Answered step by step

Verified Expert Solution

Question

1 Approved Answer

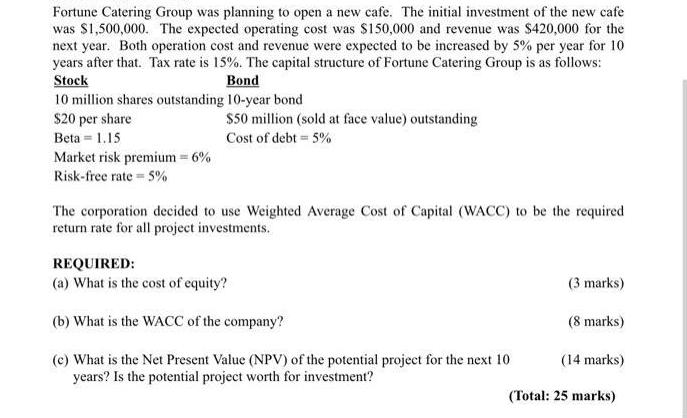

Fortune Catering Group was planning to open a new cafe. The initial investment of the new cafe was $1,500,000. The expected operating cost was

Fortune Catering Group was planning to open a new cafe. The initial investment of the new cafe was $1,500,000. The expected operating cost was $150,000 and revenue was $420,000 for the next year. Both operation cost and revenue were expected to be increased by 5% per year for 10 years after that. Tax rate is 15%. The capital structure of Fortune Catering Group is as follows: Stock Bond 10 million shares outstanding 10-year bond $20 per share Beta 1.15 Market risk premium = 6% Risk-free rate = 5% $50 million (sold at face value) outstanding Cost of debt = 5% The corporation decided to use Weighted Average Cost of Capital (WACC) to be the required return rate for all project investments. REQUIRED: (a) What is the cost of equity? (b) What is the WACC of the company? (e) What is the Net Present Value (NPV) of the potential project for the next 10 years? Is the potential project worth for investment? (3 marks) (8 marks) (14 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started