has an agreement with Forrester, his former partner, to help out during the busy tax season, up to 245 hours in any given month if needed, for an hourly fee of $125. Cohen will not even consider laying off one of his colleagues in the case of a slow economy. He could, however, hire another CPA at the same salary, as business dictates a) Develop an aggregate plan for the 6-month period (enter your reaponses as whole numbers). Use regular time, then overtime, then Forrester, and then hire additional CPAs if needed. Note For the CPA column only include Cohen, his 3 CPAs, and any new CPAs he may hire in your total. Do NOT include Forrester Month CPAS Estimate of Billable Hours 800 Reg. time billable hours Reg. time cost "Overtime" hours "Overtime" cost Forrester hours Forrester cost Jan SL