Forward Rates. The wall street journal lists forward rates for Japanese yen. Say that the current listings are as follows:

3 month forward rate (indirect): 106.81

6 month forward rate (indirect): 106.24

9 month forward rate (indirect): 105.15

First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States?

Second, if the current indirect rate is 106.92, what is the 9-month rate and the current ratio imply about the relative difference in the anticipated annual inflation rates?

Finally, using the current indirect rate and the 9-month forward rate, determine the annual anticipated inflation rates for Japan if the anticipated US inflation rate is 4.99%

Please answer the following:

please show all working steps with formulas or excel

please show all working steps with formulas or excel

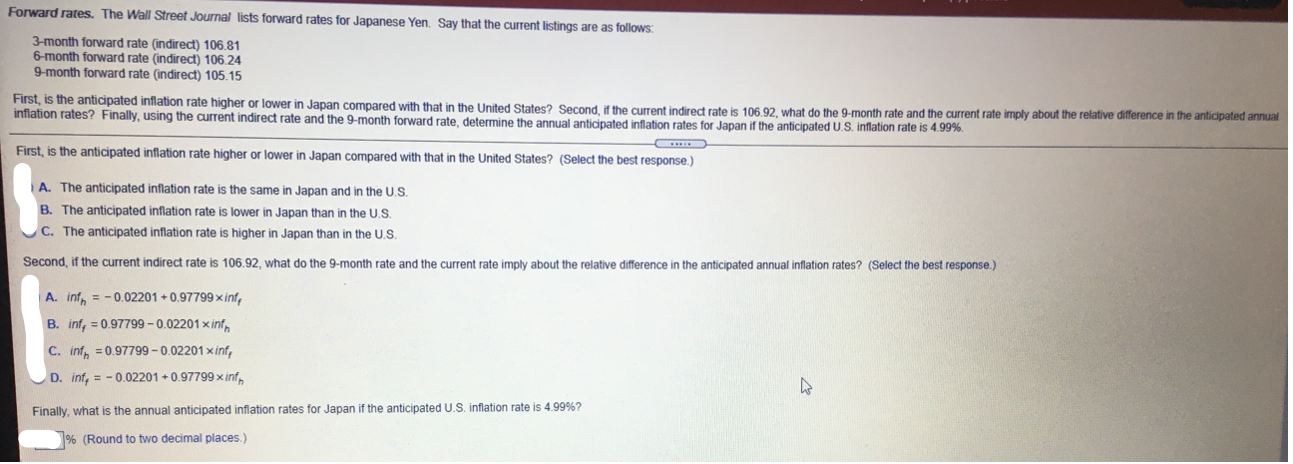

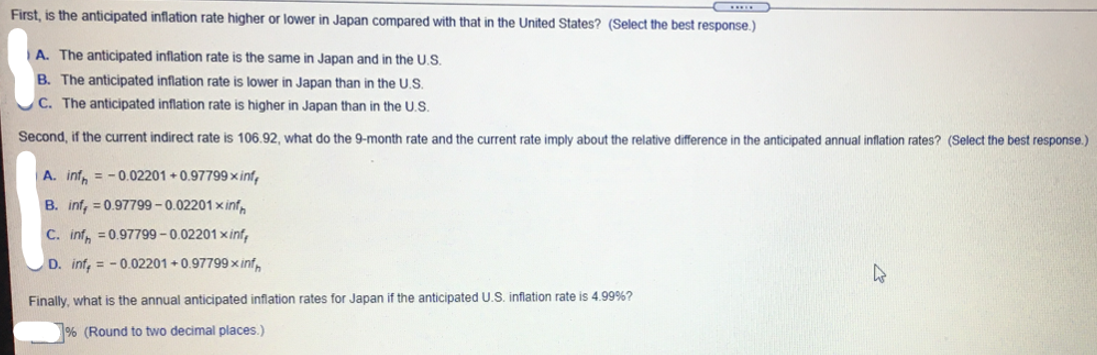

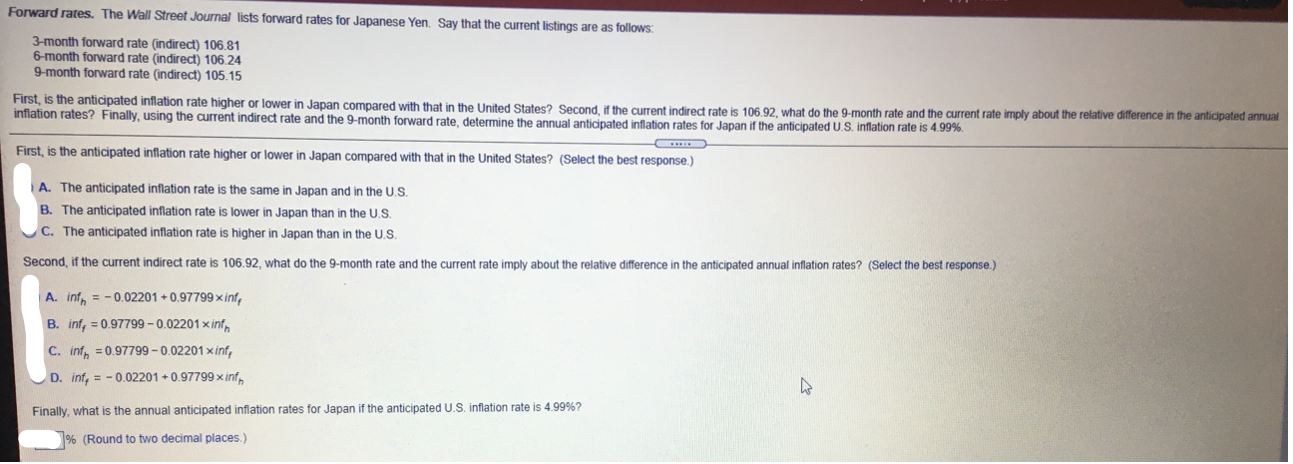

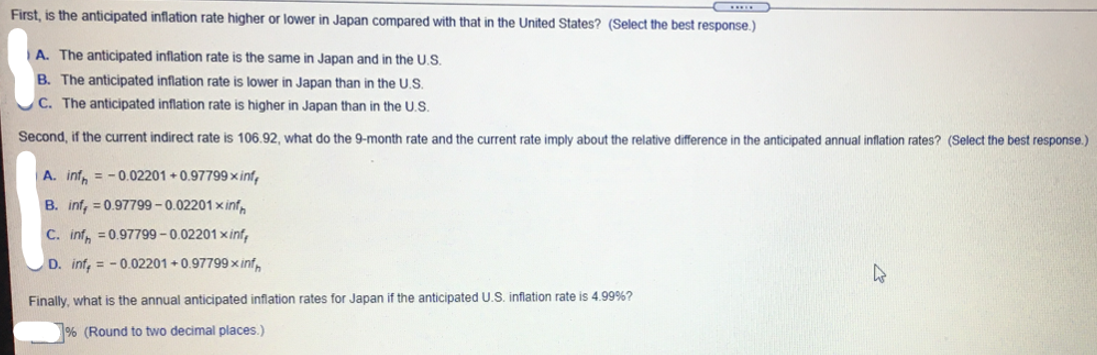

Forward rates. The Wall Street Journal lists forward rates for Japanese Yen Say that the current listings are as follows: 3-month forward rate (indirect) 106.81 6-month forward rate (indirect) 106.24 9-month forward rate (indirect) 105.15 First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? Finally, using the current indirect rate and the 9-month forward rate, determine the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%. First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? (Select the best response.) A. The anticipated inflation rate is the same in Japan and in the U.S. B. The anticipated inflation rate is lower in Japan than in the US C. The anticipated inflation rate is higher in Japan than in the U.S. Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? (Select the best response.) A. info = -0.02201 +0.97799 xinh, B. inf, = 0.97799 -0.02201 x inn C. inh = 0,97799 - 0.02201 xinfo D. inf. = -0.02201 +0.97799 x in Finally, what is the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%? % (Round to two decimal places.) First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? (Select the best response.) A. The anticipated inflation rate is the same in Japan and in the U.S. B. The anticipated inflation rate is lower in Japan than in the U.S. C. The anticipated inflation rate is higher in Japan than in the U.S. Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? (Select the best response.) A. info = -0.02201 +0.97799 x info B. int, = 0.97799 - 0.02201 xinh C. info = 0.97799 -0.02201 xin, D. info = -0.02201 +0.97799 x info Finally, what is the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%? % (Round to two decimal places.) Forward rates. The Wall Street Journal lists forward rates for Japanese Yen Say that the current listings are as follows: 3-month forward rate (indirect) 106.81 6-month forward rate (indirect) 106.24 9-month forward rate (indirect) 105.15 First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? Finally, using the current indirect rate and the 9-month forward rate, determine the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%. First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? (Select the best response.) A. The anticipated inflation rate is the same in Japan and in the U.S. B. The anticipated inflation rate is lower in Japan than in the US C. The anticipated inflation rate is higher in Japan than in the U.S. Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? (Select the best response.) A. info = -0.02201 +0.97799 xinh, B. inf, = 0.97799 -0.02201 x inn C. inh = 0,97799 - 0.02201 xinfo D. inf. = -0.02201 +0.97799 x in Finally, what is the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%? % (Round to two decimal places.) First, is the anticipated inflation rate higher or lower in Japan compared with that in the United States? (Select the best response.) A. The anticipated inflation rate is the same in Japan and in the U.S. B. The anticipated inflation rate is lower in Japan than in the U.S. C. The anticipated inflation rate is higher in Japan than in the U.S. Second, if the current indirect rate is 106.92, what do the 9-month rate and the current rate imply about the relative difference in the anticipated annual inflation rates? (Select the best response.) A. info = -0.02201 +0.97799 x info B. int, = 0.97799 - 0.02201 xinh C. info = 0.97799 -0.02201 xin, D. info = -0.02201 +0.97799 x info Finally, what is the annual anticipated inflation rates for Japan if the anticipated U.S. inflation rate is 4.99%? % (Round to two decimal places.)

please show all working steps with formulas or excel

please show all working steps with formulas or excel