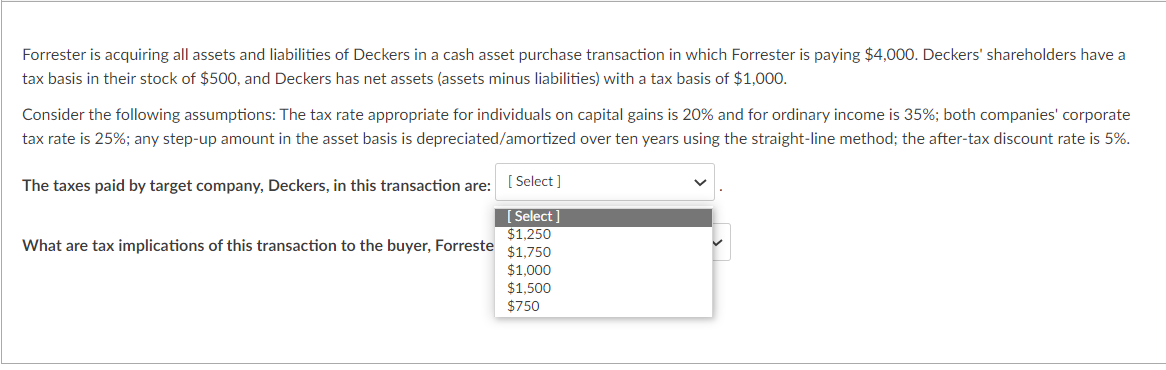

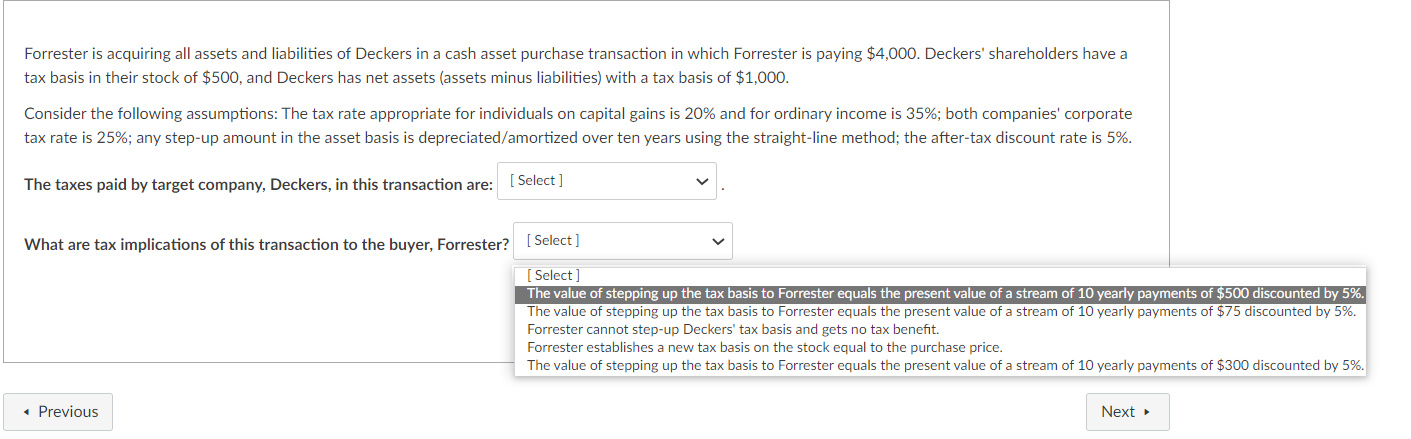

Forrester is acquiring all assets and liabilities of Deckers in a cash asset purchase transaction in which Forrester is paying $4,000. Deckers' shareholders have a tax basis in their stock of $500, and Deckers has net assets (assets minus liabilities) with a tax basis of $1,000. Consider the following assumptions: The tax rate appropriate for individuals on capital gains is 20% and for ordinary income is 35%; both companies' corporate tax rate is 25%; any step-up amount in the asset basis is depreciated/amortized over ten years using the straight-line method; the after-tax discount rate is 5%. The taxes paid by target company, Deckers, in this transaction are: Select] What are tax implications of this transaction to the buyer, Forreste [ Select] $1,250 $1,750 $1,000 $1,500 $750 Forrester is acquiring all assets and liabilities of Deckers in a cash asset purchase transaction in which Forrester is paying $4,000. Deckers' shareholders have a tax basis in their stock of $500, and Deckers has net assets (assets minus liabilities) with a tax basis of $1,000. Consider the following assumptions: The tax rate appropriate for individuals on capital gains is 20% and for ordinary income is 35%; both companies' corporate tax rate is 25%; any step-up amount in the asset basis is depreciated/amortized over ten years using the straight-line method; the after-tax discount rate is 5%. The taxes paid by target company, Deckers, in this transaction are: [Select] What are tax implications of this transaction to the buyer, Forrester? [ Select ] [Select] The value of stepping up the tax basis to Forrester equals the present value of a stream of 10 yearly payments of $500 discounted by 5%. The value of stepping up the tax basis to Forrester equals the present value of a stream of 10 yearly payments of $75 discounted by 5%. Forrester cannot step-up Deckers' tax basis and gets no tax benefit. Forrester establishes a new tax basis on the stock equal to the purchase price. The value of stepping up the tax basis to Forrester equals the present value of a stream of 10 yearly payments of $300 discounted by 5%.