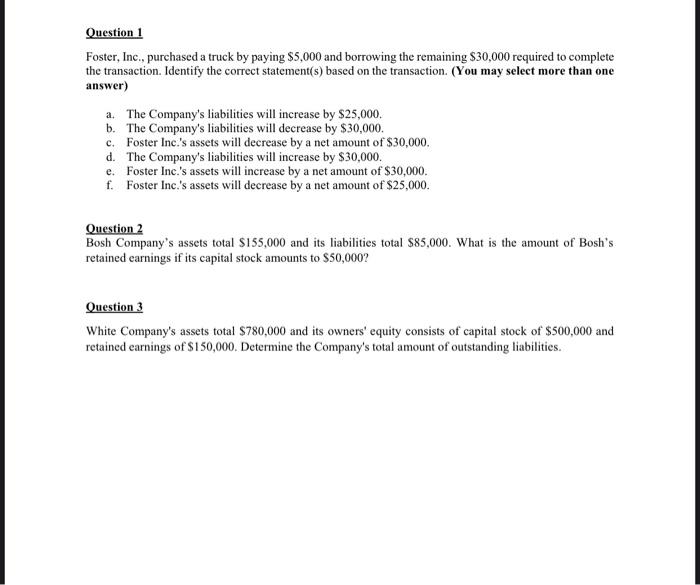

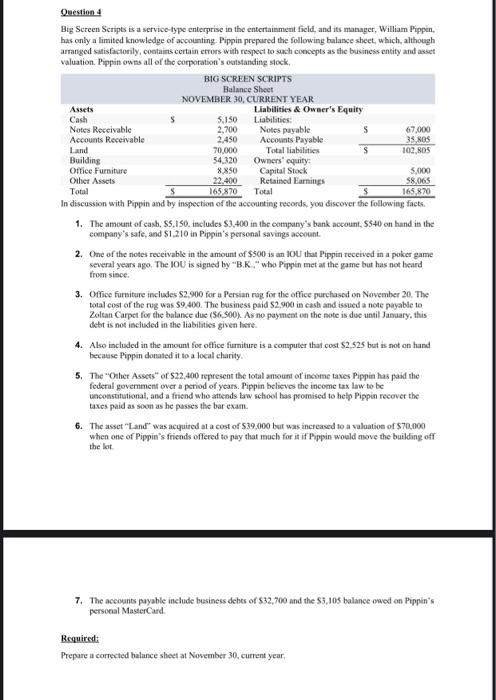

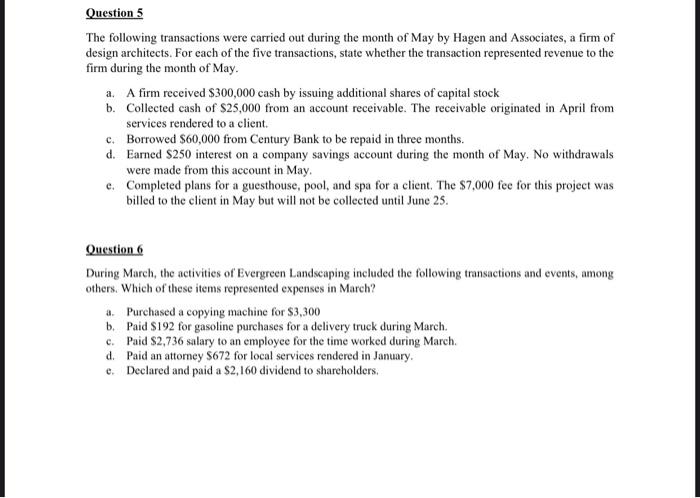

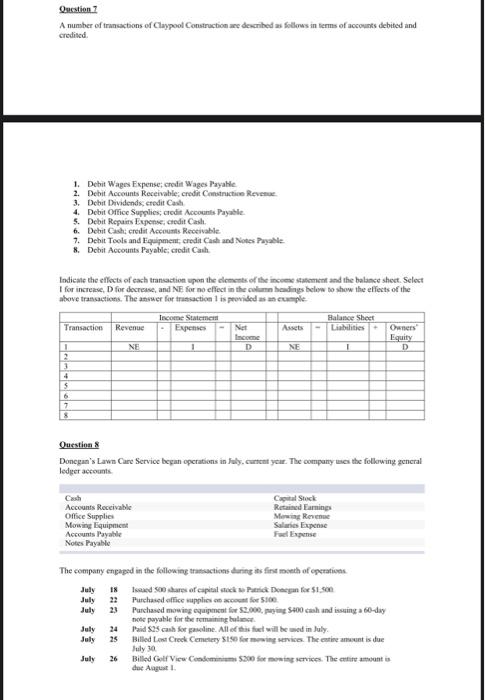

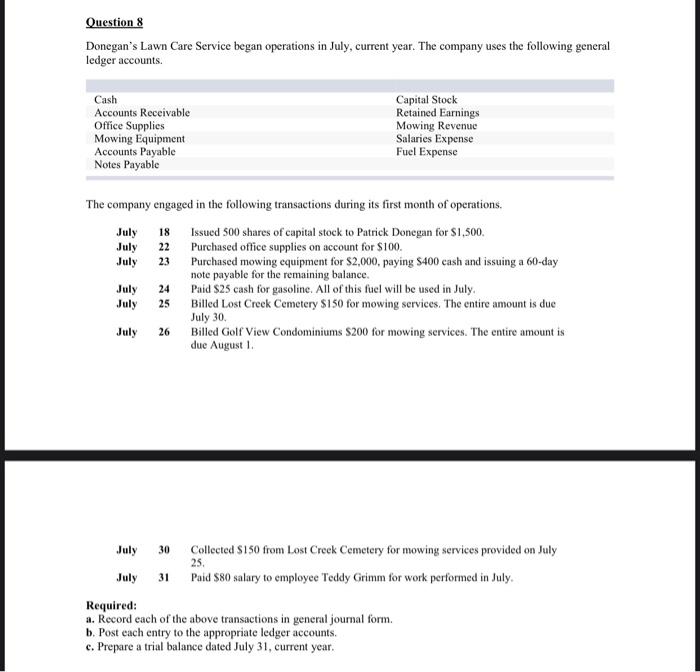

Foster, Inc., purchased a truck by paying $5,000 and borrowing the remaining $30,000 required to complete the transaction. Identify the correct statement(s) based on the transaction. (You may select more than one answer) a. The Company's liabilities will increase by $25,000. b. The Company's liabilities will decrease by $30,000. c. Foster Inc.'s assets will decrease by a net amount of $30,000. d. The Company's liabilities will increase by $30,000. e. Foster Inc.'s assets will increase by a net amount of $30,000. f. Foster Inc.'s assets will decrease by a net amount of $25,000. Question 2 Bosh Company's assets total $155,000 and its liabilities total $85,000. What is the amount of Bosh's retained earnings if its capital stock amounts to $50,000 ? Question 3 White Company's assets total $780,000 and its owners' equity consists of capital stock of $500,000 and retained earnings of $150,000. Determine the Company's total amount of outstanding liabilities. Question 4 Big Screen Seripts is a service-type enterprise in the entertaiament ficld, and its manager, William Pippin, has only a limited knowledge of accounting. Pippin prepared the following balance sheet, which, although arranged satisfactorily, contains certain errors with respect to soch concepts as the business entity and aset valuation. Pippin owns all of the eorporation's oststanding stock. 1. The amount of eash, $5,150, includes $3,400 in the company's bank account, $540 on hand in the company's safe, and $1,210 in Pippin's personal savings aceount. 2. One of the notes receivable in the amount of $500 is an 1OU that Pippin received in a poker game several years ago. The 10U is signed by "B.K.," who Pippin met at the game but has not beard from since. 3. Office fursiture includes $2,900 for a Persian rag for the office purchased on November 20 . The total cost of the rug was $9,400. The business paid $2,900 in cash and issued a note payable to Zolean Carpet for the balance due (56,500). As no paymemt on the note is due until Janaary, this detot is not included in the liabilities given here. 4. Also included in the amount for office furniture is a computer that cost $2,$25 but is not on hand because Pippin donated it to a local charity. 5. The "Other Assess" of $22,400 represent the total amount of income taxes Pippin has paid the federal government over a period of years. Pippin believes the income tax law to be unconstitutional, and a friend who attends law school has promised to help Pippin recover the taxes paid as seon as he passes the bar exam. 6. The asset "Land" was acquired at a cost of $39,000 but was increased to a valuation of $70,000 when one of Pippin's friends offered to pay that much for it if Pippin would move the building off the kot. 7. The accounts payable include besiness debes of $32,700 and the $3,105 balance owed on Pippin's personal MasterCard. Bequired: Prepare a corrected balance sheet at November 30, current year, The following transactions were carried out during the month of May by Hagen and Associates, a firm of design architects. For each of the five transactions, state whether the transaction represented revenue to the firm during the month of May. a. A firm received $300,000 cash by issuing additional shares of capital stock b. Collected cash of $25,000 from an account receivable. The receivable originated in April from services rendered to a client. c. Borrowed $60,000 from Century Bank to be repaid in three months. d. Earned \$250 interest on a company savings account during the month of May. No withdrawals were made from this account in May. e. Completed plans for a guesthouse, pool, and spa for a client. The $7,000 fee for this project was billed to the client in May but will not be collected until June 25 . Question 6 During March, the activities of Evergreen Landscaping included the following transactions and events, among others. Which of these items represented expenses in March? a. Purchased a copying machine for $3,300 b. Paid $192 for gasoline purchases for a delivery truck during March. c. Paid \$2,736 salary to an employe for the time worked during March. d. Paid an attorney $672 for local services rendered in January. e. Declared and paid a $2,160 dividend to shareholders. Qucstion ? A number of transactions of Claypool Construction anc decribed as follows in lerms of accounts debited and credised. 1. Dehit Wages Expense; credit Wages Rayahe. 2. Debit Accounts Receivable; credin Construction Reveste 3. Debit Dividends eredit Cadi 4. Debit Office Supplies; credit Accoumls Payable. 5. Debit Repairs Expense; ciedit Caht. 6. Debit Cidhi eretit Accounts Receivable: 7. Debit Tools and Fouipment; crodit Cad and Notes Puyalle 8. Dchit Accounts Payable; crodit Canh. Indicate the effocts of each trancaction upon the denents of the inceene stabement and the balance shect. Select I for increase, D for decrease, and NE for no effect in the colamn healings below to show the effects of the Qurstion 8 Donegun's Lawn Care Servioe began operations in Jaly, cewtent year. The oompany bes the following general ledger aecounts. The company engaped in the following tratsactions hring its fint moeth of epcrations. \begin{tabular}{|c|c|c|} \hline July & 18 & \\ \hline July & 22 & Purchased office uupplies at axocent for 5300 . \\ \hline July & 23 & \\ \hline July & 24 & Paid S25 cash lor gradine. Afl ef bis fuel will be oued in July. \\ \hline July & 25 & \\ \hline July & 26 & \\ \hline \end{tabular} Question 8 Donegan's Lawn Care Service began operations in July, current year. The company uses the following general ledger accounts. T July 30 Collected $150 from Lost Creek Cemetery for mowing services provided on July 25. July 31 Paid $80 salary to employee Teddy Grimm for work performed in July. Required: a. Record each of the above transactions in general journal form. b. Post each entry to the appropriate ledger accounts. c. Prepare a trial balance dated July 31 , current year