Question

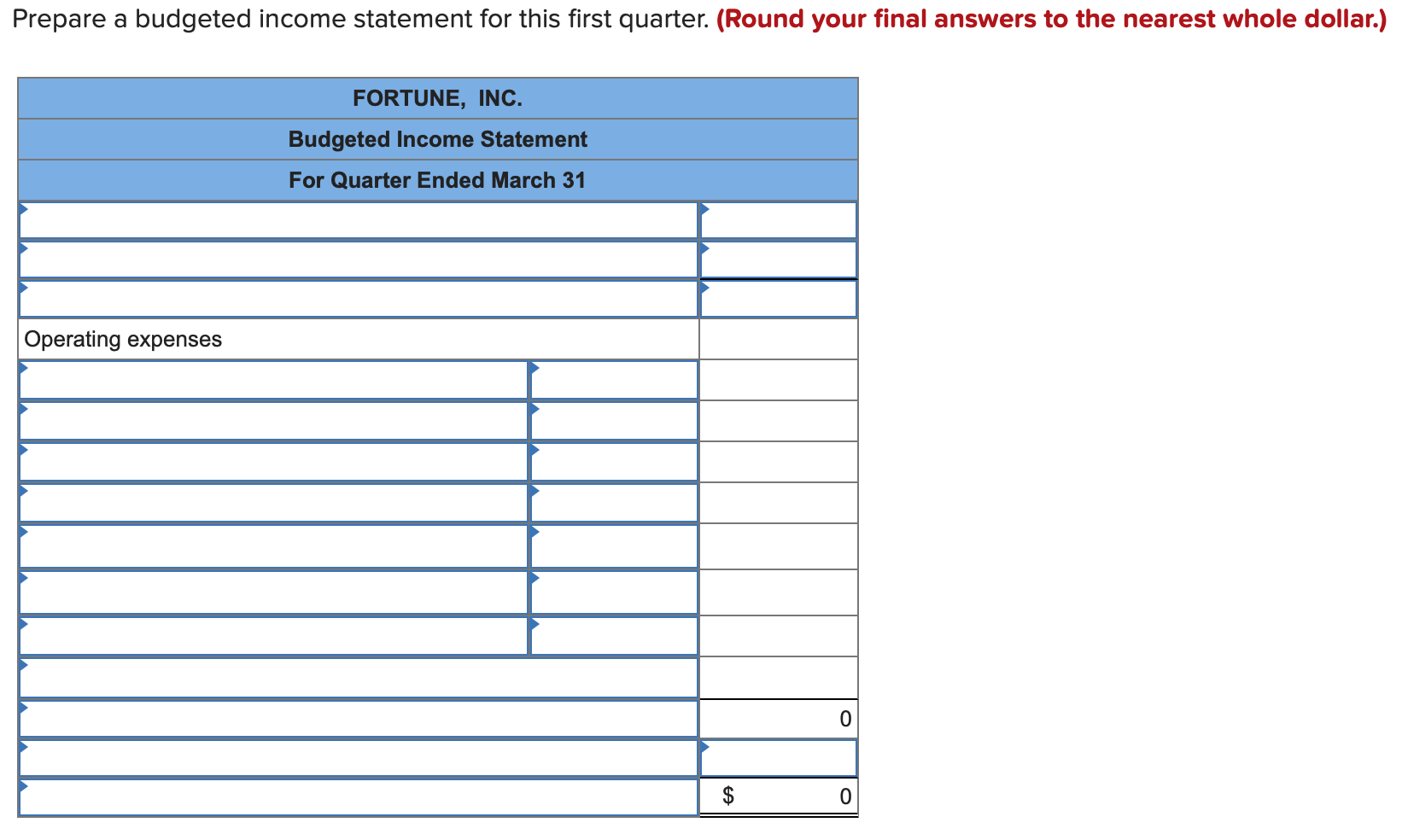

Fortune, Inc., is preparing its master budget for the first quarter. The company sells a single product at a price of $25 per unit. Sales

Fortune, Inc., is preparing its master budget for the first quarter. The company sells a single product at a price of $25 per unit. Sales (in units) are forecasted at 38,000 for January, 58,000 for February, and 48,000 for March. Cost of goods sold is $12 per unit. Other expense information for the first quarter follows. Commissions 11 % of sales dollars Rent $ 23,000 per month Advertising 15 % of sales dollars Office salaries $ 74,000 per month Depreciation $ 54,000 per month Interest 12 % annually on a $280,000 note payable Tax rate 40 %

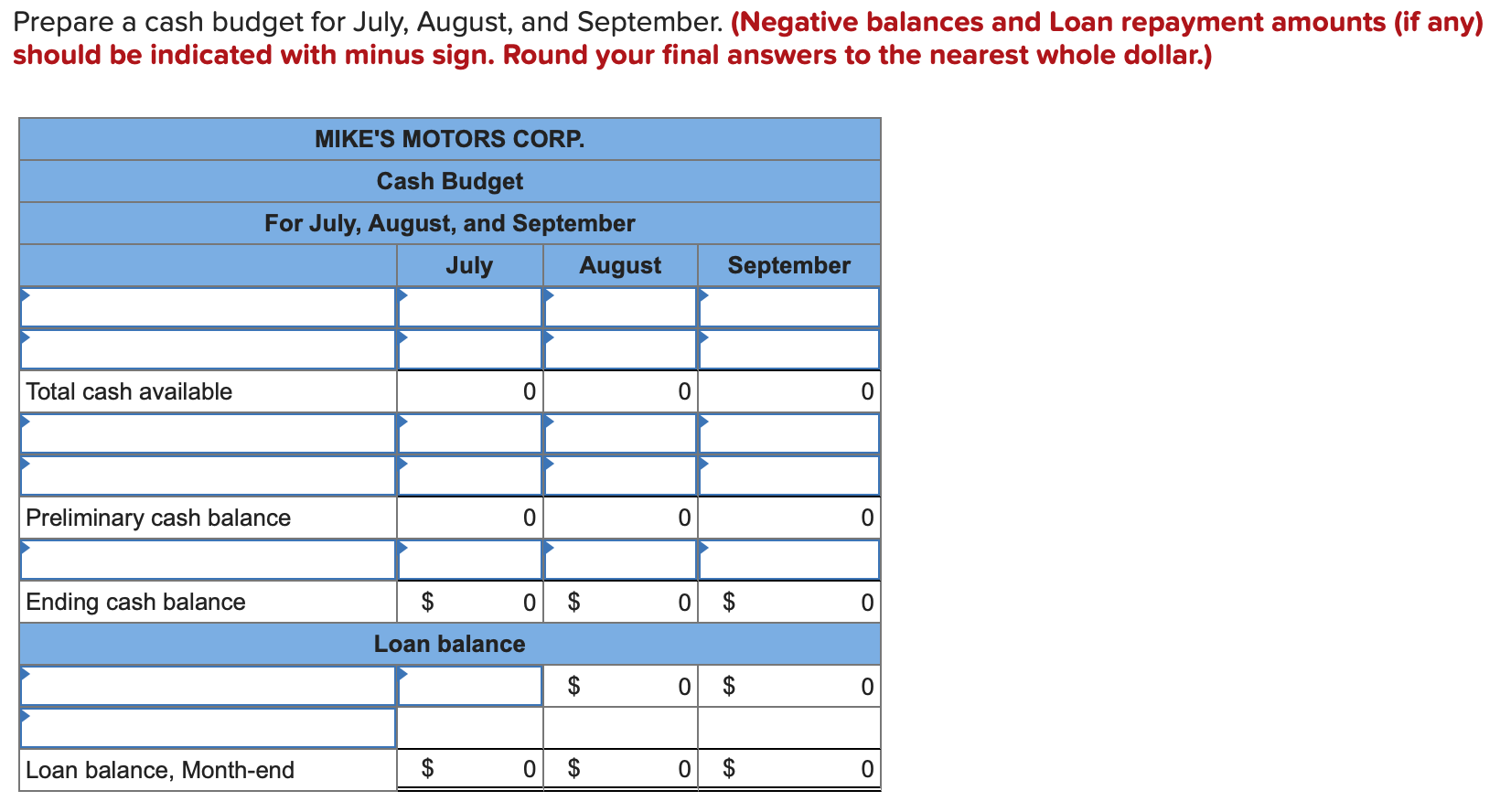

Mikes Motors Corp. manufactures motors for dirt bikes. The company requires a minimum $30,000 cash balance at each month-end. If necessary, the company borrows to meet this requirement, at a cost of 3% interest per month (paid at the end of each month). Any cash balance above $30,000 at month-end is used to repay loans. The cash balance on July 1 is $27,000, and the company has no outstanding loans at that time. Forecasted cash receipts and forecasted cash payments (other than for loan activity) are as follows.

| Cash Receipts | Cash Payments | |||||||

| July | $ | 78,000 | $ | 106,000 | ||||

| August | 104,000 | 92,900 | ||||||

| September | 143,000 | 120,400 | ||||||

| ||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started