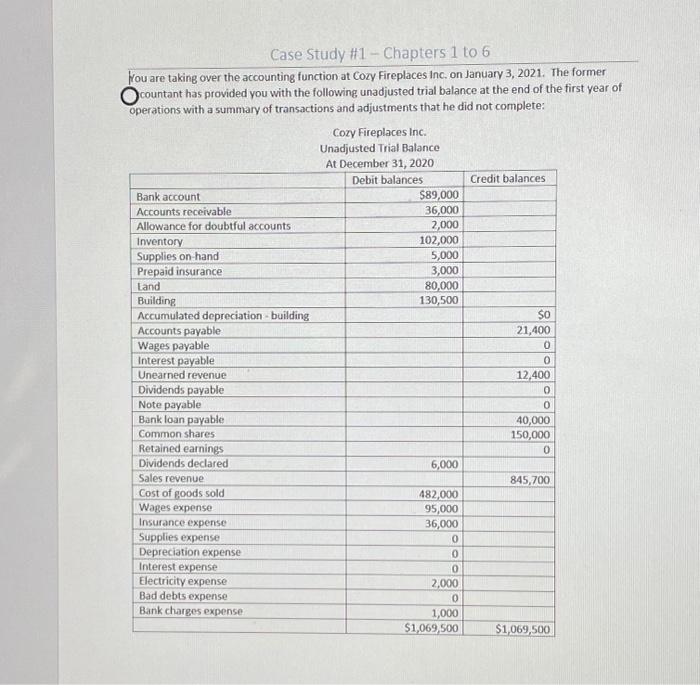

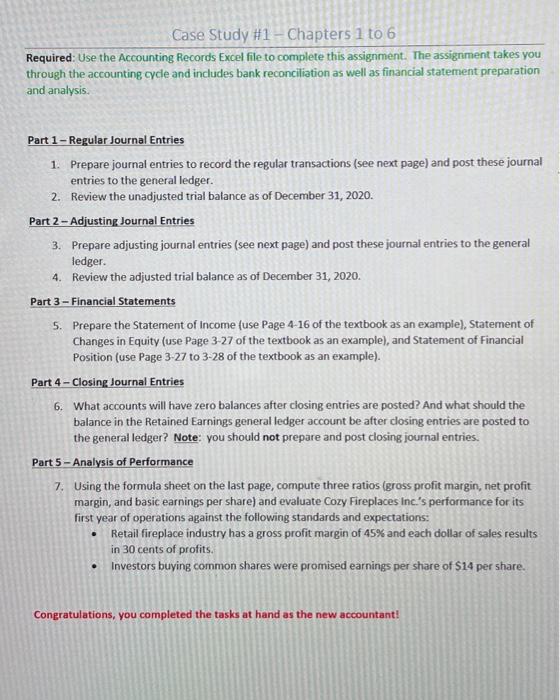

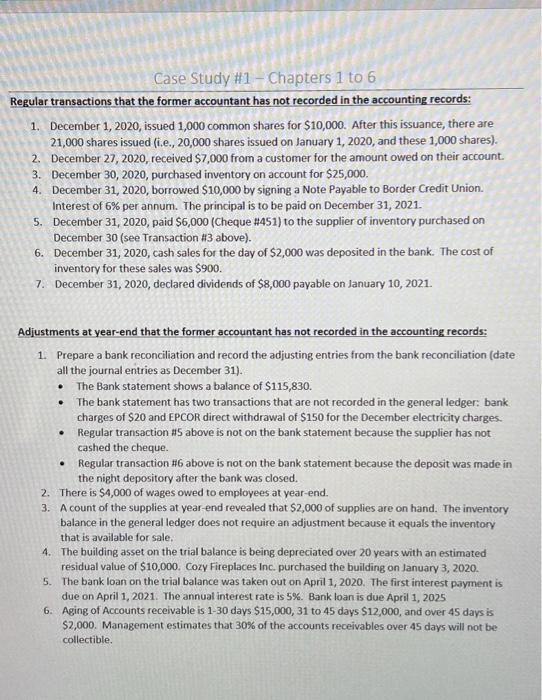

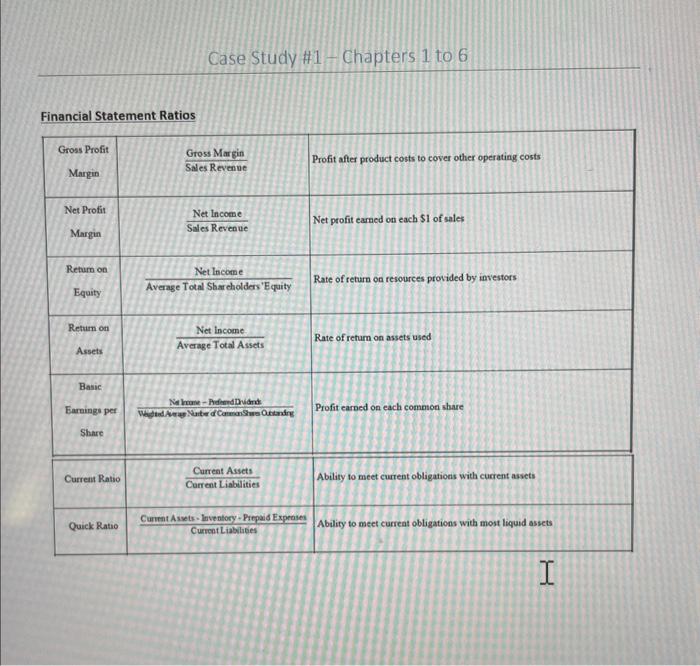

Fou are taking over the accounting function at cozy fireplaces inc. on January 3, 2021. The former countant has provided you with the following unadjusted trial balance at the end of the first year of operations with a summary of transactions and adjustments that he did not complete: Cory Fireplaces Inc. Unadjusted Trial Balance Regular transactions that the former accountant has not recorded in the accounting records: 1. December 1,2020 , issued 1,000 common shares for $10,000. After this issuance, there are 21,000 shares issued (i.e., 20,000 shares issued on January 1,2020, and these 1,000 shares). 2. December 27,2020 , received $7,000 from a customer for the amount owed on their account. 3. December 30,2020 , purchased inventory on account for $25,000. 4. December 31,2020 , borrowed $10,000 by signing a Note Payable to Border Credit Union. Interest of 6% per annum. The principal is to be paid on December 31, 2021. 5. December 31,2020 , paid $6,000 (Cheque $451 ) to the supplier of inventory purchased on December 30 (see Transaction $3 above). 6. December 31,2020 , cash sales for the day of $2,000 was deposited in the bank. The cost of inventory for these sales was $900. 7. December 31,2020 , declared dividends of $8,000 payable on January 10,2021. Adjustments at year-end that the former accountant has not recorded in the accounting records: 1. Prepare a bank reconciliation and record the adjusting entries from the bank reconciliation (date all the journal entries as December 31 ). - The Bank statement shows a balance of $115,830. - The bank statement has two transactions that are not recorded in the general ledger: bank charges of \$20 and EPCOR direct withdrawal of \$150 for the December electricity charges. - Regular transaction \#5 above is not on the bank statement because the supplier has not cashed the cheque. - Regular transaction #6 above is not on the bank statement because the deposit was made in the night depository after the bank was closed. 2. There is $4,000 of wages owed to employees at year-end. 3. A count of the supplies at year-end revealed that $2,000 of supplies are on hand. The inventory balance in the general ledger does not require an adjustment because it equals the inventory that is available for sale. 4. The building asset on the trial balance is being depreciated over 20 years with an estimated residual value of $10,000. Cozy Fireplaces Inc. purchased the building on January 3, 2020. 5. The bank loan on the trial balance was taken out on April 1,2020. The first interest payment is due on April 1, 2021. The annual interest rate is 5\%. Bank loan is due April 1, 2025 6. Aging of Accounts receivable is 130 days $15,000,31 to 45 days $12,000, and over 45 days is $2,000. Management estimates that 30% of the accounts receivables over 45 days will not be collectible. Case Study \#1-Chapters 1 to 6 Financial Statement Ratios Required: Use the Accounting Records Excel file to complete this assignment. The assignment takes you through the accounting cycle and includes bank reconciliation as well as financial statement preparation and analysis. Part 1-Regular Journal Entries 1. Prepare journal entries to record the regular transactions (see next page) and post these journal entries to the general ledger. 2. Review the unadjusted trial balance as of December 31,2020 . Part 2-Adjusting Journal Entries 3. Prepare adjusting journal entries (see next page) and post these journal entries to the general ledger. 4. Review the adjusted trial balance as of December 31,2020. Part 3-Financial Statements 5. Prepare the Statement of income (use Page 4-16 of the textbook as an example), Statement of Changes in Equity (use Page 3-27 of the textbook as an example), and Statement of Financial Position (use Page 3-27 to 3-28 of the textbook as an example). Part 4-Closing Journal Entries 6. What accounts will have zero balances after closing entries are posted? And what should the balance in the Retained Earnings general ledger account be after closing entries are posted to the general ledger? Note: you should not prepare and post closing journal entries. Part 5 - Analysis of Performance 7. Using the formula sheet on the last page, compute three ratios (gross profit margin, net profit margin, and basic earnings per share) and evaluate Cozy Fireplaces Inc.'s performance for its first year of operations against the following standards and expectations: - Retail fireplace industry has a gross profit margin of 45% and each dollar of sales results in 30 cents of profits. - Investors buying common shares were promised earnings per share of \$14 per share. Congratulations, you completed the tasks at hand as the new accountant! Fou are taking over the accounting function at cozy fireplaces inc. on January 3, 2021. The former countant has provided you with the following unadjusted trial balance at the end of the first year of operations with a summary of transactions and adjustments that he did not complete: Cory Fireplaces Inc. Unadjusted Trial Balance Regular transactions that the former accountant has not recorded in the accounting records: 1. December 1,2020 , issued 1,000 common shares for $10,000. After this issuance, there are 21,000 shares issued (i.e., 20,000 shares issued on January 1,2020, and these 1,000 shares). 2. December 27,2020 , received $7,000 from a customer for the amount owed on their account. 3. December 30,2020 , purchased inventory on account for $25,000. 4. December 31,2020 , borrowed $10,000 by signing a Note Payable to Border Credit Union. Interest of 6% per annum. The principal is to be paid on December 31, 2021. 5. December 31,2020 , paid $6,000 (Cheque $451 ) to the supplier of inventory purchased on December 30 (see Transaction $3 above). 6. December 31,2020 , cash sales for the day of $2,000 was deposited in the bank. The cost of inventory for these sales was $900. 7. December 31,2020 , declared dividends of $8,000 payable on January 10,2021. Adjustments at year-end that the former accountant has not recorded in the accounting records: 1. Prepare a bank reconciliation and record the adjusting entries from the bank reconciliation (date all the journal entries as December 31 ). - The Bank statement shows a balance of $115,830. - The bank statement has two transactions that are not recorded in the general ledger: bank charges of \$20 and EPCOR direct withdrawal of \$150 for the December electricity charges. - Regular transaction \#5 above is not on the bank statement because the supplier has not cashed the cheque. - Regular transaction #6 above is not on the bank statement because the deposit was made in the night depository after the bank was closed. 2. There is $4,000 of wages owed to employees at year-end. 3. A count of the supplies at year-end revealed that $2,000 of supplies are on hand. The inventory balance in the general ledger does not require an adjustment because it equals the inventory that is available for sale. 4. The building asset on the trial balance is being depreciated over 20 years with an estimated residual value of $10,000. Cozy Fireplaces Inc. purchased the building on January 3, 2020. 5. The bank loan on the trial balance was taken out on April 1,2020. The first interest payment is due on April 1, 2021. The annual interest rate is 5\%. Bank loan is due April 1, 2025 6. Aging of Accounts receivable is 130 days $15,000,31 to 45 days $12,000, and over 45 days is $2,000. Management estimates that 30% of the accounts receivables over 45 days will not be collectible. Case Study \#1-Chapters 1 to 6 Financial Statement Ratios Required: Use the Accounting Records Excel file to complete this assignment. The assignment takes you through the accounting cycle and includes bank reconciliation as well as financial statement preparation and analysis. Part 1-Regular Journal Entries 1. Prepare journal entries to record the regular transactions (see next page) and post these journal entries to the general ledger. 2. Review the unadjusted trial balance as of December 31,2020 . Part 2-Adjusting Journal Entries 3. Prepare adjusting journal entries (see next page) and post these journal entries to the general ledger. 4. Review the adjusted trial balance as of December 31,2020. Part 3-Financial Statements 5. Prepare the Statement of income (use Page 4-16 of the textbook as an example), Statement of Changes in Equity (use Page 3-27 of the textbook as an example), and Statement of Financial Position (use Page 3-27 to 3-28 of the textbook as an example). Part 4-Closing Journal Entries 6. What accounts will have zero balances after closing entries are posted? And what should the balance in the Retained Earnings general ledger account be after closing entries are posted to the general ledger? Note: you should not prepare and post closing journal entries. Part 5 - Analysis of Performance 7. Using the formula sheet on the last page, compute three ratios (gross profit margin, net profit margin, and basic earnings per share) and evaluate Cozy Fireplaces Inc.'s performance for its first year of operations against the following standards and expectations: - Retail fireplace industry has a gross profit margin of 45% and each dollar of sales results in 30 cents of profits. - Investors buying common shares were promised earnings per share of \$14 per share. Congratulations, you completed the tasks at hand as the new accountant