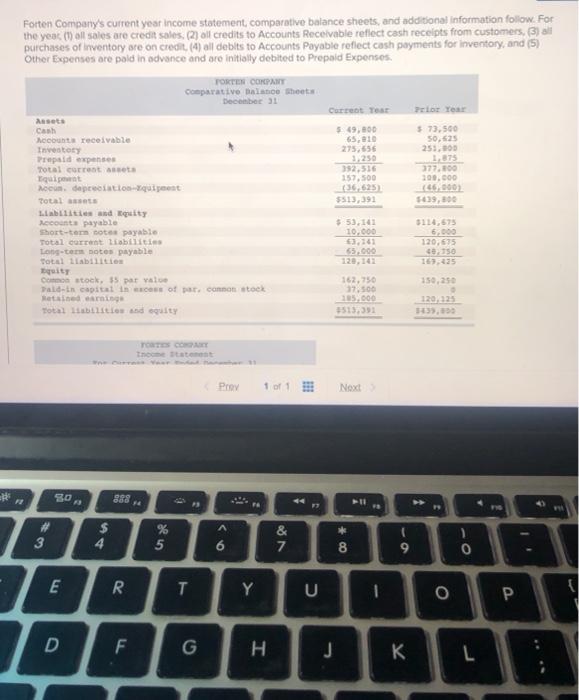

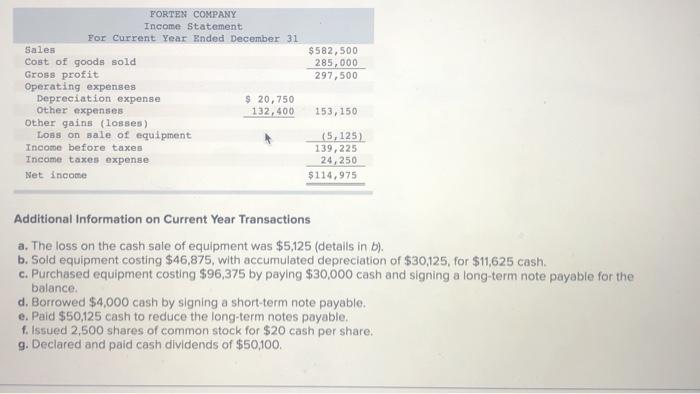

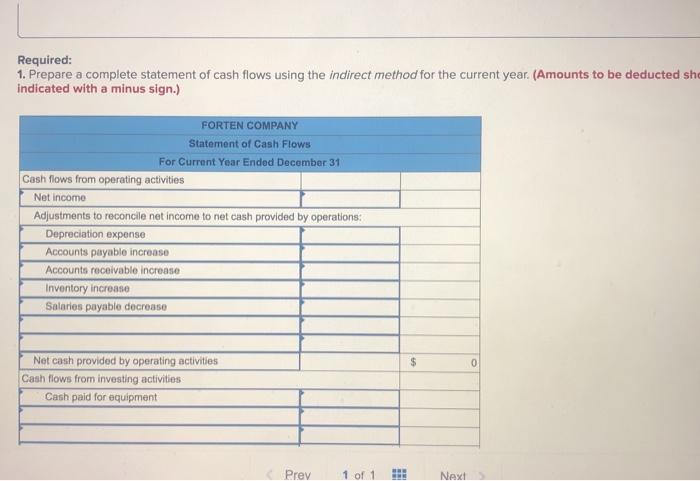

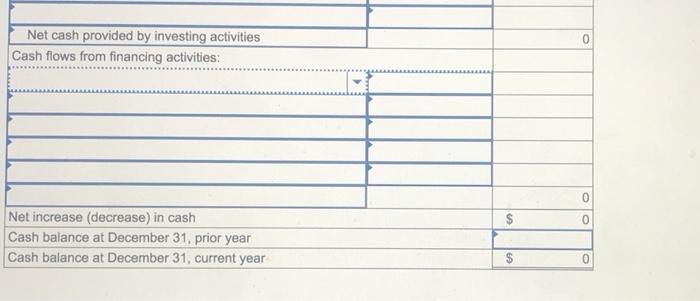

Forten Company's current year income statement comparative balance sheets, and additional Information follow. For the year (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) purchases of Inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses PORTES COME Comparative Balance Sheets December 31 Current Tear or Year este Cash $149,00 $ 73,500 Accounts receivable 65,810 50,525 Inventory 275,656 253,000 Prepaid expenses 3.250 275 Total corretta 32,516 377.100 Equint 157.500 200.000 soeun deposition qui poent (36,625 6.000 Total $513,391 5639,00 Liabilities and Equity Accounts payable 5.53,141 5114,575 Short-tem totes payable 10.000 6,000 Total current liabilities 63.141 120,675 Long-tam potes payable 65.000 150 Total Liabilities 169.235 Equity Common stock, 35 par value 162.750 150.250 Tald-in capital of a cannon stock 17.500 Metained 25.000 120,125 Total abilities and equity 3515,393 Incetatest Prey Nox 888 # 3 $ 4 % 5 6 7 8 9 0 E 70 T Y U 0 P D F G H J L $582,500 285,000 297,500 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 20,750 Other expenses 132,400 Other gains (losses) LOs on sale of equipment Income before taxes Income taxes expense Net income 153, 150 (5,125) 139, 225 24,250 $114,975 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $5,125 (details in b). b. Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash c. Purchased equipment costing $96,375 by paying $30,000 cash and signing a long term note payable for the balance. d. Borrowed $4,000 cash by signing a short-term note payable. e. Pald $50,125 cash to reduce the long-term notes payable. f.issued 2,500 shares of common stock for $20 cash per share. 9. Declared and paid cash dividends of $50,100, Required: 1. Prepare a complete statement of cash flows using the indirect method for the current year. (Amounts to be deducted she indicated with a minus sign.) FORTEN COMPANY Statement of Cash Flows For Current Year Ended December 31 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operations: Depreciation expense Accounts payable increase Accounts receivable increase Inventory increase Salaries payable decrease $ 0 Net cash provided by operating activities Cash flows from investing activities Cash paid for equipment Prev 1 of 1 Next Next 0 Net cash provided by investing activities Cash flows from financing activities: 0 $ 0 Net increase (decrease) in cash Cash balance at December 31. prior year Cash balance at December 31, current year $ 0 Forten Company's current year income statement comparative balance sheets, and additional Information follow. For the year (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) purchases of Inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses PORTES COME Comparative Balance Sheets December 31 Current Tear or Year este Cash $149,00 $ 73,500 Accounts receivable 65,810 50,525 Inventory 275,656 253,000 Prepaid expenses 3.250 275 Total corretta 32,516 377.100 Equint 157.500 200.000 soeun deposition qui poent (36,625 6.000 Total $513,391 5639,00 Liabilities and Equity Accounts payable 5.53,141 5114,575 Short-tem totes payable 10.000 6,000 Total current liabilities 63.141 120,675 Long-tam potes payable 65.000 150 Total Liabilities 169.235 Equity Common stock, 35 par value 162.750 150.250 Tald-in capital of a cannon stock 17.500 Metained 25.000 120,125 Total abilities and equity 3515,393 Incetatest Prey Nox 888 # 3 $ 4 % 5 6 7 8 9 0 E 70 T Y U 0 P D F G H J L $582,500 285,000 297,500 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 20,750 Other expenses 132,400 Other gains (losses) LOs on sale of equipment Income before taxes Income taxes expense Net income 153, 150 (5,125) 139, 225 24,250 $114,975 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $5,125 (details in b). b. Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash c. Purchased equipment costing $96,375 by paying $30,000 cash and signing a long term note payable for the balance. d. Borrowed $4,000 cash by signing a short-term note payable. e. Pald $50,125 cash to reduce the long-term notes payable. f.issued 2,500 shares of common stock for $20 cash per share. 9. Declared and paid cash dividends of $50,100, Required: 1. Prepare a complete statement of cash flows using the indirect method for the current year. (Amounts to be deducted she indicated with a minus sign.) FORTEN COMPANY Statement of Cash Flows For Current Year Ended December 31 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operations: Depreciation expense Accounts payable increase Accounts receivable increase Inventory increase Salaries payable decrease $ 0 Net cash provided by operating activities Cash flows from investing activities Cash paid for equipment Prev 1 of 1 Next Next 0 Net cash provided by investing activities Cash flows from financing activities: 0 $ 0 Net increase (decrease) in cash Cash balance at December 31. prior year Cash balance at December 31, current year $ 0