Question

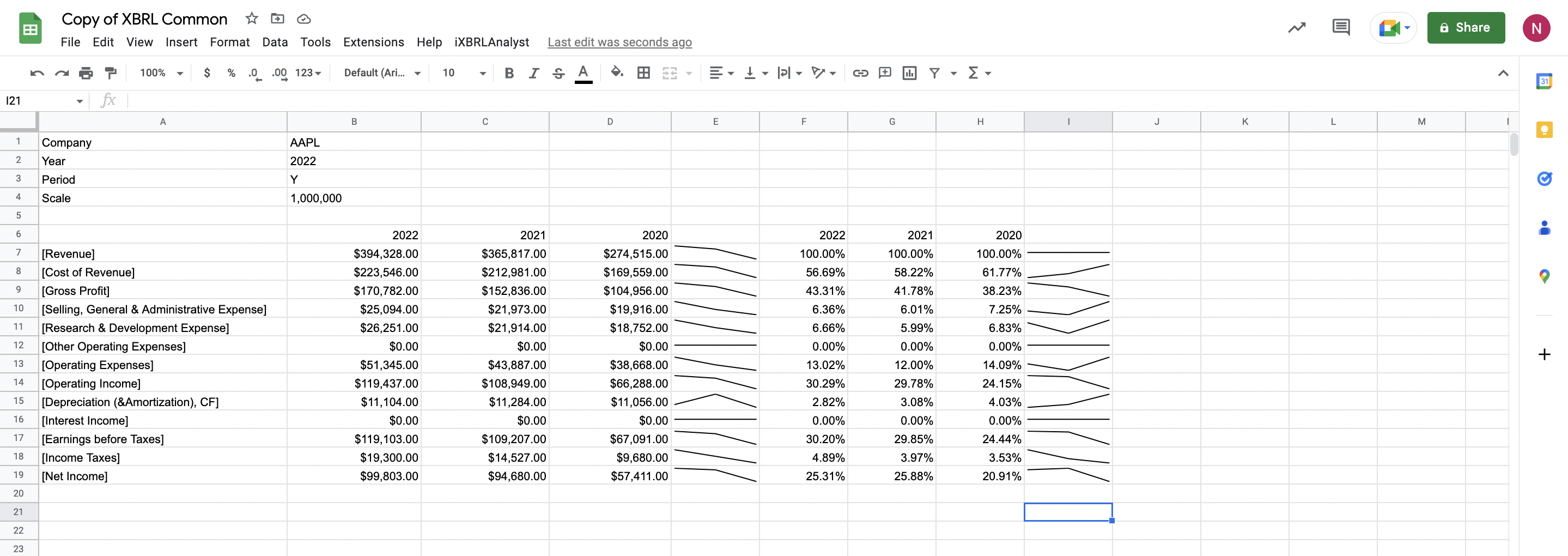

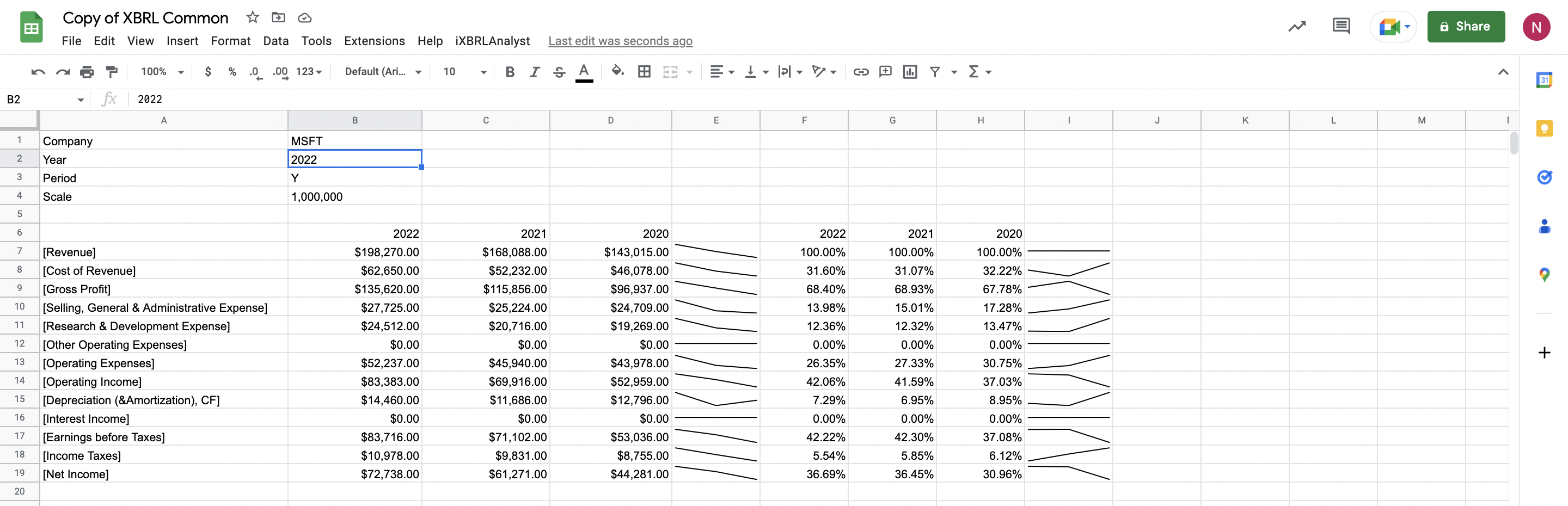

Fortune 100 Project #2 In this project, students need to follow the lab to create common size financial statements (income statement and partial balance sheet),

Fortune 100 Project #2 In this project, students need to follow the lab to create common size financial statements (income statement and partial balance sheet), read statement of cash flow from 10-Ks, perform preliminary vertical and horizontal analysis, and write a report to answer the following questions:

1. Follow the lab instructions (separately attached), perform a trend analysis for your two companies income statements. Discuss whether your companys performance related to these items appeared to be improving, deteriorating, or remaining stable (For example, you could analyze whether companies have smooth earnings over time; what are the significant expenses on the income statement for the most recent years? Do the two companies have a consistent percentage of costs of goods sold to sales revenues? What are the significant expenses on the income statement for the most recent years? Are total and specific expenses as percentage of sales similar over time?). Justify your answer. Please paste your screenshots of lab results (labelled: Project#2 Base Company Income Statement & Project#2 Comparison Company Income Statement) in your report to support your arguments.

2. Pick three asset accounts, three liability accounts, and three shareholders equity accounts from balance sheet that would be important to an investor. Follow the lab instructions, perform a trend analysis for your two companies balance sheet accounts. Discuss whether your companys performance related to these items appeared to be improving, deteriorating, or remaining stable. Justify your answer. Please paste your screenshots of lab results (labelled: Project#2 Base Company Balance Sheet & Project#2 Comparison Company Balance Sheet) in your report to support your arguments.

3. Read statement of cash flow from 10-Ks. Are the free cash flows positive or negative? Are there any significant and unexplainable decline in capital expenditure? Analyze investing and financing activities for the most recent year as identified in the statement of cash flows, specifically identifying the two largest investing activities and the two largest financing activities, for both base company and comparison company. Discuss whether you agree or disagree with the investing and financing strategies that your company appears to be employing.

.

PLEASE HELP ME ASAP, PLEASE ANSWER ALL THE QUESTIONS CORRECTLY ASAP PLEASE PLEASE ALL THE INFORMATION THAT U NEED IS HERE

Copy of XBRL Common $ ( $ File Edit View Insert Format Data Tools Extensions Help iXBRLAnalyst Last edit was seconds ago Copy of XBRL Common $ File Edit View Insert Format Data Tools Extensions Help iXBRLAnalyst Last edit was seconds ago Copy of XBRL Common $ ( $ File Edit View Insert Format Data Tools Extensions Help iXBRLAnalyst Last edit was seconds ago Copy of XBRL Common $ File Edit View Insert Format Data Tools Extensions Help iXBRLAnalyst Last edit was seconds ago

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started