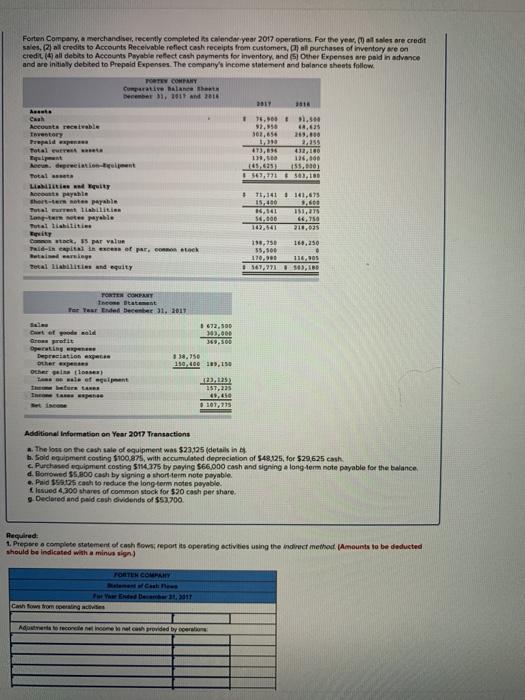

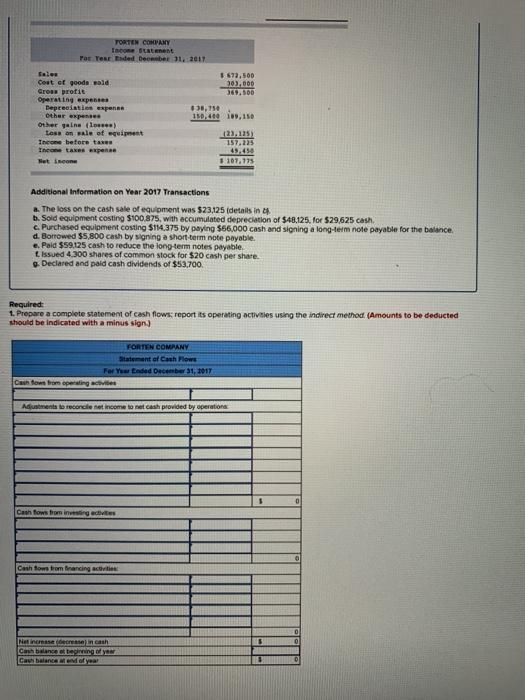

Forten Company, merchandiser, recently completed its calendar year 2017 operations. For the year, sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, purchases of inventory me on credit (4) all debits to Accounts Payable reflect cash payments for inventory, and (5 Other Expenses ne pold in advance and are initially debited to Prepaid Expenses. The company's income statement and balance sheets follow. POT COMPANY Comparative ale that MAD, 2017 And 2014 Accounts receivable Theory Prepaid Total cu Equip | Necu depresionet Total Liity Roots payable short-terte parable Tutal multilities Loyable Tutal liabilities 18.00 1,500 97.50 48.631 302,654 249.650 2.355 7473, 432,10 1.10 126.000 45.6253 155.000) 6371 1 T., 141 141,675 Cannotac, 35 par Valur Tid-i capital is of pr. con el Retirse Detalii ies and equity 16.10 183,275 50.000 6,756 218,035 138,250 168.250 55,100 120.000 110.10 167,7114),10 TORTEN COMPANY Income Statement Ter Ter Ended December 31, 2017 # 672,500 Date de cald 143,000 Gross profit 39.500 Operating we Depreciation expen 13.750 her expenses 150,400 189,15 Other in ) wale eft 23.125 There 157,235 49, se 107,775 Additional Information on Year 2017 Transactions The loss on the cash sale of equipment was $23,125 (details in b. Soid equipment costing $100.875, with accumulated depreciation of 548,125, for $29,625 cash Purchased equipment costing $154.375 by paying $66.000 cash and signing a long-term note payable for the balance d. Borrowed $5,000 cash by signing a short term note payable. Paid 15 cash to reduce the long-term notes payable issued 4.300 shares of common stock for $20 cash per share. s Declared and paid cash dividends of $52.700. Required 1. Prepere a complete statement of cash Bows report its operating activities using the indirect method (Amounts to be deducted should be indicated with a minus sign) FORTEN COURARY we 2017 Cath tow trompeg Adderece income nech provided by coerwone TORTEN COMPANY Income state For Testded Deceber 31, 2017 5672,500 303. DOO 30,150 110,400 1,150 Coat of goods wald Cross profit Operating expen Depreciatim expenn Other expense Other gaine (see) tess on sale of equipent Thce before taxe The taxes expense Het icon (23.125) 157.225 49.450 1 107,175 Additional Information on Year 2017 Transactions a. The loss on the cash sale of equipment was $23,125 (details in b. Sold equipment costing $100.875, with accumulated depreciation of $48,125. for $29,625 cash c. Purchased equipment costing $114.375 by paying $66,000 cash and signing a long-term note payable for the balance d. Borrowed $5,800 cash by signing a short-term note payable. e Paid $59.125 cash to reduce the long-term notes payable tissued 4.300 shares of common stock for $20 cash per share. Declared and paid cash dividends of $53.700 Required 1. Prepare a complete statement of cash flows report its operating activities using the indirect method (Amounts to be deducted should be indicated with a minus sign) FORTEN COMPANY Statement of Cash Flowe For You Ended December 31, 2017 Chwefrom operating advies Adjustments to reconcile net income to net cash provided by operations Cash flows Bom investing Cash fowe trom Binancing activities Nelisse anch Cash balance beginning Cah balance Meyer